Biometrics will be used instead of passwords in banking as soon as 2019, says data and analytics company GlobalData, as banks step up efforts in the war against fraud.

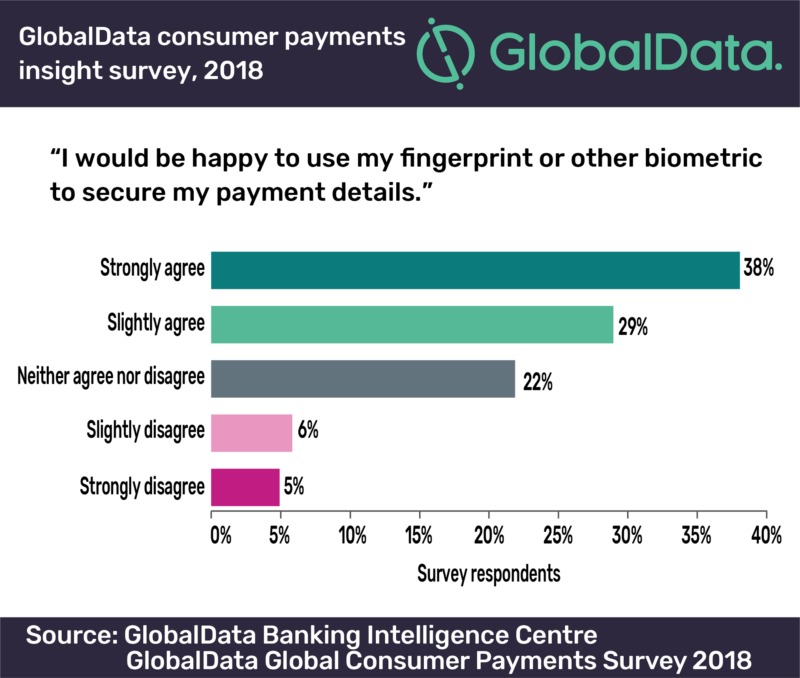

GlobalData’s 2018 Consumer Payments Insight Survey says that 16% of global consumers have fallen victim to a payment fraud over the last four years.

Customers are willing to use biometrics

Frauds cost the banking industry billions on top of reputational damage and yet only 34% of banking providers see a threat to their company’s brand from the effects of data breaches.

The analytics company found that 67% of consumers globally are happy to use some kind of biometrics to secure their payments.

Banks, “it’s time to act, or be left behind’’

GlobalData Senior Wealth Management Analyst Heike van den Hoevel said: “Biometrics is a key theme at the 2018 Money 20/20 conference in Las Vegas, and while industry experts agree that the application of biometrics has the potential to tackle fraud more effectively than ever before, more has to be done to roll it out to different aspects of a bank’s operations.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“Of those consumers who have been subject to fraud, 9% closed their accounts and switched to another provider. Given the costs involved in acquiring and retaining customers, this is a significant proportion. Yet, the level of concern from financial services providers remains low.

“Banks often worry about the balancing act of extra security and maximizing convenience, but clearly there are solutions such as biometric security that can address both. It’s time to act, or be left behind.’’

High biometrics adoption rates

At Money 20/20, a payments, FinTech and financial services industry conference, adoption rates of biometric authentication were said to be as high as 93% if rolled out properly with banking customers.

The highest risk of fraud and reputational damage is in wealth management and the private banking space where the highest-value transactions happen.