The US and China are locked in a battle to achieve tech supremacy in 5G, AI, quantum computing, autonomous vehicles, IoT, and other next-generation technologies. The ensuing trade war has resulted in tariffs or bans on imports and exports of various goods and technology transfers ranging from semiconductors to industrial robots and machinery, computer storage devices, electrical components, imaging systems, and networking equipment.

This trade war is impacting many IoT technology leaders (including Amazon, Apple, Cisco, Dell, Google, HPE, Huawei, IBM, Intel, and Microsoft) from a supply chain point of view, and the whole IoT ecosystem from an innovation and R&D point of view.

China is accelerating investment in next-generation technologies

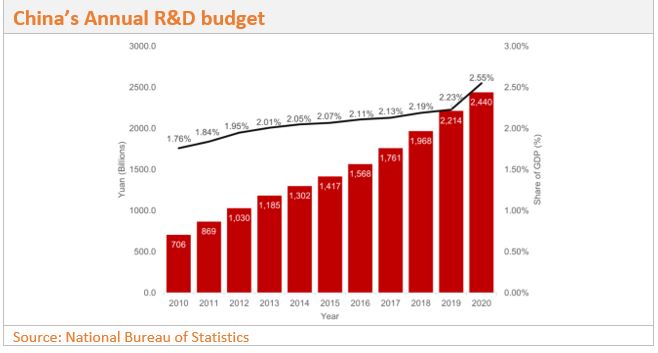

To counter the geopolitical challenge from the US and to reduce its dependence on imported semiconductors, China has set a target to become 70% self-sufficient in semiconductor production in the next ten years. In its ‘14th Five Year Plan’ (FYP), which was announced in March 2021, China proposes increasing research and development (R&D) spending by at least 7% every year between 2021 and 2025, including the public and private sectors.

China is estimated to spend more than 2.5% of GDP on R&D this year. In 2020, a $1.4 trillion state program was announced to support R&D in key enabling technologies over the next five years. These include: semiconductors; AI; robotics; autonomous vehicles; 5G and 6G; data centres and cloud; supercomputing and quantum computing technologies; as well as low-earth orbit satellites.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

Why China can lead in IoT

GlobalData expects that China will emerge as a key player in chip technology over the next two to three years. As chip technology is one of the key enablers for IoT, China is well-positioned to lead in the emerging IoT arena. The IoT market, morphing into the AIoT market (where AI is integrated with the IoT), will be huge in China in terms of the number of devices that will carry embedded chips.

Meanwhile, the arrival of Swiss-based RISC-V architecture – an open-source chip blueprint technology – opens up vast opportunities for Chinese semiconductor companies to play a leading role in the IoT ecosystem.

In terms of innovation, China is racing ahead of various developed countries. According to GlobalData patent analysis, China is the top assignee for IoT patent publication. Of the 2,440 IoT-related patent applications in 2020, China alone is responsible for 69% of them, with 1,683 applications.