Amid strong expectation, Disney launched its OTT video service platform, Disney+, in Latin America and the Caribbean on 17 November, as part of its ambitious global expansion plan.

The SVoD platform, which arrives to the region after a successful reception in the US, Western Europe and Southeast Asia-Pacific, is available at US$5.99 per month, although clients can also access the platform for an annual discounted fee of US$59.99.

As part of its distribution strategy, Disney is setting up partnerships with a number of telecom operators, pay-TV and media service providers across the region, such as Telecom Argentina/Cablevision, Izzi (Televisa), Globoplay in Brazil, America Movil (Claro) and Telefonica among others. These agreements will allow operators to offer the service with monthly subscription discounts and/or extended trial periods.

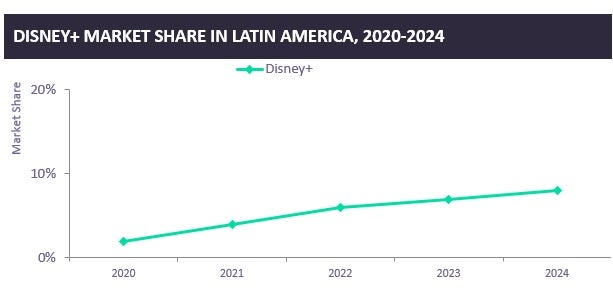

GlobalData estimates that SVoD unique subscription household penetration in Latin America will reach 23.6% at year-end 2020, expanding to 33.3% by 2024. Growth will be mainly driven by the increasing uptake of broadband services; viewers changing habits, from time-scheduled to on-demand content; and the emergence of new platforms featuring locally relevant content.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataGlobal players such as Netflix and Amazon Video, for instance, have been investing on the production of local content over the last several years, while Disney+ includes Disney’s existing catalog of locally produced series and is working on several local productions.

By 2024, Disney+ will consolidate as the third largest player in Latin America with 8.0% of the total SVoD subscriptions in the region, behind market leaders Netflix and Amazon Video.

Related Company Profiles

Netflix Inc

Telefonica SA