The US Federal Communications Commission (FCC)’s recommendation last week to repeal so-called net neutrality — rules that say all website traffic should be treated equally — will penalise regular people and smaller companies in the US, helping only internet service providers (ISPs) and large tech companies.

The announcement by FCC chairman Ajit Pai was greeted acrimoniously by advocacy groups but welcomed by telecoms companies, who have been fighting since the law’s introduction to get them overturned.

Net neutrality is unpopular with ISPs, because they struggle to differentiate themselves if all they can offer are faster speeds or higher bandwidth caps.

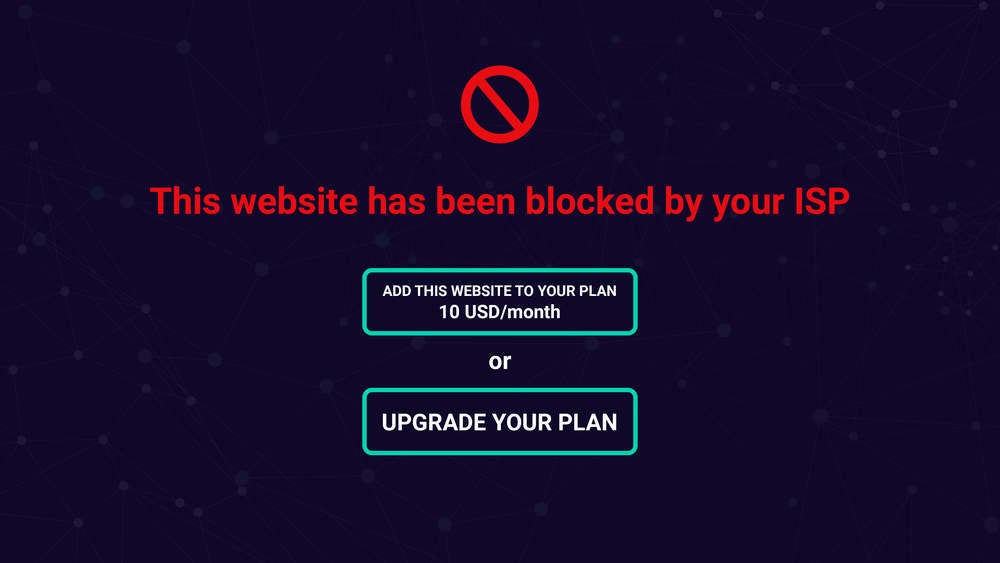

Should the regulatory framework ultimately be abolished ISPs would be permitted to charge more for higher speeds, more content, and conversely block or slow other content.

The US internet market will become more concentrated

Weak neutrality laws are not necessarily a bad thing as long as the market is open, and innovation and competitive impulses are permitted.

However, the market structure in the US in particular makes this unlikely, as only half of US households have more than one ISP to choose from, with local monopolies enshrined in law.

Read more: Net neutrality: what will change if the FCC’s chief gets his way?

Most of the rest are served by duopolies with little innovative impulses, with only two companies providing high-speed connections for three quarters of the US population.

While there could be some scope for industry disruption in the future with improved wireless technology, this seems to more a long-term hope, and will offer little comfort to US consumers until that arrives.

US ISPs would be able to engage in monopolistic extraction, forcing customers to pay extra to access sites at full speed or forcing companies to pay for access to customers.

US consumers already pay a lot for mediocre access

Concerns that net neutrality would impede investment in networks is also unfounded, as the US steadily increased its broadband speeds, but currently US consumers historically suffered some of the poorest mobile broadband speeds globally while paying some of the highest costs.

The argument is that by banning big websites from paying providers to pioneer ways of making their service faster, network innovation will freeze, consequently making networks less profitable and thereby removing a reason for investing in network infrastructure.

In August Speedtest’s Global Index found the US ranked ninth in the world in fixed broadband speed, and has improved its rank between 2016 and 2017, (when net neutrality was in place), from 11th to ninth.

When assessing mobile internet speed, the US ranks sixth in the world in the cost for mobile internet and 46th in mobile internet speed.

This is not a strong signal that freed from the shackles of net neutrality, companies such as Comcast, AT&T, and Verizon would dramatically improve infrastructure.

Repeal will entrench big tech’s position at expense of smaller companies

There is a debate to be had surrounding access to the internet, with big tech companies such as Google and Netflix massively profiting for the infrastructure (and with estimates by Sandvine that Google’s YouTube and Netflix alone account for half of US traffic), while not paying a premium.

However, these companies already deeply integrate themselves into ISPs via peering connections and content delivery servers, and the current proposals would severely limit the access to smaller companies.

The final vote is expected in December 2017.