Is another cryptocurrency winter coming? Investors and analysts increasingly warn about the possibility that this is the case. They have reason to be nervous.

The price of bitcoin collapsed from the $68,000 all-time-high it reached in November 2021 to be worth just over $35,000 in mid-January. It has since recovered slightly and is now hovering on the $39,000 line. Both ether and solana have suffered similar drops.

In total, the crash shaved over $1tn of value from the cryptocurrency market. For anyone keeping score, that’s more than the $600bn in 2022 value that was lost in the 1929 stock market crash, as noted by The Byte.

The collapse of the market comes after two years of a pandemic-induced cryptocurrency boom. Rewind to the height of the Covid-19 crisis and you could barely walk without falling over another think piece about how bitcoin was used the way people would normally invest in gold during times of turmoil.

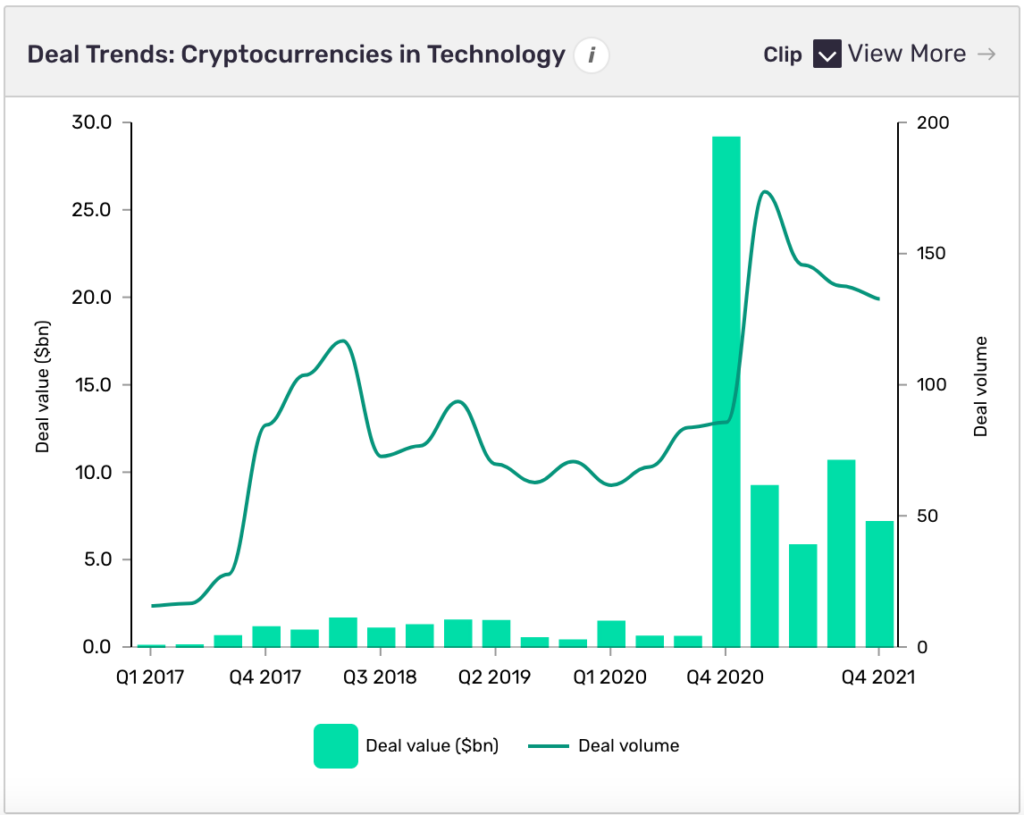

It wasn’t just the price of digital assets that skyrocketed, so did the funding deals. For comparison, the 298 venture financing, M&A and public funding deals recorded in the cryptocurrency sector had a total value of $3.9bn in 2019, according to analyst firm GlobalData’s data. Those numbers jumped to 301 deals worth $31.787bn in 2020.

Now it seems as the weather is shifting, with some analysts wondering whether or not the industry is heading towards another cryptocurrency winter.

But what is a cryptocurrency winter, are we really heading towards one and what would the consequences be if we were? Let’s find the answers.

What is a cryptocurrency winter?

All markets go through cycles when the price either goes up or down. Fluctuations are normal and expected. Sometimes they can, however, be caught in a downward spiral with the price of certain stock falling more than expected. A cryptocurrency winter is when that happens in the cryptocurrency market and experts see no likely recovery happening over the next year or so.

Cryptocurrency winters aren’t uncommon. The latest one occurred back in 2018. The Bitcoin Crash or the Great Crypto Crash as it became known occurred after the then-unprecedented boom of 2017 when bitcoin ended the year on a $19,000 high. Fast-forward to February 2018, and the digital dosh had plunged below $8,000. It ended the year trembling on the $3,100 line.

While it’s difficult to pinpoint a single factor behind the Bitcoin Crash, one doesn’t have to look hard to find potential culprits. These include the $530m hack of cryptocurrency over-the-counter market in January and compromised Binance application programming interfaces were being used to execute irregular trades in March. It’s not a confidence-building exercise to discover that two of the leading exchanges in the world have been hacked.

Other factors contributing to the collapse of the bitcoin market would also include that Google, Facebook and Twitter banned cryptocurrency ads on their platforms in March.

Whatever the reason, the 80% slump of the market highlights how common booms and busts are in the cryptocurrency market. The timing similarities between that crash and the current one should probably send a chill down the backs of veteran traders wondering if another cryptocurrency winter is coming.

A similar drop occurred in May 2021, although the market soon recovered from it.

“If you want to get involved with crypto, you have to be comfortable with this type of swings. Cryptos are known for their volatility,” Nicklas Nilsson, thematic analyst at GlobalData, tells Verdict.

Why are we talking about a cryptocurrency winter now?

Just like with the 2018 Bitcoin Crash, it’s difficult to pinpoint one single factor behind the most recent collapse of the cryptocurrency market.

Some have pointed towards Russia’s central bank proposing a ban on cryptocurrency trading and mining. The ban would add to the laundry list of regulators in Europe, the US, India, China and elsewhere that have either indicated or introduced new rules to provide more oversight over the cryptocurrency market over the last year.

The plummeting bitcoin has also been attributed to a lingering fear of Covid-19, ironic as that may seem given several linked the skyrocketing price over the past two years with the pandemic.

Another potential reason behind the collapse of the market is the same thing that has seen the majority of Big Tech stock fall over the past month: the US Federal Reserve announcing that it will raise interest rates and it indicated a dialling back of its aggressive bond-buying programme.

Just like in 2018, there have also been several high-profile hacks of cryptocurrency exchanges such as the $196m Bitmart hack in December. Cybercriminals also stole $80m from DeFi platform Qubit Finance and $30m from exchange Crypto.com in January.

These factors as well as the natural volatility of the market could all have contributed to the big market swings at the start of 2022.

“In an evolving infant industry like crypto, it doesn’t take much to drive big swings in price, and to make matters worse, there is a high level of greed and leverage on the crypto market,” Nilsson says.

“The get-rich-quick mantra that is strongly prevalent in the crypto space has contributed to the crypto derivatives market booming. Studies from last year show that derivatives trading volume now exceed that of the underlying spot markets. What this means is that traders are taking on excessive risk and being forced to sell when the price goes down, making an already volatile market more volatile. “

He also noted that the growing cryptocurrency lending market, where people use their digital asset holdings as collateral for loans, may have exacerbated the situation.

“If you take out a $1m loan backed by bitcoin and the price drops by 30%, you owe the lender 30% more and if the price continues to go down and hit a certain level, all your bitcoin will be sold and sent to the lender,” Nilsson explains. This is exactly what we saw in May 2021 and it is exactly what we’re seeing now. Unfortunately, people are not learning their lesson and it is making the overall crypto market more volatile.”

Does that mean cryptocurrency investors should take out their snow shoes?

The market has dropped for a number of reasons. Some analysts looking where the wind is blowing are now starting to expect snow.

David Marcus, who up until recently led Facebook’s failed cryptocurrency project Diem until he left at the end of 2021, seems to think that the cryptocurrency winter is already here, telling entrepreneurs in the space to hunker down and to innovate.

“It’s during crypto winters that the best entrepreneurs build the best companies,” Marcus tweeted on January 24. “This is the time again to focus on solving real problems vs pumping tokens.”

It’s during crypto winters that the best entrepreneurs build the better companies. This is the time again to focus on solving real problems vs. pumping tokens.

— David Marcus ⚡ (@davidmarcus) January 24, 2022

Katharine Wooller, managing director at cryptocurrency wealth platform Dacxi, echoes the sentiment.

“In comparison to the dulcet summer of 2021, winter is already here for crypto,” she tells Verdict. “That said plenty of investors are taking advantage of cheap coin, and embracing the fact that bitcoin is on sale.”

George McDonaugh, co-founder and managing director at digital asset investment company KR1, believes it’s “a very real concern” that a cryptocurrency winter is coming, saying that it was only a matter of time before the flow of “cheap money” would go out of the market.

“In my view this will only happen if the Fed turns out to be more dovish than expected, and inflation worries fade into the background as the world’s supply chains get fixed after Covid decimated them,” McDonaugh tells Verdict. “Eventually though, the innovation and creativity within the crypto space will naturally bring things out of winter. “

Other experts are not so sure, saying the recent talk of a cryptocurrency winter is just drummed up by “wealthy groups of people” trying to influence the market to the detriment of small retail investors.

“The notion of the cryptocurrency winter all boils down to one thing in my opinion: controlling the market through fear and greed,” Mark Basa, global brand and business manager at DeFi aggregator HOKK Finance. “There are very wealthy groups of people that can influence bear markets in order for a global shift in investments. They then buy up and sell off when the bull market returns.”

Nilsson offers a more measured outlook on things. He suggests that the recent downturn is just part of the nature of things in the digital assets market, adding that he believes a 2018 crash is “unlikely.”

“As always with crypto the hype or doom and gloom around the market is out of proportion. It was only a couple of months ago that most believed that we were in a supercycle and bitcoin hitting $100,000 was just a matter of formality,” Nilsson says.

“Now, many believe that a crypto winter is here where we will see a significant drop in value for an extended period. While it is true that we lost $1tn worth of market cap of crypto and bitcoin is down over 50% from the all-time-highs, this type of corrections is within normal territory when it comes to bitcoin and the overall crypto market.”

Several of the cryptocurrency market stakeholders are, unsurprisingly, eager to share that opinion.

So where does this leave the industry?

No matter how long the current downturn will end up being, it is clear that the market has taken a beating. Some expect that the pummeling could be a good thing.

“Meme coins will die, scam DeFi Ponzis will collapse and under-capitalised projects will be forced to cut the fat bloating their organisations,” Nick Saponaro, CEO, decentralised payment ecosystem Divi Project, tells Verdict. “This would be a net positive for the space, which tends to balloon irrationally in times of euphoria. Strong projects will rise in rank, while the market shakes out the projects that really shouldn’t have been there in the first place.”

The recent downturn hasn’t prevent VCs from betting on cryptocurrency companies. Bahamas-based exchange FTX raised a $400m funding round at a $32bn valuation at the end of January. Around the same time, US-based blockchain infrastructure company Blockdaemon secured $207m in a Series C funding round led by Sapphire and Tiger Global.

If the cryptocurrency winter ends up being severe, then this state of things may not last.

“A crypto winter would obviously have a knock-on affect on the entire industry, leading to venture capital drying out, causing widespread redundancies, hindering mainstread adoption, resulting in institutional investors pulling out, causing research into emerging areas like NFTs and DeFi to stagnate, and, naturally, cause crypto prices to plummet affecting long-term consumer confidence and acceptance,” Nilsson says.