Amazon is rolling out its telemedicine service Amazon Care across the States just as data shows that investors’ appetite for the sector is declining. A previous Amazon-backed healthcare initiative named Haven imploded in January 2021.

Amazon Care has been in the works for some time. Officially, it launched a pilot version in September 2019. The programme’s offerings include a combination of virtual care visits, telemedicine consultations and in-house visits.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

From the get-go, the company only provided these services to its Washington state employees and their families. However, it has been clear that something has been brewing over at Amazon’s Seattle HQ for some time. Last spring, the online retailer began to ramp up its efforts with Amazon Care by expanding it to other companies in Washington.

Over the past year, it has signed up home-fitness operator Peloton, which is struggling on the stock markets at the moment, and hotel giant Hilton.

But now it’s upping the stakes by rolling out Amazon Care nationwide. At the moment, the in-person service is only available in eight cities, but Amazon said it will launch in 20 new cities later in 2022. Those new cities include, New York City, San Francisco, Miami and Chicago.

The news comes as the Covid-19 pandemic has accelerated the use of telemedicine around the globe, with the demand for virtual visits propelled by nationwide lockdowns on both sides of the Atlantic.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Healthcare providers have been quick to implement alternative solutions to in-person care to ensure patients can access diagnostic and therapeutic services,” notes a recent GlobalData report on digital health solutions. “This has led to significant increases in the use of remote patient monitoring, telemedicine platforms and virtual clinical trials.”

Amazon said the care initiative expansion aims to capitalise on the skyrocketing demand for smooth medical services.

“Patients are tired of a health care system that doesn’t put them first,” said Kristen Helton, director of Amazon Care. “Our patient-centric service is changing that, one visit at a time. We’ve brought our on-demand urgent and primary care services to patients nationwide. As we grow the service, we’ll continue to work with our customers to address their needs.”

Data shows Amazon Care arrives just as investors lose interest

Amazon Care certainly seems to make a lot of sense on paper. It enables to the Seattle giant to expand its revenue streams and get its hands on even more data. This would add to the medical data already collected by Amazon Halo, a wrist device that uses sensors to measure heart rate, temperature and other health metrics.

At the same time, other businesses could use the service to offer their employees more benefits in the new normal of remote and hybrid working. Companies would certainly be motivated to take a closer look at telemedicine services given the growing focus on environmental, social and governance (ESG) issues.

Despite companies’ renewed focus on healthcare and the pandemic seemingly creating a virtual healthtech revolution, new data from GlobalData suggests that investors are losing interest in the sector.

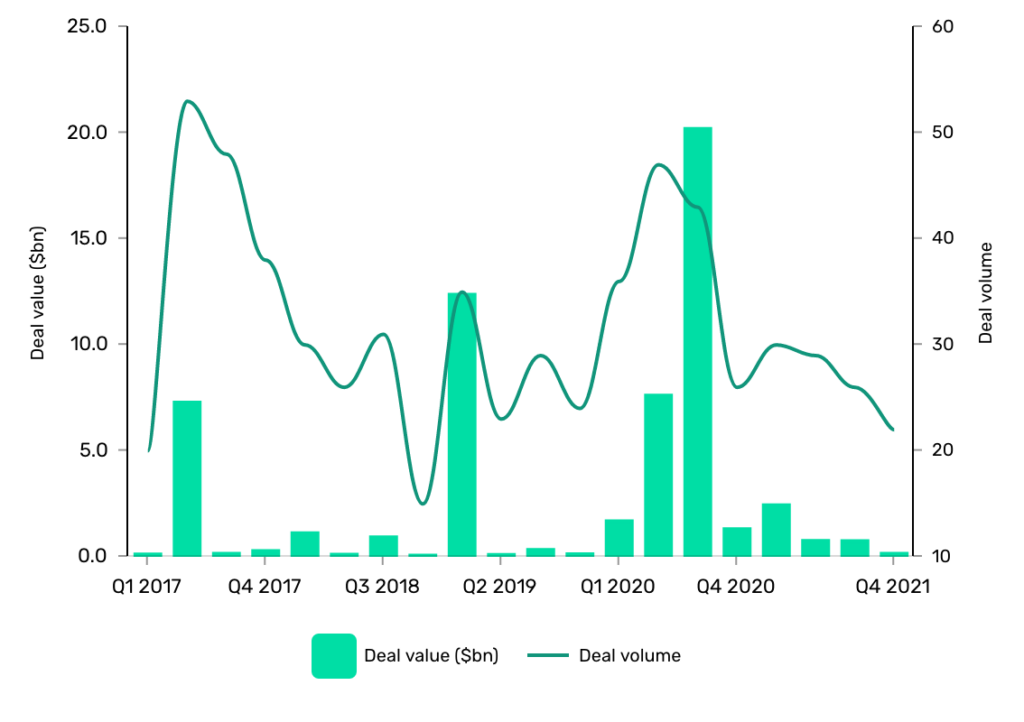

As one would expect, the data shows that the number of venture financing, M&A and public listing deals peaked when the pandemic was at its worst.

During the second and third quarter of 2020, the analytics firm recorded 90 deals worth a total of $27bn. During the same period in 2021, those figures had dropped to 55 deals worth a grand total of $1.496bn.

Amazon Care will also have to compete in an increasingly crowded space. Other tech companies, such as Verizon, have launched similar services over the years.

Other competitors include insurers who have increasingly offered telemedicine services as part of their packages. Tellingly, insurer Anthem announced this week that it would roll out virtual primary care across several US states. Other players in the space include UnitedHealthcare, CVS Health’s Aetna division and Cigna, who all now offer employers virtual primary care plans, as noted by CNBC.

Amazon’s other healthcare project

Amazon Care is not the first time online shopping behemoth has supported a healthcare project. In November 2020, the tech giant launched Amazon Pharmacy, which essentially meant that it added medicine to the list of home-delivery items available for Amazon Prime subscribers.

“The news represents a disruption to the system and competitive threat that will likely shift scripts away from the retail channel,” analysts at Citi Research said in a note at the time.

The launch of Amazon Pharmacy saw the stocks of pharmaceutical companies – such as CVS Health Corp., Walgreens and Rite Aid – flounder. A similar drop was felt by telemedicine company Teladoc on Tuesday this week. Following the news of the nationwide rollout of Amazon Care, the virtual rival saw its shares drop by 6%.

But before the launch of Amazon Pharmacy, Amazon had teamed up with Berkshire Hathaway and JP Morgan to back Haven.

Launched in February 2018, Haven would pool the resources from its backers to independently create technology solutions to help employees overcome what Berkshire Hathaway chair Warren Buffet referred to as the “ballooning costs of healthcare [that] act as a hungry tapeworm on the American economy.”

Admirable as that goal was, the non-profit eventually collapsed in January 2021. Several factors contributed to the implosion of Haven. The project was marred by vague objectives, the hiring of an inexperienced CEO and the outsized scope of the healthcare cost challenge that left the company unable to get market traction.

Another factor contributing to Haven’s implosion was that while Haven was cited as a great incubator for ideas, each founding firm executed their own projects separately with their own employees, obfuscating the need for a joint project.

The company had also been unable to wring costs down from providers. Harvard Business Review noted that insurers had little reason to change the status quo, given they are already making massive profits from it.

Following the collapse, Amazon, Berkshire Hathaway and JP Morgan said they would use the insights gained Haven in their own projects.

GlobalData is Verdict and its sister publications’ parent company.