Governments have adopted new tax and trade policies to try to restart economic growth. How well has it worked?

.jpg)

A decade ago, the world entered a deep financial crisis. It started when the US housing bubble burst, leading to a credit crunch that spread rapidly overseas. Global businesses, ranging from banks to carmakers, required bailouts and the global economy slid into a recession.

SUBSCRIBE TO THE EY TAX INSIGHTS NEWSLETTER HERE

Governments responded with austerity measures and by introducing changes to tax policy and enforcement, which fundamentally changed the tax landscape and created massive uncertainty.

From global efforts coordinated by the Organisation for Economic Co-operation and Development to combat base erosion and profit shifting activities to a heavier reliance by more governments onindirect taxes for revenues, the tax department has evolved from being a backroom function to a boardroom concern.

.jpg)

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataTaxing questions

It’s a difficult balancing act: governments have had to gather enough taxes to fund public services while continuing to grow their economies. Tax revenue as a percentage of GDP — a measure known as the tax burden — has increased in a number of developed countries over the past 10 years. At the same time, a larger share of this revenue is coming from indirect taxes in many countries, forcing businesses to spend more time on value-added tax (VAT) obligations as well as customs duties and excise levies.

Total tax revenue as a percentage of GDP — 2007 versus 2017*

*2017 figures are forecast and calculated in local currency terms

Stimulating business

Many governments have pursued a two-pronged tax strategy to kick-start their economies: increasing tax on goods and services while cutting corporate tax to spur private investment and, they hope, productivity. Increasingly, governments have again started offering incentives to lure investment. Businesses must keep track of all these changes at a global level and make adjustments to minimise risk and identify opportunities.

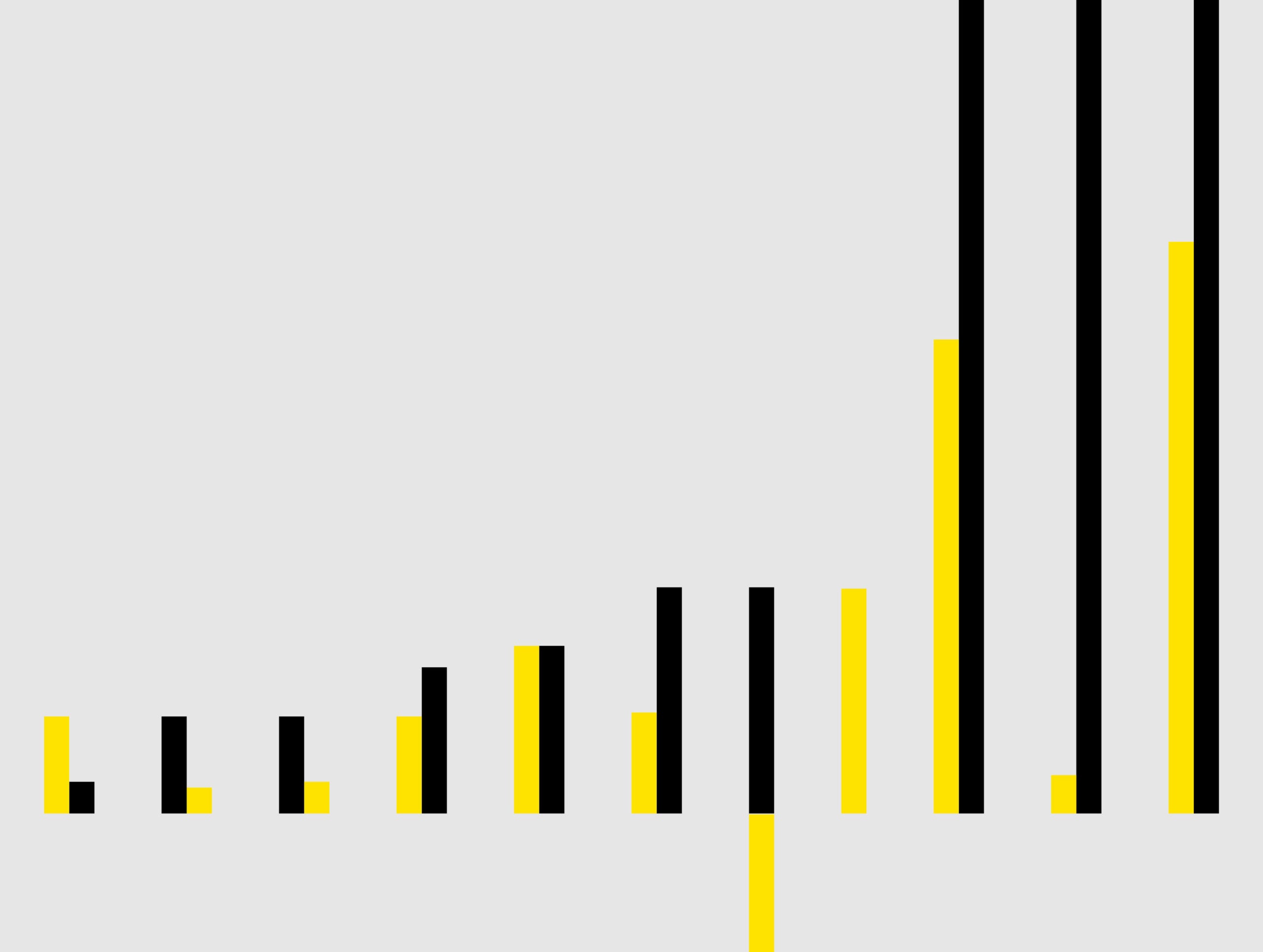

Percentage-point changes in corporate tax revenue and VAT/sales

tax revenue as a percentage of GDP between 2007 and 2015

Austerity measures

Many governments in the developed world have attempted to address a long-term trend toward larger budget deficits by curbing public spending or increasing taxation. Deficits have also increased in developing countries due to a general reduction in commodity prices and slower economic growth. The ensuing changes in tax policy require constant monitoring and greater engagement among the tax function, C-suite and tax authorities.

Difference between national government revenue and expenditure as a percentage of GDP — 2007 versus 2017*

*2017 figures are forecast

(Negative numbers indicate that government expenditures exceeded revenue)

.jpg)

A risky situation

Worldwide debt — national, corporate and household — is at a record high. If interest rates start rising sharply and/or global output falters, this burden poses a significant threat to economic stability. It would again put pressure on government tax revenues, leading to yet more policy changes. Going forward, businesses will need to create agile tax and growth strategies as uncertainty becomes the “new normal.”

Real inflation adjusted average annual percentage change in tax revenue — 2002—07 versus 2012—17*

*2017 figures are forecast

These charts illustrate some of the lasting effects of the global financial crisis and underscore how the tax environment has fundamentally changed. Businesses that want to succeed in this rapidly changing environment need to have a global strategy to adapt to rapid change and safeguard growth. This includes putting the right people, processes, technology and resources in place to respond to demands for greater tax transparency. And it also means proactively monitoring changes in tax policy and adapting operating models so they function effectively in the changing environment.