The war in Ukraine won’t change much when it comes to cryptocurrencies in Russia, according to the experts – at least not for now. Since Vladimir Putin’s regime launched its invasion of its neighbour, the digital asset industry has faced demands to cut off Russian customers from its services to avoid oligarchs circumventing sanctions imposed by the West.

At the same time, the question has been raised as to what the war would mean for the bitcoin ban proposed by Russia’s central bank earlier this year. If you ask industry stakeholders, their answer is: not much.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Let’s start with the notion that cryptocurrency exchanges should ban customers in Russia from accessing their services. The call to do so has grown louder over the past two weeks. The idea is that the ban would add to the unprecedented economic sanctions already imposed by the US and its allies against the Russian regime, ensuring that they could not be avoided by transferring wealth into cryptocoins.

The punitive economic sanctions against Russia imposed by the Group of Seven, or G7, are designed to cripple the regime’s finances and force it to withdraw from Ukraine. The sanctions include barring Russia from international payments system SWIFT, cutting off the nation from secure international communications and transactions.

The US Department of the Treasury has also imposed sanctions against the Corporation Bank for Development and Foreign Economic Affairs Vnesheconombank, and Promsvyazbank Public Joint Stock Company, along with 42 of their subsidiaries, as well several Kremlin-connected individuals.

At the same time, companies have hustled to support Ukraine. Big Tech firms like Microsoft have devoted resources to protecting the government from Russian cyberattacks. Others, like Apple, Netflix and PayPal have stopped providing their services in Russia. Google has also limited its services.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataElsewhere, Elon Musk has sent ground terminals enabling Ukrainians to access the Starlink low-orbit satellite network, providing them with internet access as the unrelenting Russian shelling threatens to destroy the nation’s infrastructure. Several companies – like challenger bank Revolut and Uber – have set aside resources to aid their Ukrainian employees and the nation’s fragile tech community.

The sanctions have already had an effect. The combined pressure from companies and the sanctions have seen credit rating agencies Fitch, Moody and S&P downgrade Russian bonds to junk status.

As a result of the Federation’s finances tumbling off a cliff, market analysts predict that the likelihood of Russians turning to cryptocurrencies has increased.

“Russian consumers have been hit by rapid inflation of the ruble, which hit a 10-year low against the US dollar on March 3rd 2022,” GlobalData researchers wrote in an executive briefing about the Ukraine conflict on March 4. “This will make Russian consumers likely to turn to cryptocurrencies also, as has been seen in other markets hit by inflation such as Nigeria.”

Blockchain research firm Coin Metrics has similarly noted that the use of cryptocurrencies has gone up slightly in Russia following the Ukraine invasion.

However, cryptocurrency exchanges have not barred all customers in Russia from accessing their services.

Cryptocurrency exchanges won’t ban all customers in Russia – yet

The punitive sanctions against Putin are unprecedented. Naturally, lawmakers and regulators would hate it if Russian oligarchs could easily sidestep these sanctions with something as commonplace as cryptocurrencies.

“Now these sanctions are powerful, but Russia can dodge some of this pain by using the same cryptocurrency tools that are currently used by drug traffickers, cyber criminals, and tax cheats,” senator Elizabeth Warren said during a committee hearing last week. She and three other Democratic senators had previously raised their concerns to Treasury secretary Janet Yellen in an open letter on March 2.

The Treasury itself has warned that because many cryptocurrency exchanges don’t follow the same strict know-your-customer (KYC) and anti-money laundering (AML) rules that banks do, they have become an increasingly serious threat to US sanctions.

The British National Bureau of Economic Research made a similar point in a report published in October, 2021. The researchers warned that criminals could move money between low or no-KYC exchanges to hide their tracks with reasonable ease.

Sidestepping sanctions with the help of cryptocurrencies would therefore, arguably, be an open goal for Russians, according to some analysts.

“Russia has had a lot of time to think about this specific consequence,” Michael Parker, a former federal prosecutor who now heads the anti-money-laundering and sanctions practice at the Washington law firm Ferrari & Associates, told the New York Times. “It would be naïve to think that they haven’t gamed out exactly this scenario.”

Unsurprisingly, several politicians have urged digital asset companies to do everything possible to keep this from happening. Ukraine’s vice prime minister, Mykhailo Fedorov, has called on eight major cryptocurrency currency platforms to block transactions among all Russian users, claiming it’s necessary to “sabotage ordinary users.”

However, cryptocurrency exchanges have so far been reluctant to turn off their services in Russia, at least not entirely

Binance CEO and founder Changpeng Zhao has refused to put in place a blanket ban against all Russian transaction, but has blocked the “hundred individuals that are on the international sanctions list in Russia” in order to adhere with regulatory pressure.

“We differentiate between the Russian politicians who start wars and the normal people, many normal Russians do not agree with war,” Zhao tol BBC Radio 4’s Today programme.

Julian Sawyer, CEO of Bitstamp, said in a statement sent to Verdict: “We adhere to all sanctions and work with all regulators to ensure that that we’re operating at a bank grade level on anti-money laundering checks, and know-your-customer and know-your-transaction controls. We‘re not seeing any increased activity from Russia, either.”

Brian Armstrong, CEO and co-founder of US-based Coinbase, tweeted: “Every US company has to follow the law – it doesn’t matter if your company handles dollars, crypto, gold, real estate or even non-financial assets. Sanctions laws apply to all US people and businesses.”

Like his rivals, Armstrong said it would bar sanctioned individuals and entities from using Coinbase’s services. However, he added that Coinbase wouldn’t ban ordinary Russians – including those potentially protesting the war – from using the services.

“That said, if the US government decides to impose a ban, we will of course follow those laws,” Armstrong said.

Similarly, Kraken CEO and co-founder Jesse Powell has also stated that his company follows the law to the letter and is working hard to prevent sanctioned individuals from using its services, but won’t ban all Russians.

“It’s a pretty extreme measure, and it’s far beyond turning off someone’s access to their music streaming service, or their their photo sharing app,” Powell told CNBC. “Shutting off someone’s financial access is something we take very seriously.”

Can oligarchs use cryptocurrency exchanges to sidestep sanctions on Russia?

The argument about cryptocurrency exchanges blocking Russians hinges on the assumption that Russian oligarchs can sidestep sanctions by simply buying bitcoin and converting it to a fiat currency somewhere else. Sure, there is a slight risk to that, but market stakeholders aren’t too concerned about it.

“[We] don’t think there’s a high risk of Russian oligarchs using crypto to avoid sanctions,” Armstrong said. “Because it is an open ledger, trying to sneak lots of money through crypto would be more traceable than using US dollars in cash, art, gold, or other assets.”

This may surprise some readers who recall bitcoin evangelists’ touting Satoshi Nakamoto’s gospel about digital dosh being a decentralised asset that could easily be moved around without any governmental oversight. Well, that pipe dream hasn’t really been real for some time.

As Verdict has reported in the past, the US Federal Bureau of Investigation has been able to track and recover ransoms paid out to cybercriminals, despite those ransoms being paid in bitcoin. In June, for instance, the FBI was able to recover $2.1m in bitcoin paid out to cybercriminals behind the Colonial Pipeline hack.

Law enforcement agencies and regulators in the West are now closely looking at the distributed ledgers for big money transfers happening in the digital realm, making it more likely that they will detect oligarchs trying to sneak out their assets.

In this regard, it’s very similar to when the US Treasury detected billions of dollars in dirty money being moved through Latvia’s third biggest bank in 2018, leading to the collapse of ABLV Bank.

The obvious counter-argument to this is that sanctioned individuals could simply try to make smaller transactions in an attempt to fly under the radar. Sure, they could do that, but as Politico points out, that would raise the demand for the finite number of cryptocurrency assets out there, making the price surge. Such a plan would thus become an expensive endeavour and that’s not even accounting for the fact that processing bitcoins is expensive in itself.

Even once cryptocurrency had been obtained, Sanctions busters would eventually want to convert their digital assets to fiat money. However, this would again run the risk of regulators catching them.

“Crypto could certainly be one way to get around many of these sanctions,” Josh Fabian, co-CEO, and founder of trading programme tastytrade, tells Verdict. “I think the more likely scenario though is increased Russian trade with China and trading in the renminbi. If you’re China, this is an opportunity to offer an alternative to the US dollar, especially if Russia plans to expand further. I’m not sure how China wouldn’t try taking advantage of the situation.”

What about the Russian ban?

Cryptocurrency trading enjoyed a massive surge during the pandemic, with digital assets like bitcoin and ether reaching record heights in November, 2021. At the same time, investment into the cryptocurrency sector skyrocketed.

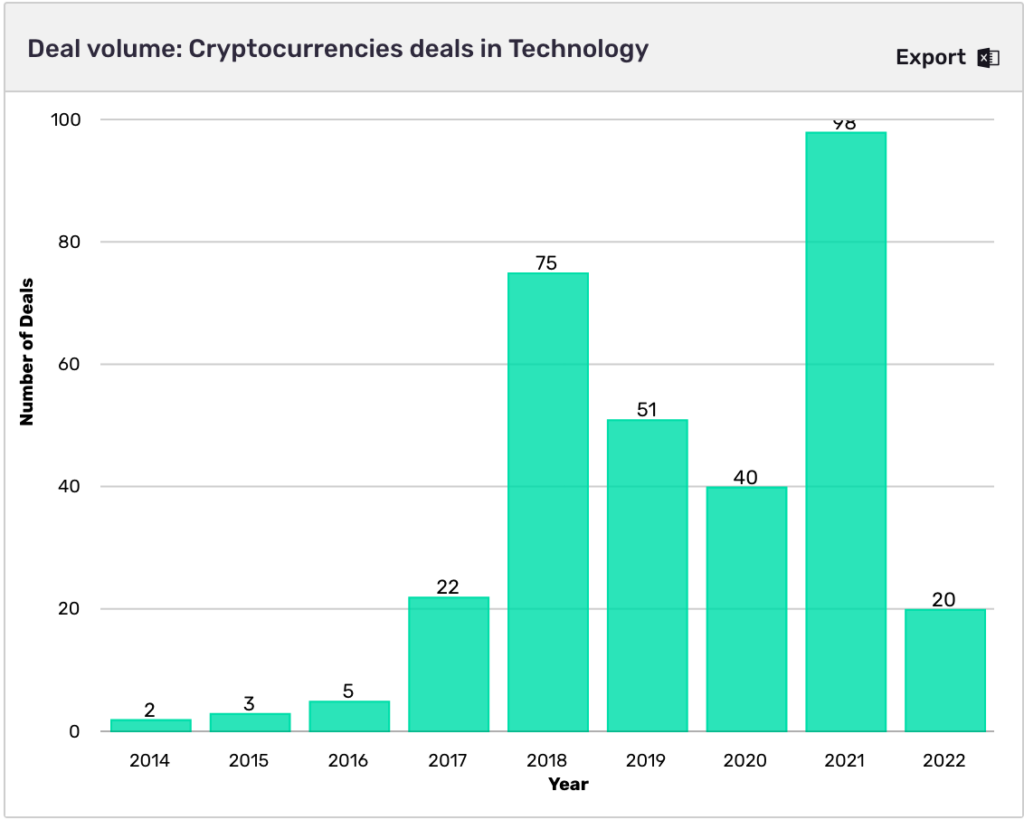

GlobalData’s data suggests that the number of investment deals in the cryptocurrency space jumped from 40 to 98 deals between 2020 and 2021. So far in 2022, the firm has recorded 20 deals.

At the same time, the total value of these deals jumped from $679m in 2020 to $8.28bn in 2021. So far in 2022, the sector has recorded deals worth $5m, according to GlobalData’s data.

That being said, the sector took a tumble in the first two months of 2022, taking over $1tn out of the cryptocurrency market.

Despite some recovery, the market hasn’t fully recovered.

Given that cryptocurrencies were thought by some to have become a safe haven asset like gold during the pandemic, some would’ve thought the market uncertainties brought on by Russia’s invasion of Ukraine would see the valuation of bitcoin shoot through the clouds. That didn’t happen, somewhat undermining the theory that cryptocurrencies would work as a safe haven asset.

One factor identified as contributing to this slump was the Russian central bank’s proposal in January that the country should ban cryptocurrencies. The bank argued that cryptocurrency trading and mining threaten financial stability and that they should therefore be banned. The proposal and the consequent plunge in bitcoin sparked warnings about an imminent cryptocurrency winter around the world.

However, the Russian finance ministry has indirectly challenged the proposals. As we reported in February, it instead suggested the introduction of new regulations to better police cryptocurrencies and to create a market for the asset class. These rules would accept that cryptocurrencies could be used as investment tools, but not as means of payment.

With all the talk about Kremlin gremlins circumventing Western sanctions with the help of cryptocurrencies, it could seem logical to think that the ban would be postponed. Market experts are not as certain, suggesting Putin’s people will do whatever they wanted to anyway.

“Putin has a plan, and he’ll go for that plan whether that is accepting crypto now or rolling out their own decentralised currency for their own people,” Mark Basa, global brand and business manager at HOKK Finance, tells Verdict. “For a country to adopt crypto is an enormous task – it doesn’t happen overnight, but I don’t think the conflict between Russia and the Ukraine will change their stance on crypto, at least not immediately.

“Russia’s central bank has taken a tough stance against cryptocurrencies, going so far as proposing that the digital asset class should be banned.

“The central bank may have had those feelings in the past. However, the most recent news is that the government and central bank in Russia have reached an agreement on how to regulate cryptocurrencies. Russia’s government and central bank are collaborating on a law that will define crypto as an ‘analogue of currencies’ instead of a digital asset meaning that crypto would be treated the same as the Ruble, if they get it to work with the banking system or licensed third parties.”