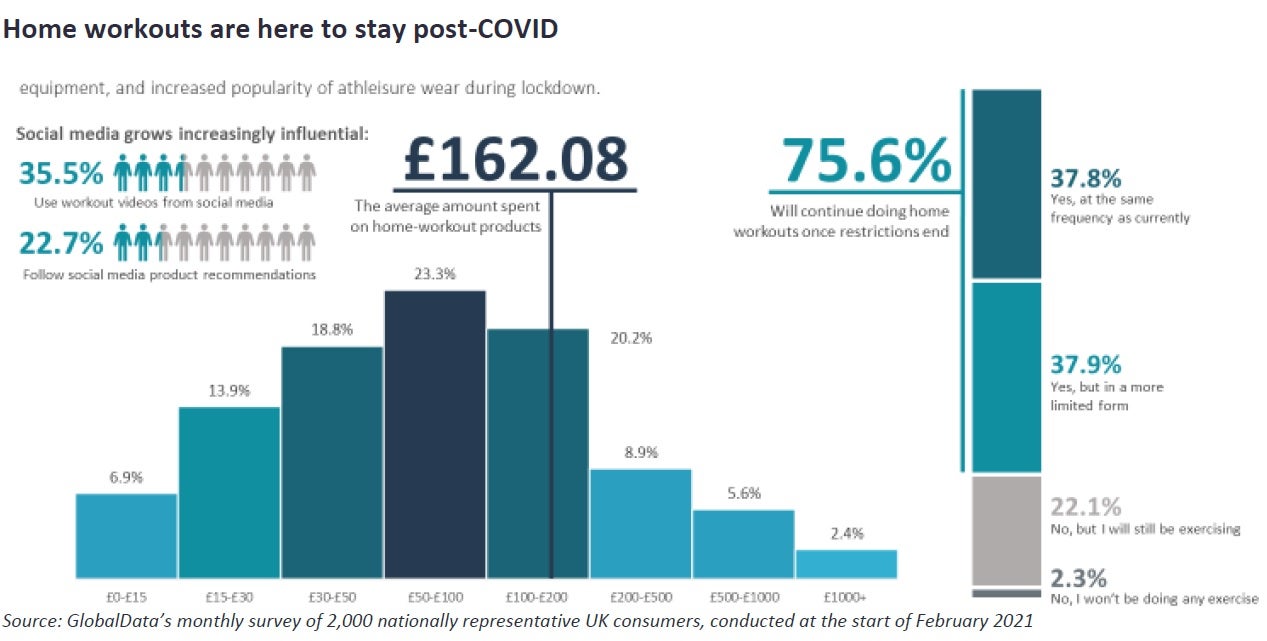

Home workouts will become a permanent switch for consumers, not just a pandemic hobby, with three quarters of people who have started doing them since March 2020 intending to continue post-pandemic.

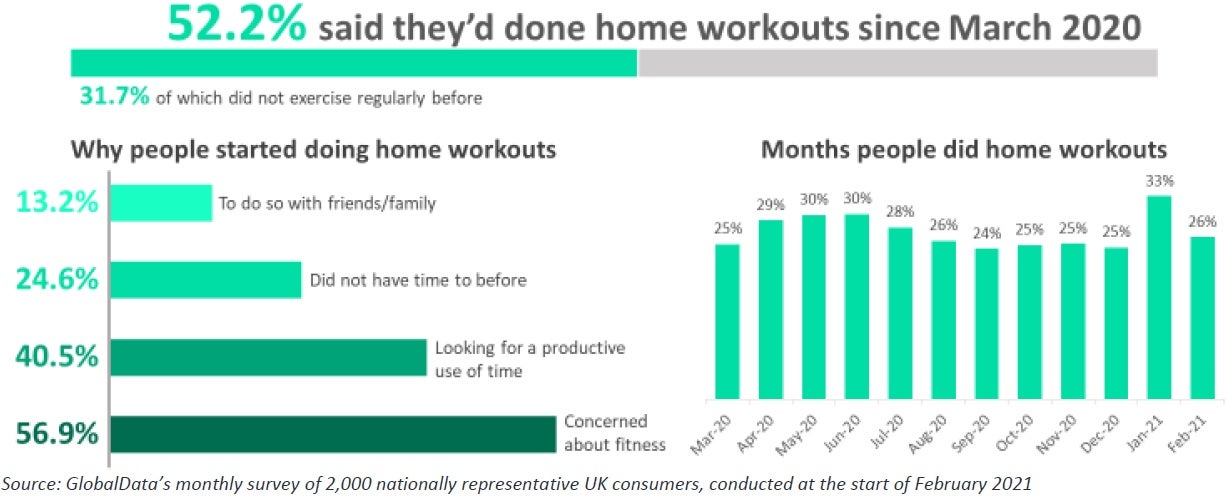

In a recent GlobalData survey, just over half of respondents said they had started doing home workouts since restrictions began in March 2020. A third of these consumers did not exercise regularly before the pandemic. Sports retailers have an opportunity, therefore, to capture demand and build loyalty among consumers who are new to the market and who have inflated budgets because of Covid restrictions.

January 2021 was the most popular month for home workouts, with the new year, new lockdown, and cold weather reigniting interest in the trend. However, since March 2020 participation hasn’t significantly dropped. Even in summer and autumn 2020 – when restrictions were minimal, the weather was excellent, and people were keen to get out of their homes – around a quarter of consumers continued their home workouts.

As working from home emerged as a more long-term response to the pandemic, consumers were more confident in purchasing big-ticket gym equipment, knowing they would get good use of the item. In parallel to this, athleisure clothing has become increasingly popular.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataComfortable workout clothing, such as leggings, are increasingly worn throughout the day – not only increasing demand for sports clothing for leisure, but also making consumers ready for home workouts. This is reflected in consumer spend, with more than 40% of respondents spending within the £50-100 and £100-200 price ranges.

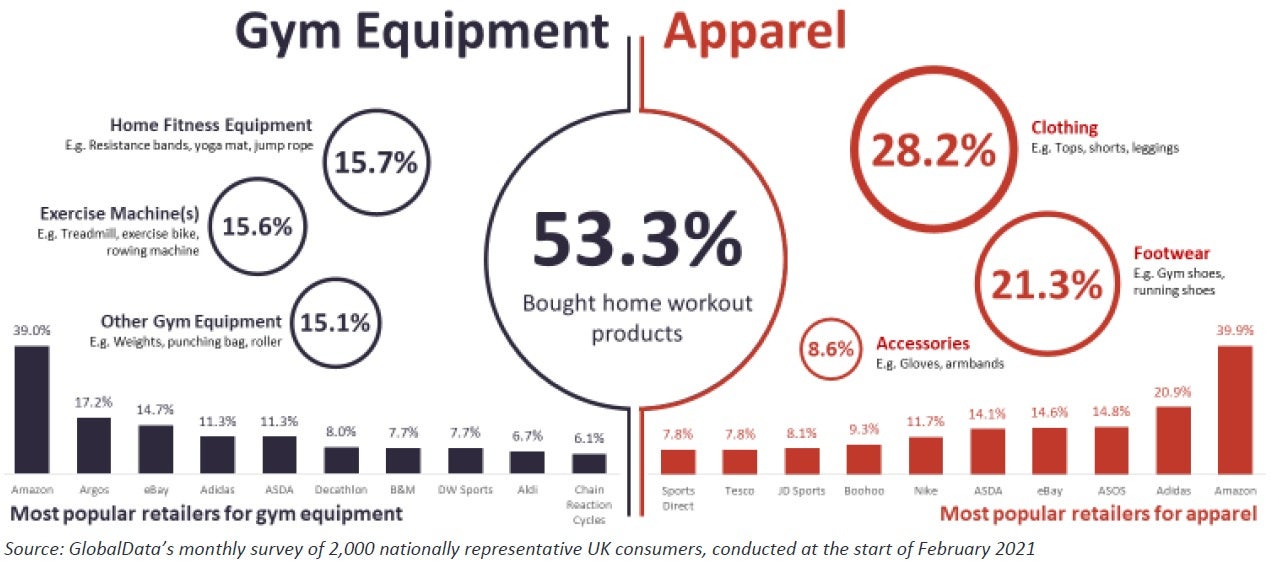

Within apparel, adidas has been particularly popular, with 20.9% of consumers buying items direct from the brand. Adidas was almost twice as popular as rival NIKE, and 5.1ppts more than apparel e-retail giant ASOS, as its emphasis on direct to consumer sales and its online platform continue to pay off.