GlobalFoundries has begun construction of a $4bn fabrication plant in Singapore to ramp up semiconductor production to meet soaring demand for chips from automakers and electronics companies.

The US-headquartered chip manufacturer also plans to invest $1bn in each of its factories in the US and Germany to increase capacity. GlobalFoundries’ investment in Singapore comes as the US government seeks to increase domestic chipmaking capabilities, with many of the world’s semiconductors currently made in Taiwan.

On Tuesday it broke ground on a new fab in Singapore that will add capacity for an additional 450,000 wafers per year, bringing its total output in the country to approximately 1.5 million wafers annually.

GlobalFoundries is a pure-play foundry, which means it does not design its own chips but instead manufactures those designed by companies such as Qualcomm and AMD.

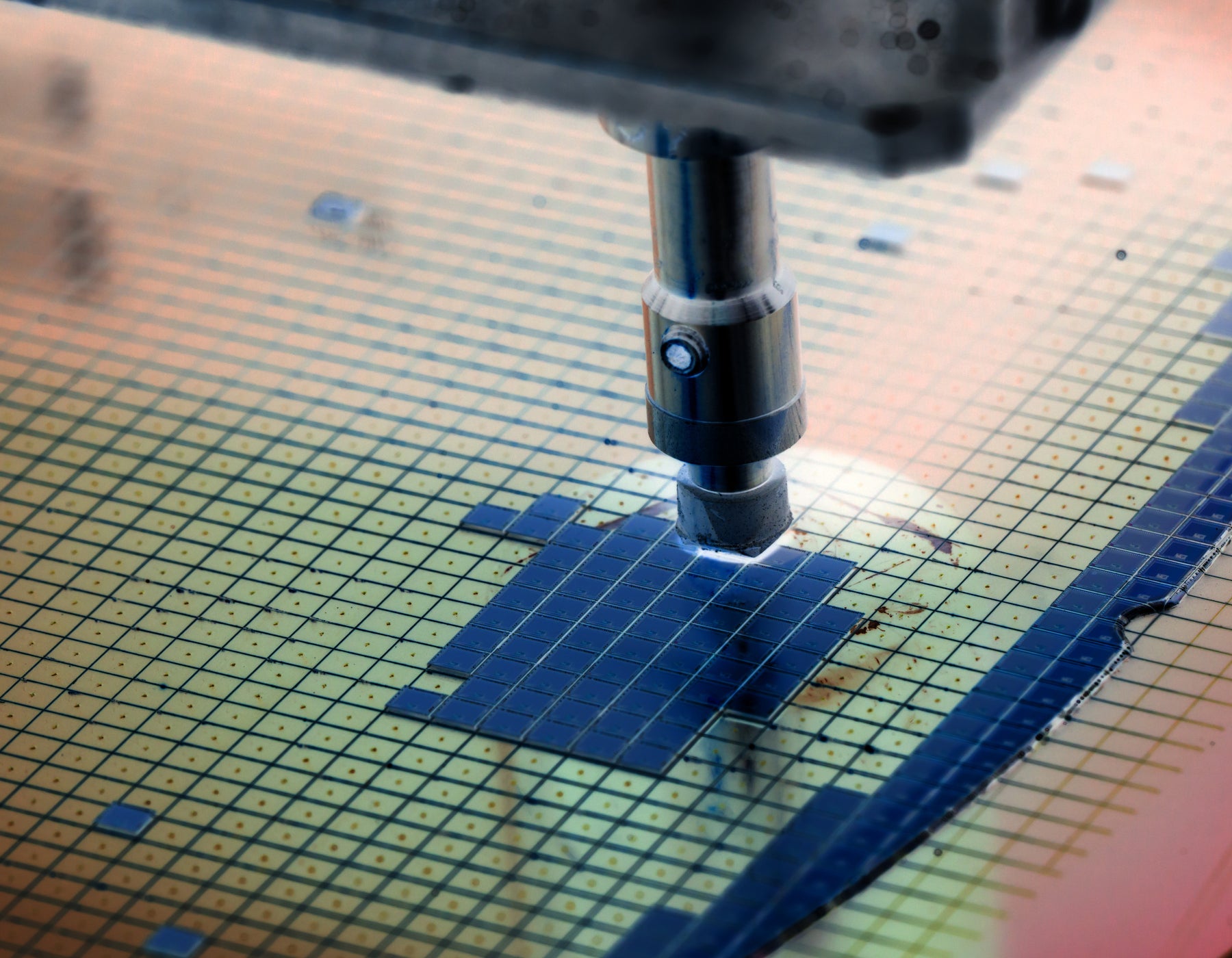

The fab will produce 300mm wafers, which is currently the largest diameter in the semiconductor industry. Wafers are flat, thin discs usually made from silicon that act as the key building block to house the integrated circuits that power many of the world’s electronic devices.

The Singapore expansion would help GlobalFoundries meet chip orders in the automotive and 5G markets, its chief executive Tom Caulfield said.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataWafers must be produced in an environment free from impurities. As such, GlobalFoundries said its expansion will include an additional 250,000 square feet of cleanroom space, along with new administrative offices.

Running the new fab would create “1,000 new high-value jobs” such as technicians and engineers, GlobalFoundries added.

GlobalFoundries Singapore fab to be ready in 2023

The new fab will become operational in 2023, which means it will not be ready to help the current semiconductor shortage that started in December 2020 and resulted in automakers halting production due to a lack of parts.

Blistering demand for consumer electronics during the Covid-19 pandemic coincided with cancelled and then re-placed orders in the automotive sector. Factory fires and severe weather affecting foundries further compounded the shortage.

“GlobalFoundries is meeting the challenge of the global semiconductor shortage by accelerating our investments around the world,” said Caulfield in a statement.

The shortage has already dented the profits of companies such as Cisco and Apple as chip suppliers pass on the additional costs from ramping up production. Technology vendors have not ruled out passing these prices on again to businesses and consumers.

For the chipmakers and companies supplying manufacturing equipment to the fabs, the shortage has meant booming sales. ASML, which sells specialist lithography machines, saw its profits surge 241% year on year.

Executives at the world’s leading chip companies including Intel, Nvidia and Taiwan Semiconductor Manufacturing Company (TSMC) have warned the shortage will continue into late 2022.

This view is echoed by David Leggett, automotive analyst at GlobalData, who said: “This problem will take some time to fix. Semiconductor wafer foundries are expensive facilities to build and lead times are long – six to nine months is the timeline commonly cited.”

In a press briefing, Caulfield added: “I think the next five to eight years, we’re going to be chasing supply not demand as an industry.”

The shortage has underscored the strategic value of microprocessors and spurred the Biden administration into passing a $54bn infrastructure bill aimed at improving chip research and design, along with subsidies for manufacturing.

While GlobalFoundries is headquartered in the US it is owned by Abu Dhani’s state-owned fund Mubadala.

Other chip companies have also poured billions into expanding capacity – Intel is spending $3.5bn to upgrade its New Mexico plant while TSMC is spending $100bn over the next three years.