Bitcoin’s most recent, and arguably, most important criticisms haven’t just come from established financial giants like JP Morgan – they’ve come from environmentalists, who say that the energy required by the cryptocurrency will soar to unsustainable levels.

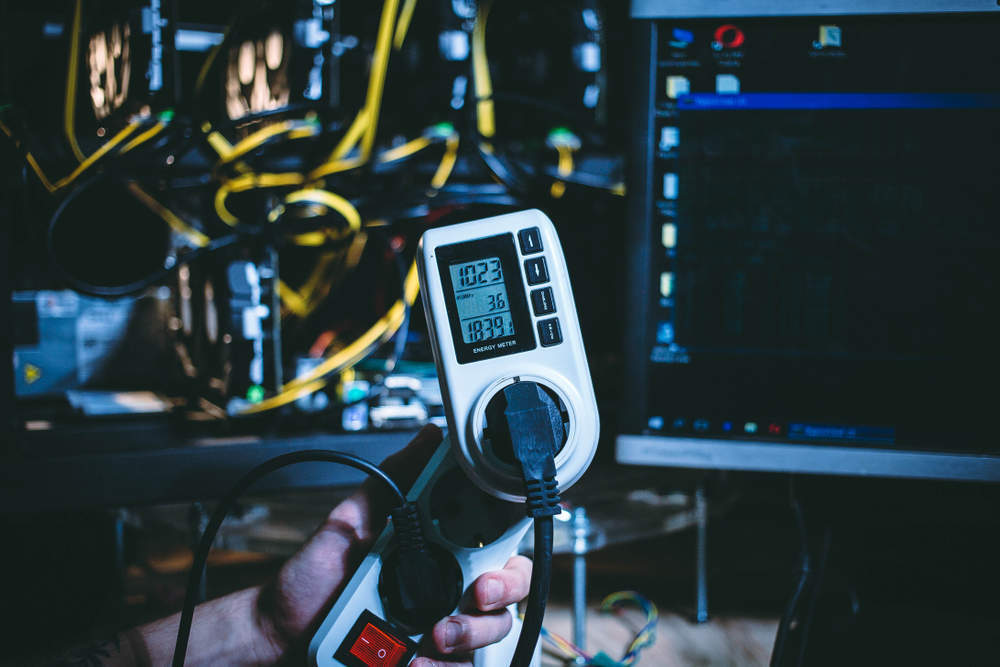

The energy-intensive calculations that go into mining or minting the currency require rows and rows of computers as the cryptographic calculations become ever-more difficult.

This increasing difficulty in mining is by design – and it squeezes the supply of the currency without centralised control.

The technological infrastructure of bitcoin has its own ever-increasing costs as demand for newer and better hardware increases with the demand for bitcoin mining, and of course, the whole thing has to be powered.

Eric Holthaus, a meteorologist who writes for Slate and Grist wrote that the computing power of the bitcoin network is estimated at nearly 100,000 times larger than the world’s 500 fastest supercomputers combined, and the network increases its energy use daily by the same amount of electricity that Haiti uses annually – around 450 GW/h.

Currently, the majority of the world’s miners are in industrial-scale electronic mining facilities in China, fuelled by the country’s coal-fired power stations, although the government is planning to limit electricity for bitcoin miners, both due to the energy usage and the connections between cryptocurrency and shadow economies, fraud and money laundering.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataBitcoin mining companies have already started to move their operations overseas to areas with cheap electricity in an effort to retain profit margins relative to energy usage and technology setup costs.

At bitcoin’s current rate of growth, Holthaus estimates that its demand for electricity will outstrip supply by July 2019, where it will “require more electricity than the entire US currently uses” and “by Februrary 2020, it will use as much electricity as the entire world does today”.

A green energy startup has stepped in to attempt to help solve the problem.

Austria’s HydroMiner GmbH raised $2.8m to install high-powered computers at hydroelectric plants to reduce the overall cost and environmental impact of mining cryptocurrencies.

Their setup is relatively cheap: purchase shipping containers to fill with servers and place them by hydroelectric dams.

Austria’s climate functions as air-cooling for the servers. More than three quarters of Austria’s electricity is generated by renewables, with 63 percent of it coming from hydro power.

Austria has many small idle hydro power stations due to the low population and plentiful hydro power, meaning that they can generate cryptocurrency cheaper than the global average by paying mill owners to start these disused facilities back up.

As Saudi Arabia moves to wean itself off what Crown Prince Mohammed bin Salman calls its “dangerous addiction to oil” and to invest in renewable energy such as solar farms, the Middle East and Africa could turn out to be the next big things in cryptocurrency mined from renewable energy.

Comparably simple setups of servers in underground containers, water-cooled and powered by solar panel arrays are certainly feasible.

Related Company Profiles

JPMorgan Chase & Co