The latest annual results for HSBC — released today — are at first glance a company boasting of a job well done.

The company’s pre-tax profit growth of nearly 150 percent is staggering in an industry that still finds itself awkwardly glancing around the room, ten years after triggering one of the worst financial crises in human history.

However in reality its pre-tax profits in 2016 — approximately $7.1bn — have not dipped as low since 2009.

Its profit collapse in 2016 is due largely to a series of significant items totalling $12.2bn, including a goodwill write-off in its European private banking business to the tune of more than $3bn.

Given that HSBC’s profits were only less than half a percentage point higher than in 2009 — when the global economy was collapsing — it is hardly surprising that HSBC managed to recover its profit in 2017.

And shareholders seem to agree, with shares in the bank falling by five percent shortly after the London market open. HSBC missed analyst expectations of $19.2bn pre-tax profits by $2.5bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataHSBC’s plan for future success seems to be the same plan that every company had five years ago — bank on China.

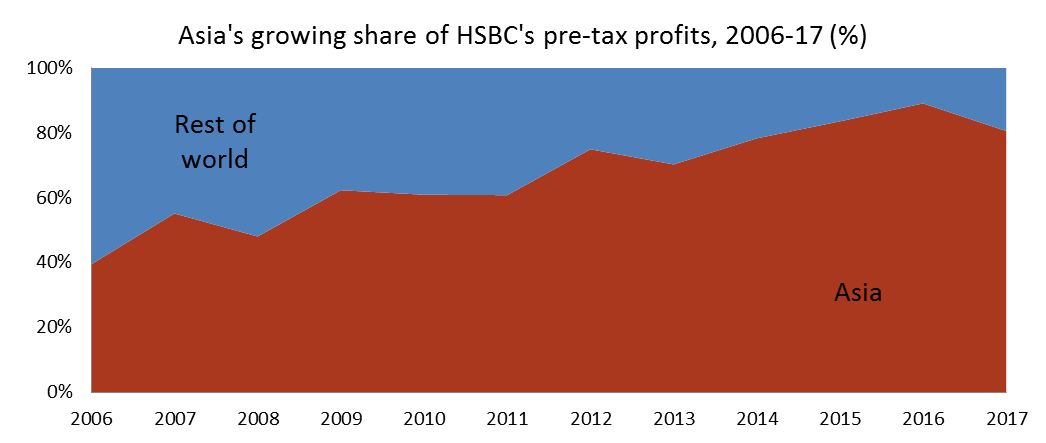

The share of the company’s pre-tax profits attributable to Asia has more than doubled in percentage terms and increased by more than 75% in monetary terms since 2006.

The most recent figures give a slight reduction in reliance on Asia — 80.55% vs 89.09% a year ago – but this remains a risky plan for HSBC given the general wariness about China’s potential to maintain its recent growth rate.

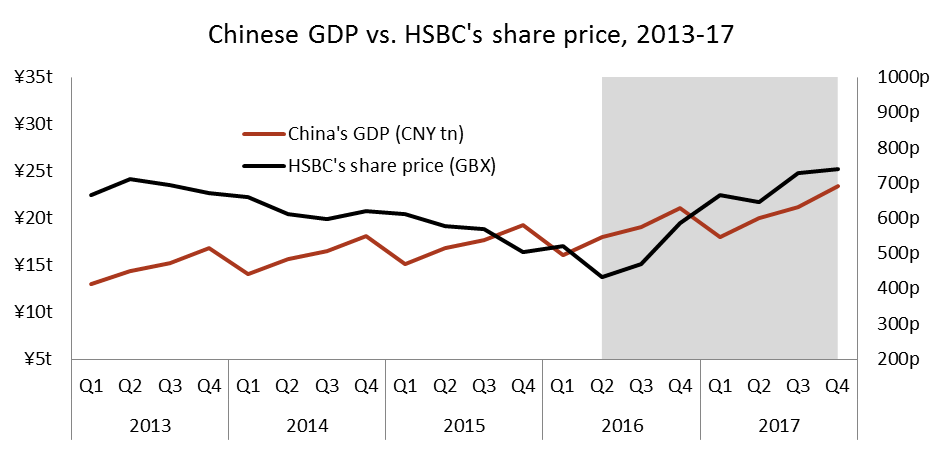

HSBC’s reliance on Asian growth can be seen when comparing its share price to China’s GDP. Over the last two years Chinese GDP and HSBC’s London share price look incredibly similar.

It is a worrying sign for any company to be so closely linked to a single country’s performance, especially with China’s economic performance both unstable and uncertain.

HSBC will likely become more intertwined with China’s economy and more reliant on its success.

When China’s economy inevitably slows HSBC could regret its close relationship with the country.