As Verdict recently reported, most M&A deals recorded by GlobalData in the third quarter of 2021 were in the Tech, Media, & Telecom (TMT) sector, representing over a third of total deals and contributing to 22% of total transaction value. But what about the outlook for TMT in 2022?

The answer depends on business themes, the issues which keep CEOs awake at night. A new report from GlobalData provides a top-down, comprehensive outlook for the top 600 players in TMT, based on key themes of the decade so far which are set to transform the industry landscape for 2022 and beyond.

The report covers 16 TMT sectors, divided into four categories: hardware, software and services, internet and media and telecoms. Sectors include IT services, enterprise security, IT infrastructure, industrial automation, semiconductors and cloud services.

Mega themes meanwhile include the usual suspects: artificial intelligence (AI), edge computing, the Internet of Things (IoT) and ESG. ESG will be the focus of an upcoming free webinar from GlobalData taking place today; register here.

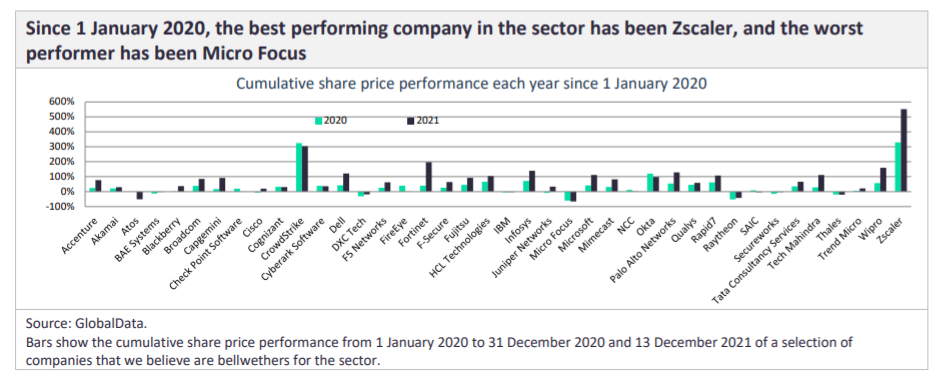

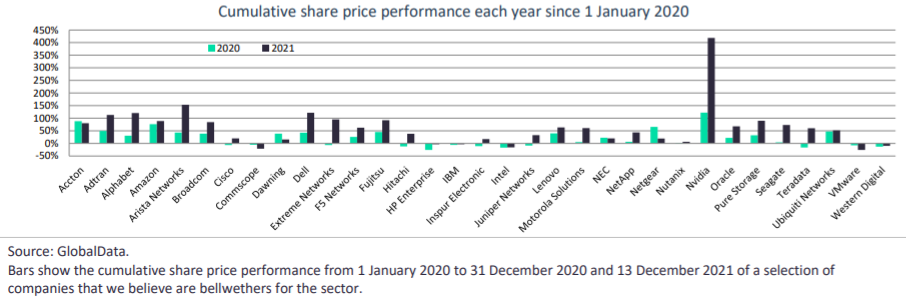

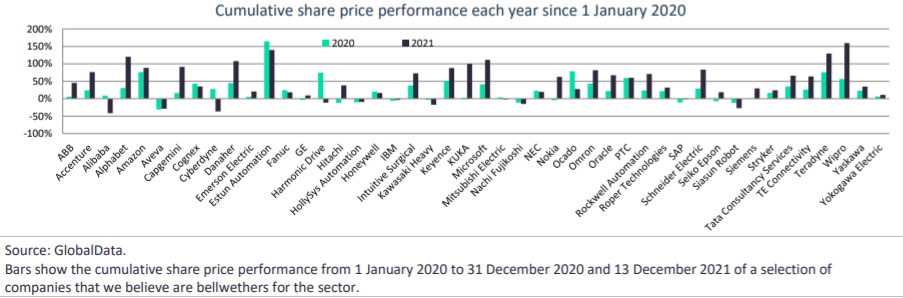

For each sector in its report, GlobalData provides the cumulative share price performance since the beginning of the Covid-19 pandemic of a selection of companies that it believes are bellwethers for the segment.

Explore with Verdict the outlook in 2022 for the sectors with heavy influence across TMT: enterprise security, IT infrastructure and industrial automation, and the major and macro themes impacting them and influencing their product decisions – the same themes affecting the business world as a whole.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataTMT in 2022: Enterprise security

The chart below from GlobalData shows the cumulative share price performance since the beginning of the pandemic of a selection of companies in enterprise security. The best performing name is the US cloud-based information security company Zscaler.

The outlook for Zscaler looks good in 2022 as more organisations come to terms with cloud security, and learn how to monitor and detect threats in cloud environments.

The challenge, GlobalData believes, is “amplified by security policies that do not encompass the cloud and a shortage of incident response skills that apply to cloud environments.”

The problem is made worse by many companies not having the same level of know-how when configuring security controls in cloud computing environments compared to on-premise networks.

Zscaler is already benefiting as companies change and adapt to the cloud: According to GlobalData figures, the company reported revenues of $673.1mn for the fiscal year (FY) ended July 2021, an increase of 56.1% over 2020.

Security in 2022

2020 was a challenging year for enterprise security, with government lockdowns forcing businesses to adopt large-scale remote working policies with little time for preparation.

As such, socially engineered attacks such as phishing and ransomware have exponentially increased. Well-known cyber incidents in 2021 included the Colonial Pipeline attack against oil infrastructure in the US, which brought home to governments how ransomware attacks are increasing in complexity and becoming more focused on monetisation.

Social engineering will continue to dominate in 2022 until companies can find a way to build a true culture of cybersecurity, train employees and improve individual cybersecurity practices, especially with so many working remotely.

Business will find solutions though, as enterprise security brands will continue to increase product development and marketing efforts around phishing and identity attacks.

Supply chain blights

Aside from Colonial Pipeline, other headline-grabbing attacks last included the biggest ever cyberattack in food production which blighted JBS, the Kaseya ransomware attack by REvil and the Health Service Executive attack on the Irish healthcare system.

These supply chain incidents show the reliance of organisations on third parties for software or hardware solutions, making them highly vulnerable to cyberattacks that exploit security weaknesses in widely used tech products.

The attacks, GlobalData analysts believe, will likely increase the adoption of zero trust in 2022, an approach centred on the belief that organisations should not automatically trust anything inside or outside their perimeters and must verify anyone trying to connect to systems before granting access.

“To adapt to hybrid working environments, more companies will drive to adopt the Zero Trust security model,” Zoom CISO Jason Lee recently told Verdict.

“Conversations around protecting the hybrid workforce from risk will lead security professionals to adopt modern tools and technologies, like multi-factor authentication and the Zero Trust approach to security.

“I believe that companies need these tools to make sure their employees can get work done as safely as possible from wherever they are – commuting, travelling, or working from home – and that all of their endpoints are secured with continual checks in place.”

The acceleration of digital transformation by the pandemic will also drive security vendor propositions that secure enterprise endpoints, networks and cloud environments for companies across all sectors.

TMT in 2022: IT infrastructure

Since 1 January 2020, the best performing company in the IT infrastructure sector has been Nvidia. The company designs graphics processing units (GPUs) and system-on-a-chip units (SOCs) for gaming, professional visualisation, data center and automotive markets.

NVIDIA provides its products to various sectors including healthcare, transportation and telecom.

According to GlobalData figures, the company reported revenues of $16,675mn for the fiscal year ending January 2021, an increase of 52.7% over FY2020.

Outlook for 2022

Wi-Fi has been dominant for nearly two decades in private wireless networks. New technologies such as Wi-Fi 6E will become the standard for networks in 2022, GlobalData predicts.

Researchers also expect growth in private 5G offerings, as there are areas where latency and distance limitations make Wi-Fi a poor business choice: think any sector reliant on warehouses, dockyards and factories.

IT infrastructure vendors will therefore be helping businesses view 5G and Wi-Fi as complementary technologies rather than rivals.

Cloud in 2022

As customers become more and more cloud reliant, infrastructure vendors will have to add to their standard cloud enablement strategies. As such, businesses should expect to see more IT infrastructure as a service or as subscription offerings from vendors.

There will also be other areas of notable change, as spurred on by cloud competition.

Vendors will need to expand the capabilities of their edge computing offerings, for one, with a focus on application development tools and resources for securing and managing apps at the edge, away from the cloud.

Delivering high-performance apps at the edge will, GlobalData reports, be an “essential source of differentiation for vendors, especially in the face of competition from cloud service providers.”

Solutions-designed high-performance computing (HPC) workloads will also be another area where IT infrastructure will grow and find the edge against the cloud giants.

Investments in HPC servers reflect enterprise’s need for faster data processing speeds. Flexible consumption businesses will drive the future adoption of HPC servers by infrastructure vendors, as well as helping them compete against HPC offerings from cloud service providers.

Finally, cloud environments have shown the value of IT infrastructure that is simply programmable to support DevOps efforts and rapid software iteration.

As such, GlobalData expects programmability to continue to be featured strongly in vendor, cloud and service provider products next year.

It also expects NVIDIA to continue being a leader in HPC, edge and programmable infrastructure during 2022.

TMT in 2022: Industrial Automation

Industrial automation is the commonly-referenced fourth industrial revolution. The term refers to digital disruption in industrial value chains from themes such as robotics, AI, the internet of things (IoT) and more, making up the so-called factory of the future.

Since 1 January 2020, the best performing company in the industrial automation sector has been Wipro. The company is a Bangalore-headquartered IT company that offers software solutions, IT consulting and business process outsourcing (BPO) services.

Wipro serves various industries, including healthcare, aerospace and defence, public sector, banking and financial services, oil and gas, retail, transportation and automotive.

The company reported revenues of (Rupee) INR619,430mn for the fiscal year ending March 2021, an increase of 1.5% over FY2020.

Automation promises to bring down operational costs and improve process efficiencies for enterprise, and enable the development of new products and services for customers. It will also help business resilience in a post-pandemic world.

Tech like AI and the Industrial Internet will function as the backbone of industrial automation. The sensors and actuators that are not built into industrial machinery generate data that AI will harvest to keep costs down and raise efficiency in the factory of the future.

Robotics is already getting an AI upgrade, and heavy investment from it. One of GlobalData’s top unicorns to watch in 2022 is Covariant, whose robotic arms come with a computer vision AI brain to help them identify objects.

Robotics giant ABB meanwhile is leading the pack thanks to its various AI investments.

GlobalData predicts that despite the advantage that IT vendors have in themes like AI, operational technology incumbents such as Wipro will maintain their competitive advantage in 2022 thanks to industry-specific know-how.

Find out more in a free webinar from GlobalData taking place today 4pm all about ESG; register here.