Investors need help. The tech industry is rumoured to be heading towards a major bust, the valuations are plummeting and cash-strapped founders increasingly find raising money to be a challenge. In the fractured techscape, investors need all the help they can get to keep abreast of the quick turnaround of the market.

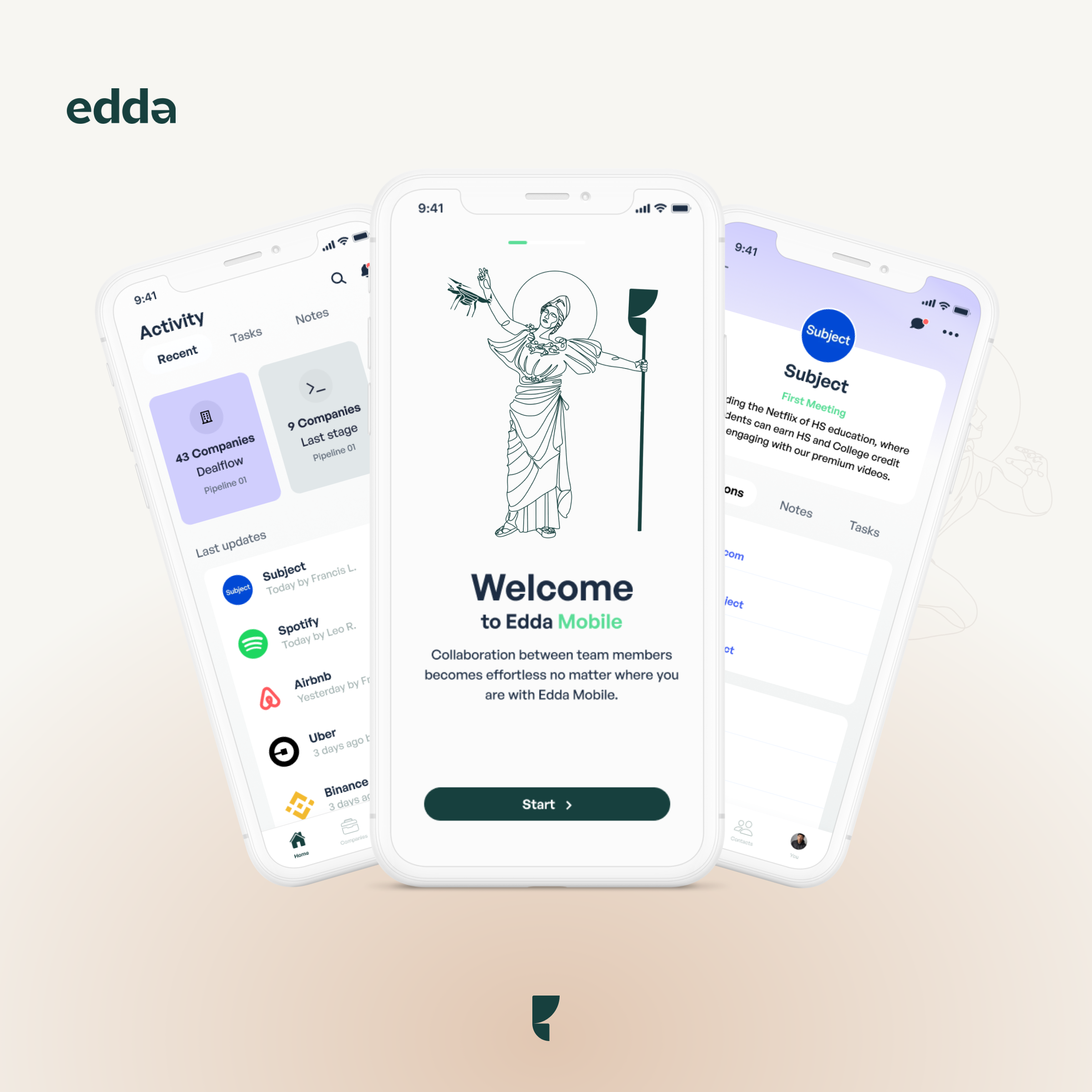

That’s where Edda comes in. Launched in 2017, the France and UK-based fintech startup has launched a product combining dealflow, portfolio, LPs and business community management into one product. Edda’s email plugin, for instance, automatically updates investors’ data whenever new emails about deals come in and synchronises it with relevant databases.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

“The deal is automatically sent to the pipeline for the rest of the investment team to start working on it collaboratively, by adding comments, reading the documents and the emails already exchanged with this company,” Clément Aglietta, the founder and CEO of Edda, tells Verdict.

“The system generates a unique and secure link for this company profile and the investment team can share the information with external contacts in a very secure way.”

To further strengthen the product, Edda has just topped up its coffers in a $5.8m funding round.

Mucker Capital, Plug&Play, FJ Labs, Tony Fadell’s Future Shape and angel investor Arnaud Bonzom backed the round. Edda will use the money from the funding round to continue hiring talent and build out the product offering as the business scales at pace.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataRaising money in a cool environment

Edda previously raised a $300,000 pre-seed round but has spent the past four years generating revenue.

“We didn’t need to fundraise for four years,” says Aglietta.

The funding round comes as fintech investment has seen drops since 2021. Venture capitalists (VC) injected north of $84.5bn into the fintech industry across 2,360 deals, according to data from research firm GlobalData.

That figure has shrunk in 2022. As of September 8, the fintech industry has secured $32.5bn across 1,155 VC-based deals.

Aglietta argues that the fact Edda managed to raise the funding round while many startups struggle to top off their coffers proves the viability of their product.

"We were able to do this because we built the product in-house and understood its value, so we could go to market with the initial product with very little investment and became revenue generating immediately," Aglietta says. "This is why we are so compelling because we were able to build a global customer base so quickly."

Edda secures $5.8m funding round because investors need better tech

Aglietta founded Edda out of frustration. As one of the first few employees of investment firm FJ Labs in New York, he has first-hand experience of how bad the technology investors use is.

"The only tools that existed were based on old technology and were not properly integrated with other services, such as Crunchbase and Pitchbook," he says. "They were built for engineers, by engineers and these tools used 20-year-old legacy tech."

Sluggish technology, Aglietta argues, holds back the $6.5tn private equity industry. While these companies invest in the most innovative sectors and companies in the world, he says that the majority of these investors still rely on tools such as Excel spreadsheets to manage their portfolios.

"My team and I built Edda to solve this challenge, based on our real needs, but once we began to grow we had to spin out of the VC so we could focus on building the business," he says. "We decided to build the software that investors would want to use everyday. A place that centralised all the information they need and helps them to see the bigger picture and the impact of their job on the world.

"There is no other tool on the market that shows investors the impact of their investments in real-time. If we want to drive positive change, we need to invest in the right direction."

From Kushim VC to Edda

The startup wasn't called Edda when it launched in 2017, but Kushim VC. So why did it change its branding?

"[Edda] is a book of poems from 1,000 years in Iceland," Aglietta says. "This book explains how their Gods created the world. It's also the single source of truth for northern mythology, because it's the only book that brings together oral beliefs. Finally, it's simple and elegant –[with] four letters – and it's the same pronunciation in every language, which is very important for us, because we operate in more than 20 countries."

Now Edda plans to become the Bloomberg Terminal of the investment industry.

“Much like Bloomberg altered an industry's ability to operate, Edda will transform how investors visualise their fund and manage their deal-flow and relationships," Fabrice Grinda, founding partner at FJ Labs, says in a statement."

"Venture capital and private equity in general has gone from strength to strength over the past decade, spreading into new sectors and becoming the cornerstone of innovation investment. As we face a more challenging investment environment, investors need game-changing collaborative tools such as Edda to help to ensure they remain one step ahead.”

GlobalData is the parent company of Verdict and its sister publications.