India’s finance minister has announced plans to launch a central bank-run blockchain version of the rupee in the next financial year, joining a worldwide trend among nations.

If it manages to keep to this timeline, India would’ve successfully rolled out its central bank digital currency (CBDC) faster than major nations including the UK. The news comes against a background of many countries around the world planning to bring in CBDCs.

Finance minister Nirmala Sitharaman broke the news about the new digital rupee on Tuesday.

“Introduction of a central bank digital currency will give a boost, a big boost to the digital economy,” she said while delivering the country’s annual budget. “Digital currency will also lead to a more efficient and cheaper currency management system.”

Apart from announcing that the new Indian CBDC would go live within the 12 months starting on April 1, Sitharaman provided few details. She only said it would be “using blockchain and other technologies.”

Launching a CBDC in India would make sense given the country’s ongoing demonetisation policy, which prime minister Narendra Modi’s government kicked off in 2016. The aim is to get rid of physical banknotes in an effort to rein in the nation’s shadow economy, which is believed to be large. One of the key benefits of CBDCs is that they can provide greater visibility of transactions for regulators.

The news of the Indian CBDC comes months after the Modi government planned to impose stricter rules on the wider cryptocurrency industry. In a proposal seen by Reuters, the legislation would ban the use of non-governmental cryptocurrency payments in India. China imposed a cryptocurrency ban last summer, that similarly paved the way for its own digital yuan.

“Governments in charge of stable economies are not likely to let cryptocurrencies become popular as it would cause them to surrender control of their economy to a decentralized digital currency,” a recent thematic research report from GlobalData noted.

India is far from alone in planning a CBDC

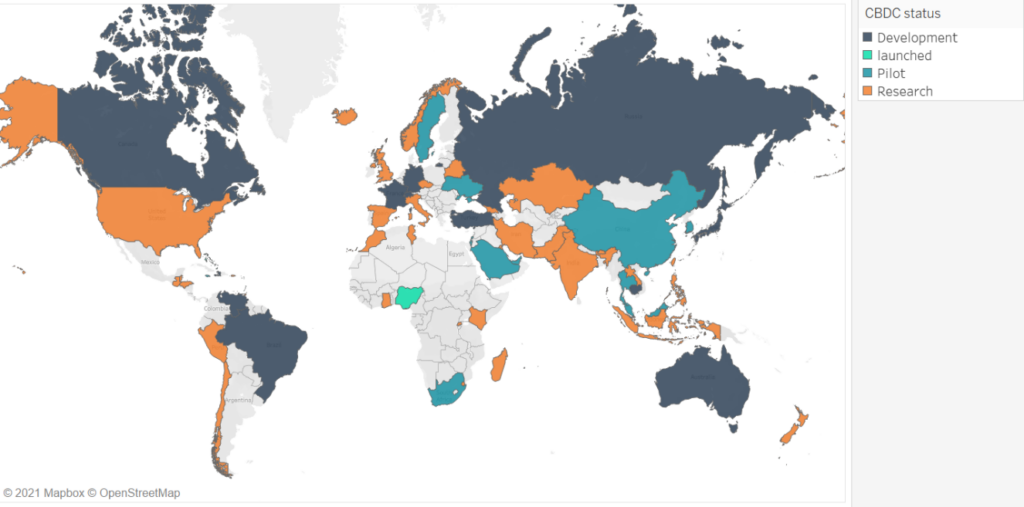

India is only the latest country to formally jump on the CBDC train. According to a 2020 survey from the Bank for International Settlements, 60% of central banks are conducting CBDC experiments and proofs-of-concept.

“There is growing interest from many governments in developing their own digital currency – a decision motivated by the decline of cash and the ability to create a currency that is transparent, but also due to the need to create an alternative to cryptocurrencies and stablecoins,” the GlobalData report noted.

Some projects are already live. The Bahamas launched the so-called Sand Dollar back in 2020 and Nigeria issued the eNaira in late October 2021. The International Monetary Fund is currently monitoring the success of these digital currencies.Several other countries have launched CBDC pilot programmes. Sweden’s effort to launch the e-krona has been tied to its goal of becoming truly cashless within the next few years.

As Verdict has reported in the past, China has trialled its digital yuan for some time. The digital yuan can so far only be used in designated cities such as Shenzhen, Shanghai and Beijing, but these are very large cities.

In late January, Chinese shopping platform Meituan has expanded digital yuan payments to over 200 types of offline merchants as China welcomes in the Year of the Tiger on February 1.

The digital yuan had over 260 million individual users within a few weeks of its expanded beta in the run-up to the Winter Olympics, with 87.5bn yuan ($13.78bn) worth of transactions already racked up.

But if anyone expected the games to be a great opportunity for China to advertise its digital dosh to the world, then they will have been disappointed: few international athletes are likely to have set up the Chinese bank accounts needed to access it.

Other countries, like the UK, Norway and the US are still in the early research stages of launching CBDCs.

On the digital money front, other nations have experimented with non-governmental cryptocurrency as legal tender with limited success, El Salvador‘s bitcoin project being one notorious example.