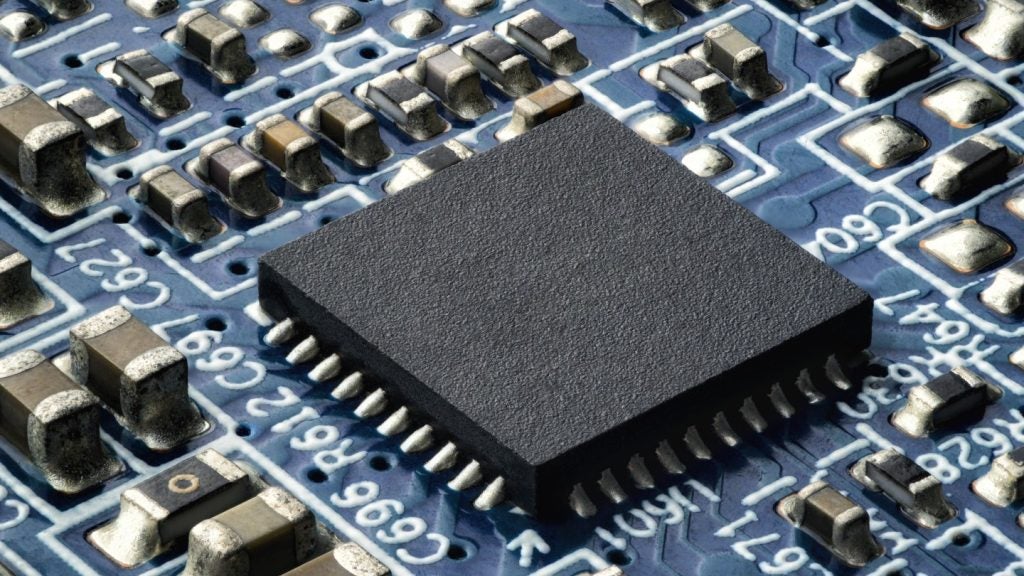

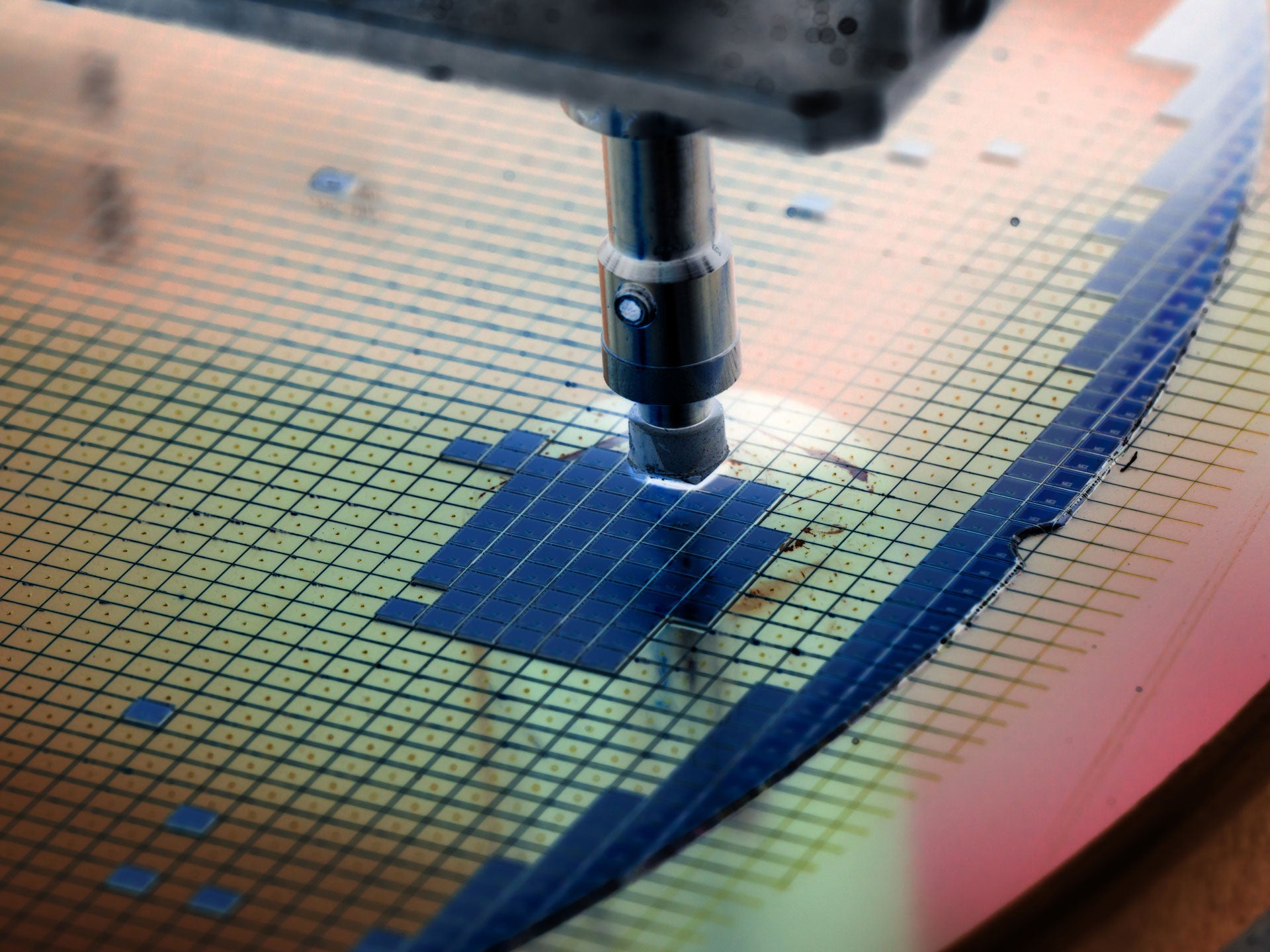

China is up to ten years away from being self-sufficient in the mass production of semiconductors, according to the latest report, ‘China Tech – Thematic Research’ by GlobalData.

However, the report also reveals that the nation is either equal with or more advanced than the West in other key tech areas, such as data-heavy, domain-specific AI and genomics.

Currently, the US is leading the way in self-sufficient mass production of semiconductors.

However, China’s potential to improve its work within the semiconductor industry could see it become increasingly competitive, particular in light of the current trade war between the two nations.

China semiconductor production amid the trade war

Recently, the Trump administration banned US companies from using tech from companies it considers a national security threat, such as Chinese tech giant Huawei.

GlobalData said that this war could see China and the US become two increasingly autonomous global superpowers by 2040 – which could drive greater self-sufficiency in industries such as semiconductor production.

“If this escalation continues, both the US and China will end up having its own internet, technology stack, captive markets and global supply chains. This will cause China to drive ever harder to become self-sufficient – even dominant – in the key next generation technologies to secure its sovereignty and power,” said Cyrus Mewawalla, head of thematic research at GlobalData.

“In contrast, China is ahead in genomics and, notably, CRISPR gene editing technology. This is highly significant, given that the ‘life code’ based global economy is likely to account for over 25% of global GDP by 2030, and close to 40% by 2040, covering healthcare and medicine, agriculture, food, materials, energy and cosmetics.”

The report also covers China’s heavy investments in the hardware, software and platform industries. In terms of hardware, China is investing in high performance computing, industrial robots, 5G telecom equipment, consumer robots, consumer electronics and electric vehicles.

In software, AI, autonomous driving and shared mobility are the main investments, while China’s platform sector invests in cloud infrastructure, quantum computing and internet platforms.

Read more: China, blockchain and the crypto “double-edged sword”: Is the tide turning for cryptocurrency?