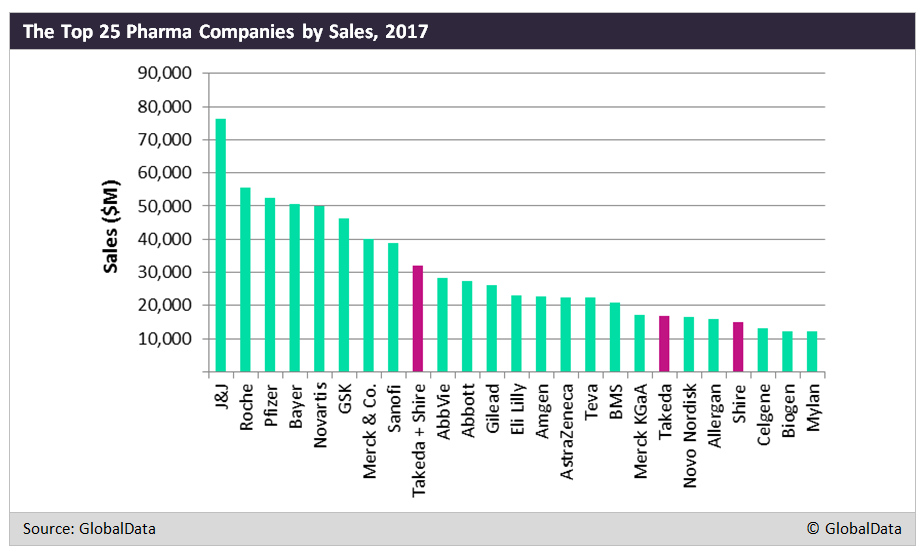

Takeda’s possible $65 billion takeover of Shire could be the largest deal value in pharma this year and combined Takeda Shire company could be catapulted to the ninth position in terms of 2017 sales.

This is the Japanese company’s fifth attempt at merging with Shire, clearly highlighting Takeda’s readiness for this move.

The deal is significantly larger than Takeda’s acquisition of Millennium in 2008 (for $8.8 billion), Nycomed in 2011 (for $13.7 billion), and Ariad in 2017 (for $5.2 billion).

Motivations for the Takeda Shire deal

Historically, Shire has been heavily focused on neurology, largely through in-house research and development and successful life cycle management strategies of major attention deficit hyperactivity disorder (ADHD) brands, which collectively generated 36% of the company’s sales in 2017.

Despite its strong position in ADHD, Shire has aimed to diversify its business to a broader therapeutic focus in recent years, seeking bolt-on acquisitions to facilitate entry into specialist markets.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIts aggressive mergers and acquisitions strategy has resulted in some notable acquisitions, including Transkaryotic Therapies in 2005, Jerini in 2008, NPS Pharma in 2015, and Baxalta in 2016.

All of these deals have significantly contributed to Shire’s expansion into rare disease markets. While its neurology portfolio offers size, its rare disease franchise offers future sales growth, and Takeda needs both in order to keep up with foreign competitors.

Currently, Takeda has a small neurology offering, consisting of three brands—Lundbeck’s Trintellix (vortioxetine), Johnson & Johnson’s (J&J’s) Reminyl (galantamine), and Teva’s Copaxone (glatiramer acetate injection)—that were in-licensed from other pharma companies in order to be marketed in its domestic market.

By acquiring Shire’s strong presence in the ADHD market, including its blockbuster Vyvanse (lisdexamfetamine dimesylate), the new combined company could expand its neurology offering and receive immediate new revenue streams.

Besides enhancing its neurology portfolio and entering the lucrative segment of rare genetic diseases, such as hemophilia, Hunter syndrome, and Fabry disease, Takeda would also inherit Shire’s ophthalmology franchise, representing yet another new therapy for the company.

On paper, this takeover looks like a sound strategy for Takeda, a Japan-based company that has always aimed for a strong global position.

However, this does not mean that nothing could possibly get in the way of this deal.

According to UK takeover rules, the deadline for Shire to accept Takeda’s deal is 8 May, unless a rival big pharma company makes another offer for the company, which would add another layer of complexity to the situation.

There are also concerns that Takeda may not be able to afford this purchase, as it has only $4.3 billion in cash at hand, and the deal could over-stretch its finances.

If and when the Shire deal goes ahead, Takeda will have to ensure the successful and rapid integration of Shire in a process that hopefully will not hamper Shire’s research and development pipeline.