Elon Musk, the self-described “Technoking” and “Chief Twit,” and the richest man in the world according to Forbes, is an unsurprisingly polarising figure.

Like so many other narratives, the one surrounding Elon Musk has bifurcated. But was it always like this for the Time 2021 Person of the Year? And does his shifting public perception match the innovativeness and commercial success of his three main businesses?

The “old Elon”, if there was such a person, ceased to exist after he acquired X (formerly Twitter) in 2022 and caused the resulting shift in management, moderation, and identity of the platform. It was in light of these events that a different understanding of Elon, based on changes in his public persona, emerged.

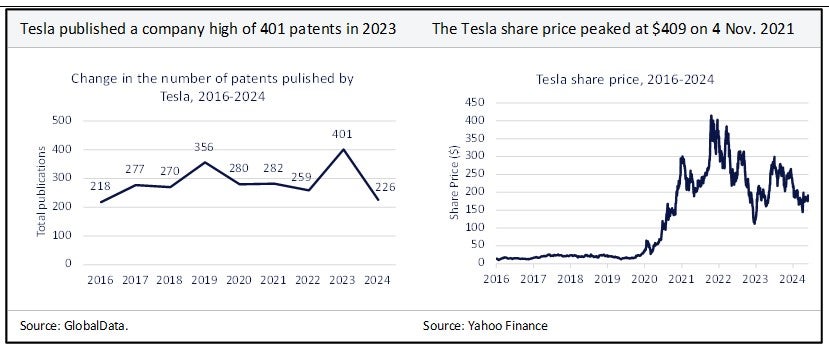

Tesla

A leader in electric vehicles, autonomous vehicles, and, according to some, robotics, Tesla’s patent activity peaked in 2023, but patent filings in 2024 provided by GlobalData suggest that this will be eclipsed. However, multiple Elon-linked, non-commercial events have damaged the Tesla share price since 2016. A few worth mentioning include Elon smoking marijuana on the Joe Rogan Experience, the Wall Street Journal’s reporting of his drug use, and his controversial acquisition of Twitter (now X).

These events seem unrelated to the over-50% decline in Tesla’s share price from $409 in November 2021 to $178 today (20 June 2024). This huge loss of value is despite an increase in patent activity in 2023 and 2024, following a five-year low in 2022 (259).

It seems that the reasons for a decline in shareholder value have less to do with relative innovativeness, but rather the competitive position of Tesla compared to disruptive competitors like BYD, lower vehicle sales, the limited success of the Cybertruck, more clarity on the company’s robotics plans, and the rate of EV adoption.

Though I admit caution should be exercised when characterising the causes of market outcomes.

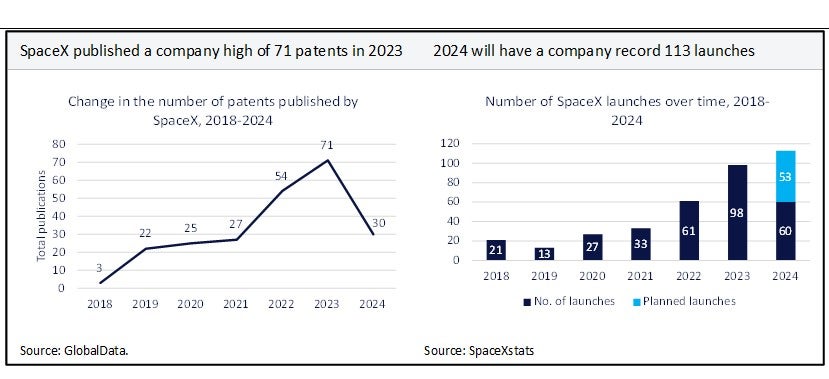

SpaceX

SpaceX, the spacecraft and satellite company, recently completed rocket launch #373, with an overall success rate of 97%. As of 2022, a launch can cost clients $67m.

Based on the current rate of patent publication, 2024 is unlikely to be a more prolific patent year for SpaceX. However, the increased number of launches and their success rate bodes well for SpaceX’s future.

SpaceX is a private company but the above information and its reported increasing revenue suggest that the “old Elon” is not entirely missed. However, SpaceX has serious competitors, notably Blue Origin, Airbus, Lockheed Martin, and ViaSat. While the “new Elon” undoubtedly presides over the success of SpaceX, the Old Elon had a big part to play.

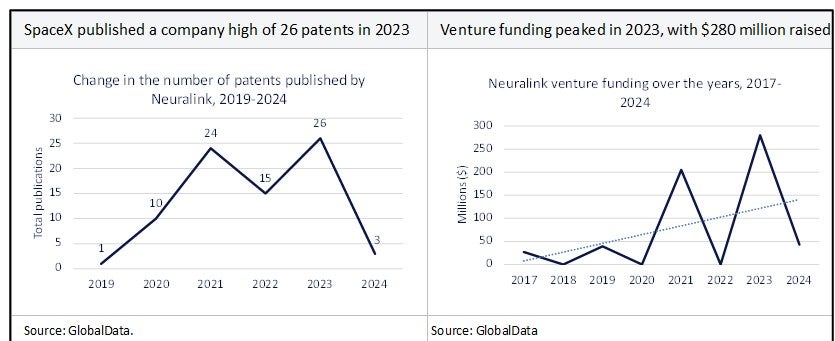

Neuralink

Neuralink, which develops implantable brain interfaces, had a breakthrough in January 2024 when it successfully implanted a device into a human. Its patent history suggests future growth despite its slow start to 2024 publication. Funding similarly shows a positive trend with nearly $600m raised since 2017.

Across Elon’s businesses, development, innovation, and progress are occurring.

The question is whether his coarsened discourse, the distraction of X (formerly

Twitter), and a large decline in Tesla’s share price indicate a less positive

future.

I write this article gravely aware that Elon’s public approval, like the value of his diverse ventures, can be prone to extraordinary growth. Nonetheless, at this time, both his investors and a majority of the public would likely agree, they miss the old Elon