Businesses are becoming more attuned to the importance of ESG, but GlobalData’s ESG Strategy Survey 2021 reveals that they are not prioritizing the G in ESG. Without good governance, companies will struggle to successfully implement good practices on the environmental and social fronts.

GlobalData surveyed 1,500 ESG leaders from around the world to gauge how companies are setting up and implementing plans to improve their records on environmental, social, and governance factors. ESG will be the most important theme for businesses over the next decade and GlobalData’s survey reveals that Covid-19 has been acting as a catalyst for ESG action.

ESG – low on the priorities list

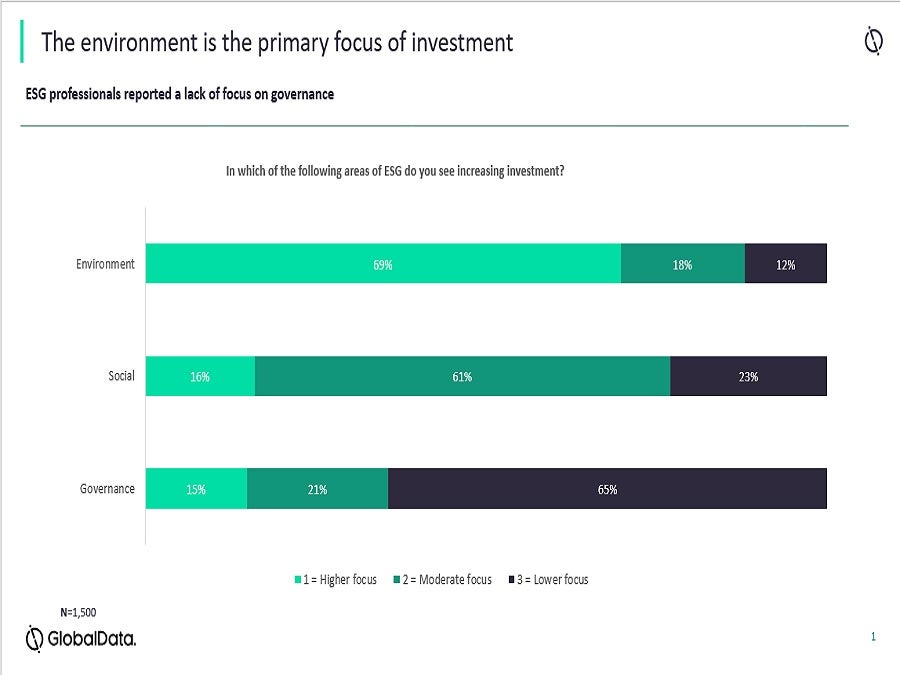

However, most of the focus and investment is going towards environmental issues. A majority of respondents thought that, of the three ESG factors, the environment was the most important for their sector. Worryingly, significant majorities said that governance was both less important and the focus of less investment. Only 15% said that governance was the focus of an increase in investment, which compares to 69% for the environment.

Of all aspects of ESG, it is the governance factors that are most in need of improvement. Most respondents to our survey claimed that their companies conducted risk assessments and that executive pay was linked to governance targets. Despite that, 38% said that their companies had faced legal action over regulatory issues in the last 12 months. That casts doubt on the current effectiveness of governance assessments.

Why governance should not be neglected and how to improve it

Given the existential threat posed by climate change, it is understandable that the environment is prioritized. However, inadequate governance practices make it more likely that companies will fail to meet ESG goals, including those that would improve their social and environmental records.

Good governance alone may not ensure long-term success, but it is a necessary component. So how is it achieved?

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataFirstly, companies must develop and adopt a vision, mission, and values statements that define their corporation and establish accountability at all levels. They must define ESG success for the company and recognize that it is entwined with financial success. They need to commit to the integrated assessment and disclosure of their ESG and financial performance.

As well as that, at a leadership level, companies must establish a team to drive ESG performance, headed by a C-level executive; incentivize ESG performance by tying it to a portion of executive compensation; and appoint more independent board members to widen the board’s vision and sense of responsibility. After all, increasing board-level diversity will drive greater diversity throughout the organization.

Overall, companies should embrace transparency, and understand that secrecy tends to grow like mould and often causes internal rot. In the future, stakeholder scrutiny will only increase.

Good corporate governance is simple

Good corporate governance is simple: take the broadest and longest-range view of corporate responsibilities and performance. It is about more than compliance and risk management, and the benefits of good governance include an organization that makes better decisions, where processes are run more efficiently.

An organization that excels at making decisions and implementing them is more likely to succeed at improving its social and environmental performance.