Non-gaming firms are likely to be overpaying for esports brand sponsorship deals, according to Sportcal, a sports market intelligence company.

Companies are paying millions for esports brand sponsorship to try and capitalise on the high levels of engagement created by competitive gaming events.

The recent Fortnite World Cup, for example, attracted more than 2.3 million viewers. The winner, a 16-year-old from the US, took home $3m in prize money.

Six-figure salaries are not uncommon for top-level gamers, with such eye-watering sums driven by a rapidly growing esports audience. At least 350 million people are estimated to watch esports around the world, with that figure expected to jump to 600 million in 2020.

But a report published by Sportcal, a GlobalData company, found that non-endemic sponsors – brands that do not sell products directly related to the activity they are sponsoring – may struggle to monetise their sponsorship investment.

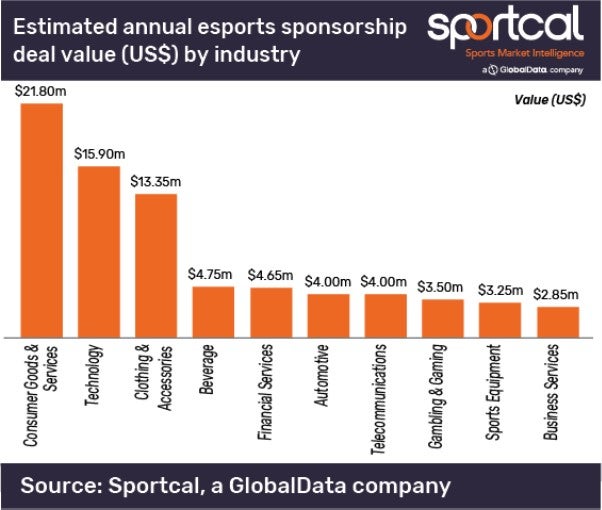

It points to the presence of automotive, financial services and gambling brands in esport sponsorship and the fact that much of esports’ target audience is too young to engage with their products and services.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe average esports brand sponsorship deal for automotive is $4m, while financial services average $4.65m.

Esports brand sponsorships: Is there a lack of market understanding?

Esports brand sponsorships: Is there a lack of market understanding?

Conrad Wiacek, head of sponsorship at Sportcal, said: “These brands don’t understand the landscape as well as the endemic brands and may overvalue their partnerships. Esports is here to stay, but their continuing attractiveness to non-endemic brands is not assured.”

Research by data measurement firm Nielsen found that non-endemic brands represented 49% of all esport brand sponsorship for 2018, an increase of 8% compared to 2017.

However, consulting firm Activate found that 62% of US esports viewers are aged 18-34, suggesting that the demographic isn’t so heavily skewed towards those under the age of 18.

But Waicek adds that there is some strategy behind esport brand sponsorship for products beyond the reach of younger viewers.

“The brand benefit from these sponsorships is in growing their awareness and visibility among a devoted and engaged audience, helping them to find and develop new brand advocates,” said Wiacek.

“This drives the spontaneous awareness of their brands now to lead to increased market share in the future when esports fans are in a position to buy these products and services.”

Read more: Esports: The network tech behind the talent