Executive pay is a hot political topic but tackling it won’t be simple.

Corporate scandals — like the collapse of high street retailer BHS at the hands of Philip Green — and shareholder revolts even at companies renowned for highly paying executives — have made a sensitive situation worse during a period of stagnant wage growth for most Britons.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Latest plans, unveiled by MPs today, propose British businesses overhaul executive pay and scrap long-term incentive plans to rebuild public trust in corporate culture.

Prime minister Theresa May has campaigned to help those who voted for the UK to quit the European Union in protest at “out of touch” elites, however the current state of affairs will take some turning around, even with shareholders revolting.

Parliament’s Business, Energy and Industrial Strategy committee wrote in its report:

Many considered the current system to be broken. There was general agreement [among consultation respondents] that remuneration packages have become too complicated. Many argued that executive pay was simply too high and could not be justified in terms of both the link to levels of performance and the growing gap with the pay of other employees. This view chimes with public opinion.”

GlobalData Strategic Intelligence

GlobalData Strategic IntelligenceUS Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

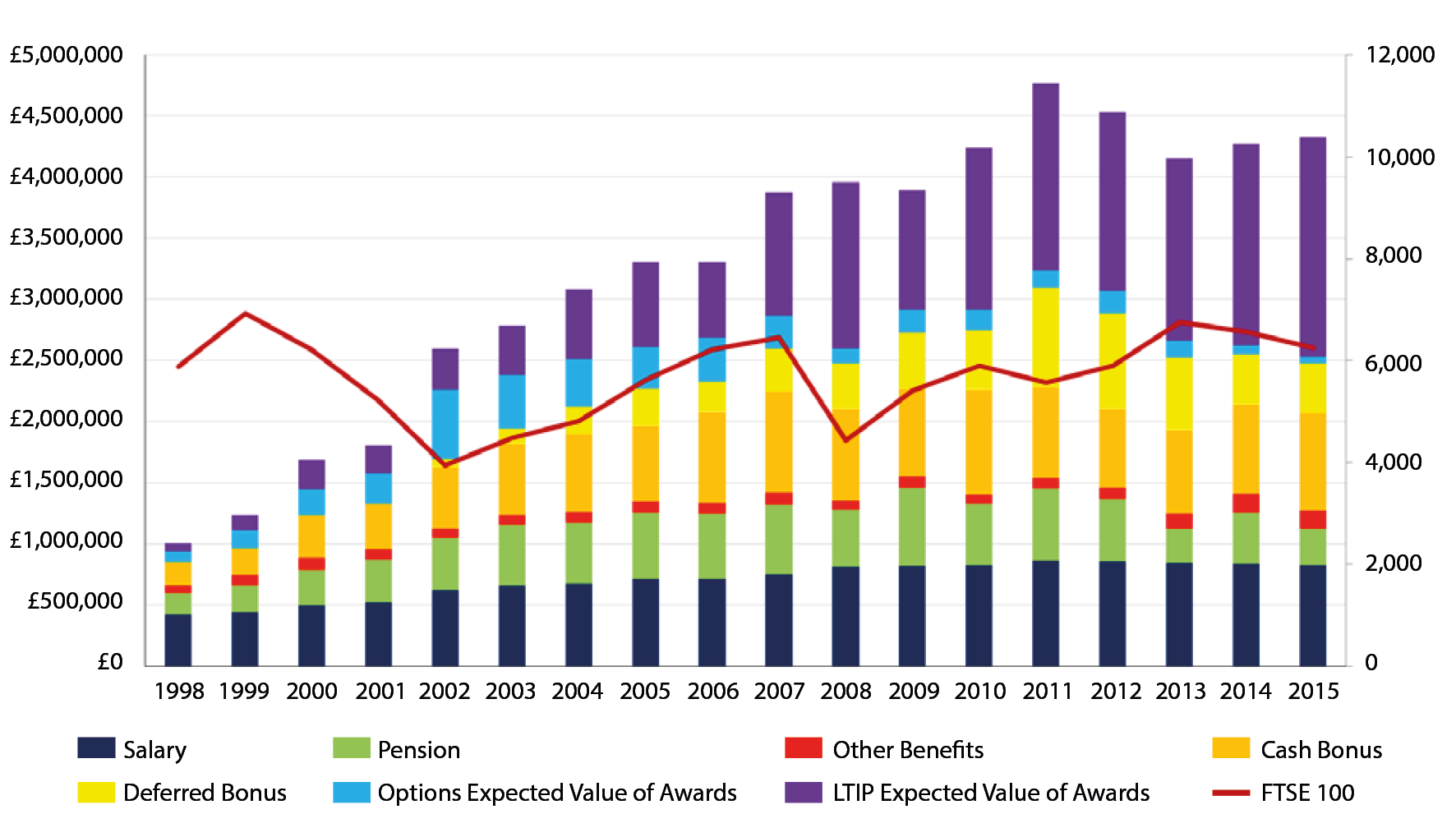

Here’s the break down of how executives now receive remuneration.

Click to enlarge

While salaries have barely grown, the amount of Long-Term Incentive Plan (LTIP) awards has leapt from almost nothing before the turn of the millennium.

Law firm Gannons explains what LTIP awards are:

The basic idea behind a LTIP is that participants receive share options or shares if they satisfy certain performance criteria over time. Sometimes, the LTIP participants have to invest a proportion of salary or cash bonus towards the acquisition of shares.

The pay out from the LTIP depends on performance targets linked to the company’s growth metrics. Increasingly performance targets include soft or behavioural components to promote the culture of the company.

LTIP pay can be clawed back, and often is due to misconduct. As a result executives want a high proportion of their pay to be fixed pay. They do not want any part of their pay to be refundable.

Executives versus workers

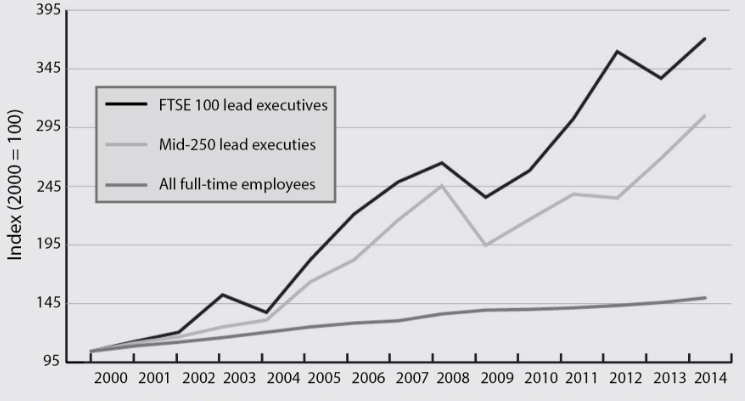

While company bosses are getting paid more than ever, workers have not seen the same growth in salary.

According to the report nearly three quarters of employees believe that CEO pay in the UK is generally too high; survey evidence also suggests that public anger over pay remains the biggest threat to the reputation of business.

A number of recent reports have highlighted the pay gap: two thirds of FTSE 100 CEOs are paid over 100 times the average salary in the UK.

What are the causes of this change?

MPs said that these are the reasons pay has changed so much in recent years.

- Globalisation: the size of multinational businesses has increased substantially, leading to higher rewards for more responsibility and financial impact;

- Scarcity of talent: a low supply of proven CEOs increasing their price and improving their position when renegotiating contracts;

- Performance-related pay: badly designed performance related pay sometimes has led to rewards that do not properly reflect performance;

- Remuneration consultants: they tend to benchmark from the median, leading to a ratcheting up of pay, an effect that has, arguably, been assisted by the publishing of executive pay levels;

- Remuneration committees: they are not able or willing to challenge excessive pay awards, due in part to the complexity of the structure or for reasons of mutual benefit;

- Shareholder engagement: a lack of engagement on pay or active support for high pay awards;

- Weak boards: ultimately boards are responsible and their governance arrangements are not always strong enough to resist upward pressures on pay, nor do they want to risk the disruption of a new CEO;

- Executive greed/contagion: no CEO will be advised to accept lower pay than the industry benchmark and high pay in one company or sector can “spill over” into others, contributing to the ratchet effect.