Facebook shares took a tumble yesterday as media revelations called into question the use of private data which forms the basis of its business model.

The digital giant is facing questions about how UK-based Cambridge Analytica acquired and used the private information of Facebook users to influence elections around the world – including the 2016 US presidential election.

Whistleblower Chris Wylie, a former research director at the UK-based company, told Channel 4 News a data grab had been carried out on more than 50 million Facebook profiles in 2014.

Facebook shares fell 6.7% yesterday to $172.56 wiping $37 billion off the company’s value (which currently stands at just over $500 billion).

Facebook said late on Friday that it had suspended Cambridge Analytica and its parent company.

It said Cambridge obtained data from 270,000 people who downloaded a purported research app that was described as a personality test. Wylie said Cambridge obtained data from tens of millions of other users who were friends with the people who downloaded the app.

The New York Times reports that Facebook’s chief information security office Alex Stamos is set to leave the company as a result of the furore.

Stamos said on Twitter: “Despite the rumors, I’m still fully engaged with my work at Facebook. It’s true that my role did change. I’m currently spending more time exploring emerging security risks and working on election security.”

Facebook is set to face questions from legislators in the UK and US over its use of private data and faces the prospect of regulation which could undermine its business model.

Why it matters

It is often said that data is the new oil and if that is the case Facebook has the largest reserves.

Its business model is based on the fact that users hand over their private information in exchange for the free use of its services.

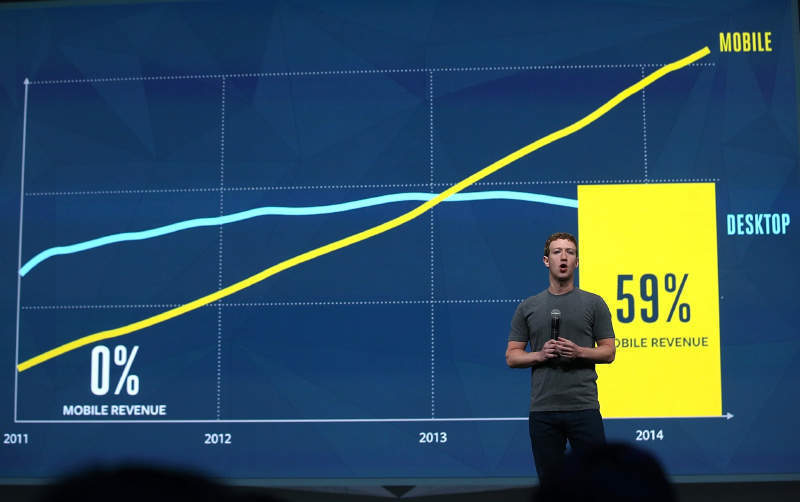

Any statutory curbs on the use of that data would undermine Facebook’s profits which stood at $16bn last year on turnover of $40.6bn.

Facebook makes much of its money by using the huge amounts of data it gathers, on its own platform and through the Facebook ‘like’ buttons distributed across the internet, to allow advertisers to deliver highly-targeted campaigns.

Questions have been raised in the UK and the US over the use of so-called dark advertising in political campaigns – ads which are only seen by the individual Facebook user and so have no regulatory oversight.