The US Securities and Exchange Commission (SEC) has approved an Ethereum exchange-traded fund (ETF), the second cryptocurrency to have an ETF approved in the US.

Launched in 2015 with the vision of being a “world computer”, Ethereum has gained interest from tech enthusiasts and investors alike, growing to a market cap of $350bn.

An exchange-traded fund, or ETF, is a type of investment that tracks a particular index, sector, or commodity that can be traded on a stock exchange like a regular stock. ETFs make it easier to gain exposure to cryptocurrencies. By investing through an ETF, investors avoid the complexities of holding crypto; like securing private keys or dealing with disreputable cryptocurrency exchanges.

The approval of a second cryptocurrency ETF in the US signals greater acceptance of the asset class and increasing regulatory clarity. Greater access combined with increasing regulatory clarity is likely to drive an increased demand for Ethereum.

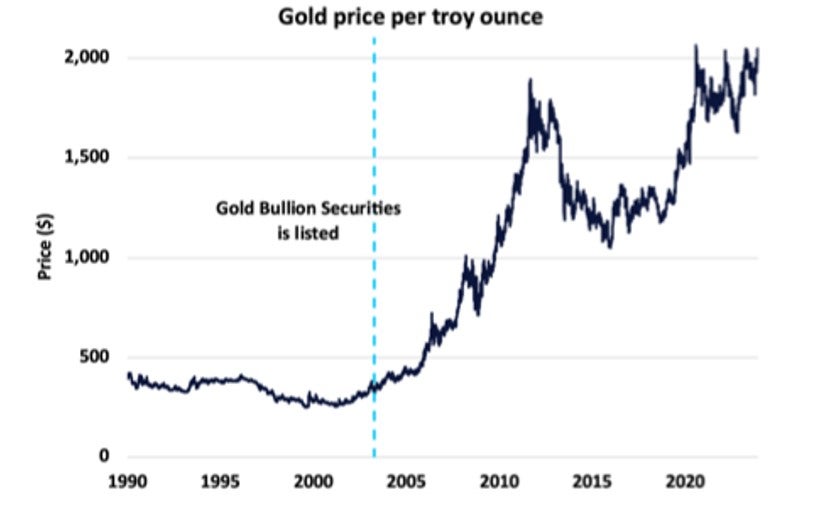

The chart above shows the subsequent price rise of gold following the listing of the first gold ETF in March 2003. When gold ETFs were introduced, they provided an accessible and cost-effective way to invest in gold compared to buying physical gold.

Why were Ethereum ETFs approved?

The approval of Ethereum ETFs by the US SEC on May 23 2024, was unexpected, with many market analysts anticipating a rejection.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIt has been speculated that the motivation behind the SEC’s decision is that crypto policy has become an election issue since Trump adopted a pro-crypto stance. However, the precedent set by the approval of Bitcoin ETFs in January was likely a key deciding factor in the SEC’s decision.

Off to a bad start: Listings of the Ethereum ETFs are delayed

Despite the approval, the listing of Ethereum ETFs has faced delays. This delay is unusual, as ETFs typically start trading immediately after approval, as was the case for the Bitcoin ETFs launched in January. Pending SEC approval of S-1 forms, trading is expected to begin mid-to-late July, although an exact timeline is uncertain.

These delays have tempered investor excitement and highlighted the ongoing challenges with crypto regulation. When trading does begin, the Ethereum ETFs will be welcomed into a cryptocurrency market experiencing a summer lull. Both Ethereum and the wider cryptocurrency market are down 30% since their highs in the first quarter.

What we can expect when Ethereum ETFs are listed

The approval of Ethereum ETFs follows the successful introduction of Bitcoin ETFs in January, which exceeded expectations. On the first day of trading, the ETFs saw $4.6bn in trading volume and have since amassed a combined $76bn of assets under management.

However, the success of the Ethereum ETFs is not a foregone conclusion. The mood of the cryptocurrency market is very different now from what it was in January, and while Bitcoin and Ethereum share similarities, they are also very different assets. With a fixed limited supply, Bitcoin is viewed as digital gold, whereas Ethereum, with a more technically ambitious goal of “world computer”, is often likened to digital oil.

More Crypto ETFs to come

The approval of the Ethereum ETF marks a significant milestone in the cryptocurrency market, reflecting the growing acceptance and integration of digital assets into traditional financial systems.

While delays and regulatory challenges persist, the Ethereum ETFs are likely not the last cryptocurrency ETFs the SEC will approve. Indeed 21Shares, issuer of the fourth largest Bitcoin ETF, has already filed an application with the SEC for a Solana ETF.