The withdrawal of the World Bank’s Doing Business report this year sparked alarm among investors and policymakers the world over. The bank is currently investigating ‘irregularities’ in recent editions that affected the rankings of China and Saudi Arabia, among others.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The level of concern that this move provoked says much about the index’s widespread influence. However, the furore over Doing Business obscures much more fundamental issues with the data that is used to understand foreign direct investment (FDI).

The messy realities of data collection

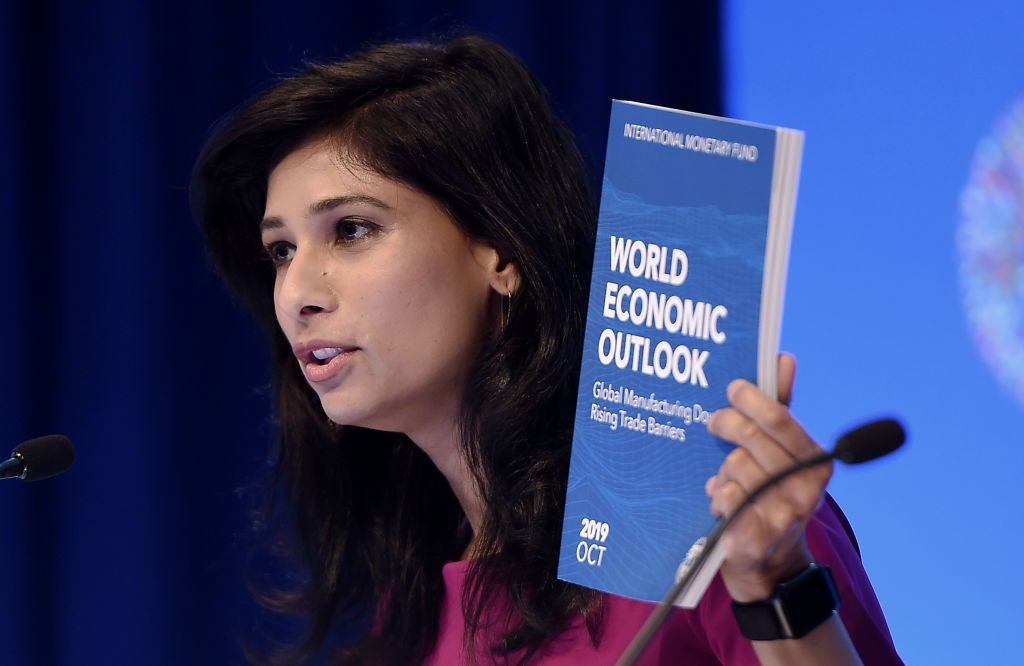

The IMF’s balance of payments statistics serve as the foundation for countless analyses, investment decisions and policy initiatives. A considerable portion of what we think we know about the global economy is drawn from these numbers.

Any accountant will state that economic phenomena do not always fit neatly into our preferred categories. The collection of such data therefore requires many small, sometimes arbitrary, decisions about how to measure and categorise messy realities.

This can be a problem for data that is collected by many different institutions, each of which may have its own way of making these decisions. FDI statistics are no exception – although compiled by international organisations they are typically gathered at the national level or below.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSome data is also just better than others. The UK collects its data through a census of all relevant firms, while Sweden collects data from a representative sample – a cheaper method, but one that can introduce inaccuracies. About one-fifth of the IMF’s inward and outward FDI estimates make use of surveys.

Economists are broadly aware of these issues. When asked to estimate the margin of error for the IMF’s data on FDI inflows, researchers Lukas Linsi and Daniel Mügge found that most economists came up with an answer of about 5%. This would imply that a recorded FDI inflow of $100bn could be off by up to $5bn in either direction.

While this might sound like a lot – especially to those basing decisions or models on small shifts in FDI flows – Linsi and Mügge found that is, in fact, a monumental underestimate.

One way of measuring the inaccuracy of FDI statistics is to compare the flows recorded by the investor country with those recorded by the host country. In theory, the inward investment that Mozambique reports receiving from China should equal the outward investment that China reports sending to Mozambique. Differences between these records, known as ‘bilateral asymmetries’, indicate a problem.

The scale of these asymmetries far outstrips the modest predictions offered by Linsi and Mügge’s economists. In 2016, the UK reported a total outward FDI stock of $1.49trn. Countries hosting UK investments, however, valued these at $2.46trn – a difference of 65%.

How to achieve harmony in data collection

Issues with the harmonisation of data collection have long been a priority for the IMF, particularly in regards to the distinction between FDI and foreign portfolio investment.

The original Balance of Payments Manual, published in 1948, located the distinction in the foreign direct investor’s effective managerial control of the enterprise. Deciding whether a particular investor exerted ‘effective control’ over his or her firm was considered a judgement best made on a case-by-case basis by national statisticians.

By the early 1990s, the situation had changed. Global FDI had begun its surge to modern levels, resulting in growing demand for internationally comparable statistics.

The IMF answered these calls in 1993 with the fifth edition of the Balance of Payments Manual, which defined FDI unambiguously as a cross-border capital flow in which the foreign investor owns at least 10% of voting stock (or equivalent). Since then, the IMF has continued its mission to harmonise international FDI statistics.

However, the 10% rule hasn’t been adopted by all countries, and there are important structural impediments to harmonisation in other areas. For instance, some statistical agencies have the legal authority to gather census data on FDI or to inspect tax records directly, while others are forced to rely on survey responses.

Another major issue is measuring reinvested profits, an important component of FDI. Since this capital does not cross any border, it is often missed by the agencies tasked with recording FDI. Many countries use surveys to estimate the size of this flow, but others do not. This is a major omission: in 2012, reinvested earnings accounted for 85% of US FDI outflows.

Countries also differ widely in how they value FDI stocks. Historically, the value of FDI stock was recorded at the time of purchase. A German factory purchased by a US investor in 1970 for $1m would, if fully operational, still contribute exactly $1m to the US’s outward FDI stock to this day. While extremely simple to carry out, the historic value of a country’s FDI stock can be highly misleading, since it fails to account for inflation and changes in exchange rates over time.

The IMF and OECD have therefore increasingly encouraged national statistical agencies to estimate the current market value of FDI stocks. This is relatively simple for publicly traded companies, where the stock price serves as a simple indicator of market value, but more complex for unlisted entities. As such, adoption of market-based valuation techniques remains highly incomplete.

As of 2009, the IMF recommends seven different ways of valuing unlisted FDI stock. Recalculating Danish inward FDI stock using these seven methods, one study found the number ranged between €48bn and €340bn (22% to 156% of Danish GDP).

This one, seemingly trivial, accounting decision can have a major effect on how the world economy is viewed. A 2007 valuation of US-owned assets abroad by Ricardo Hausmann and Federico Sturzenegger demonstrated that switching from book value to stock-adjusted market value resulted in an adjustment of almost $2.7trn. This enormous undervaluation of American-owned assets abroad was enough to transform the country into a net investor, and to explain the country’s mysteriously large income from foreign assets.

However, if these were the only issues with FDI data there would be reasons for optimism. Statisticians at the IMF have devoted much of the past four decades to harmonising the measurement of international capital flows and there have been major advances. This may be why almost 90% of the economists surveyed by Linsi and Mügge considered the quality of FDI data to have improved over the past 20 years.

In fact, as Linsi and Mügge point out, there are good reasons to believe things are getting worse. International capital flows have become increasingly impenetrable, with complex ownership structures obscured by lengthy global value chains and deliberately opaque offshore holding companies. At the same time, the traditional gatekeepers of these flows that guaranteed their measurement – customs inspectors, exchange control systems – have, in many cases, either been atrophied or liquidated altogether.

The problem of the conceptual fit

Beyond these issues of measurement lies a more fundamental problem. ‘Conceptual fit’ is the congruence between the measures and the concepts they purport to represent. Scientists and economists alike are frequently forced to ask themselves whether they are measuring what they want to measure.

The problem is that conceptual fit often exists in a state of tension with measurement accuracy, especially where data is being collated from multiple sources whose collection techniques must be harmonised.

Linsi, now an assistant professor of political economy at the University of Groningen, the Netherlands, views this as a key tension at the heart of data on FDI.

“I think there’s a trade-off between having comparable data and having valid data,” he says. “In the end, you have to decide where you want to situate yourself on that trade-off. You cannot have both for the whole world, for the whole global economy. There’s a choice and you can have a bit of both, but you cannot have 100% validity and 100% harmonisation.

“It’s a fundamental contradiction because countries are so different. They’re at very different levels of economic development, very different places in the structure of the world economy. Trying to have the same standards for these very different systems – I think it’s by definition almost impossible.”

The shift towards harmonisation has resulted in the flattening of important conceptual ambiguities in the definition of FDI. The result is a growing gap between the concept and the measurement of FDI.

The first ambiguity relates to what it means for an investment to be ‘foreign’. Data on FDI flows generally defines an investment as ‘foreign’ if it originates from abroad. Data on FDI stocks, on the other hand, defines the foreignness of an investment not by the origin of the capital but by its ownership. Investments made by multinationals using capital raised in the host economy are therefore generally excluded from data on FDI flows, yet are included in some (but not all) measures of FDI stock.

The reason for this is that FDI flows are typically recorded by central banks, which are more concerned with using the data to inform decisions about the balance of payments or exchange rate than to understand investor behaviour. For their purposes, a definition of FDI that emphasises the origin of capital rather than its ownership is perfectly functional.

For the purpose of understanding investor behaviour, however, it makes little sense to exclude locally raised capital. For instance, if someone wanted to understand the exposure of US multinationals to political risk in China, it would be of little relevance whether their capital was raised in China or elsewhere.

This oversight doesn’t just produce random error. The underestimation of FDI flows that results from this discrepancy is likely to be far higher in countries with highly developed capital markets such as the UK.

That the bias may be systematic is crucial to understanding how FDI operates. For instance, consider a study that finds no connection between strong institutions and inward FDI flows. If strong institutions tend to go along with highly developed capital markets, it might be that FDI in such countries is systematically underestimated, resulting in the researcher missing a real and positive connection between strong institutions and FDI.

How direct is your foreign direct investment?

The second ambiguity relates to what makes a foreign investment ‘direct’. Foreign direct investment is typically distinguished from foreign portfolio investment (FPI) by the investor’s managerial control over the foreign subsidiary and by the long-term nature of the investment.

The notion of ‘control’ is vital for many theories of FDI’s effects. For instance, the idea that FDI promotes technological spillover assumes that it brings with it foreign expertise. Similarly, the exertion of significant control makes it more difficult to quickly disinvest if the political mood turns sour, giving the direct investor more of a stake in the host country’s long-term political climate.

As mentioned, the IMF has increasingly encouraged countries to distinguish between FDI and FPI on the basis of a simple threshold: if the foreign investor owns more than 10% of the shares, it is FDI. This emphasises the importance of liquidity, the ability to quickly sell or move assets, as the key distinction between FDI and FPI.

While implementing a clear, quantitative threshold allowed the IMF to make meaningful cross-national comparisons, the threshold is entirely arbitrary. In reality, the distinction between FPI and FDI may be more of a gradient – at least when it comes to liquidity.

Consider a foreign investor deciding between two $10m purchases: a 10% stake in a $100m company, or full ownership of a $10m company. While these appear identical in the FDI data, they have very different levels of liquidity. Minority stakes are more liquid, since they can be quickly sold without significantly reducing the stock price, and so may act more similarly to portfolio flows.

Even if the data were to account for smaller increments of control, other factors relevant to the liquidity of the investment would be missed. Factories and mines are much more difficult to pack up and move than cash or intellectual property. Investors in services or tech are therefore likely to be much more footloose than those in heavy manufacturing or extractive industries, and as a result are likely to behave somewhat more like portfolio investors – at least when it comes to questions of political risk. Similarly, investors in countries with low tax rates or high interest rates are likely to bring a sizable amount of cash with them, leading them to adopt behaviours similar to portfolio investors.

A recent study found that FDI inflows are even more closely correlated with US monetary policy decisions than portfolio inflows, despite the theoretical expectation this correlation would be close to zero. The same study also found a persistent and strong correlation between FDI inflows and outflows for a given country – behaviour that is supposed to apply to portfolio investments, not direct investments.

This suggests that much of what is officially recorded as FDI may have no productive purpose at all. FDI flow statistics do not distinguish between capital that is used in the production of goods and services and that which moves only for administrative or tax reasons.

The graphs below, by the political economist Andrew Kerner, show US FDI flows into Belgium and the Netherlands from 1997 to 2008. A 2004 US bill promised to offer tax holidays to American firms that brought their foreign investments back home. Perversely, this encouraged a wave of outward investment as firms sought to establish a large number of foreign investments that could then be repatriated to take advantage of the coming tax law. In just one year, the US’s reported FDI outflows doubled – but this was not FDI by any normal conception.

As shown below, countries with favourable tax laws, such as the Netherlands, were the primary recipients of this sudden influx of capital, suggesting there was never any intention for these investments to be long term or productive. Moreover, the surge did not coincide with any substantial increase in fixed capital purchases by American firms in the Netherlands – again suggesting that it was never intended as a productive investment.

The international movement of capital for tax avoidance would dwarf most national economies. These flows have become so vast that they frequently serve to overwhelm measures of FDI built for an older era.

Tax havens and FDI

Beyond greenfield and M&A FDI, there is a third, rarely acknowledged, category included in official FDI statistics: tax haven FDI. These are investments in holding companies, also known as ‘letterbox companies’, whose purpose is not to produce any good or service but to hold shares in another company for tax or juridical purposes.

Consider a company operating in a high-tax jurisdiction. One way it can avoid being taxed on its profits is to reduce reported profits in the high-tax jurisdiction to almost zero, shifting them abroad to a low-tax jurisdiction. Many large tech companies have avoided paying tax by granting their intellectual property rights to a letterbox company in a low-tax area, which then charges so much in royalties to the main subsidiary that its reported profits are close to nothing.

This effectively shifts the company’s profits from the high-tax country to the low-tax country, with the holding company reporting extraordinary profits off the back of these royalties – far in excess of the actual value that it adds to the product.

Looking at data from the US Bureau of Economic Affairs, Linsi found that US multinationals reported earning almost 72 times as much per employee in Ireland than in Sweden.

Many countries rely on reported profits in order to estimate FDI flows and stocks, resulting in FDI estimates being positively skewed towards tax havens. Tax haven FDI is therefore another source of systematic bias. For instance, researchers looking at the association between corporate tax cuts and FDI might conclude that tax cuts promote investment, and a politician may use these findings to argue that tax cuts promote jobs growth. However, the kind of FDI promoted by tax cuts is likely to be very different from the kind of FDI that promotes jobs growth, a fact obscured in the data.

Holding companies may also be used to deliberately obscure ownership structures, directly inhibiting statisticians from determining the origin, destination or purpose of the capital flows.

Consider a transfer from the US to a Bermuda holding company, officially recorded as FDI. This could actually just be a transfer of intellectual property rights, which are then rented to the firm’s EU subsidiary for tax purposes. Alternatively, the holding company may in fact be an investment fund, with its capital operating as a large number of foreign portfolio investments. Another possibility is that the holding company owns a US company, and that this transfer represents a domestic acquisition. The possibilities are endless, but entirely opaque to the statistician.

The scale of these operations is enormous. As of 2013, the Bureau of Economic Affairs estimates that almost half of the US’s outward FDI is channelled through holding companies, up from just 9.4% in 1982.

While the fundamental trade-off between conceptual validity and harmonisation makes data problems inevitable, Linsi argues that these have not been adequately communicated to the public or to policymakers. Part of the problem, he suggests, is with the political use of FDI inflows as an indicator of economic health.

“In the Brexit context there were a lot of journalists, but also policymakers, very focused on how much FDI is coming into the UK and saying that this is a sign of ‘confidence’ in the UK or ‘loss of confidence’ in the UK,” he says. “These numbers don’t show you how good an economy is at the moment.

“They can’t tell you that because FDI figures don’t really capture what people believe they do. They probably think about greenfield FDI – the building of factories in a country – but that’s a relatively small part of the overall headline FDI figures. It’s probably about one-third. Then another third, in the case of the UK, is M&A, which is already quite a different thing. Then the final third is these letterbox flows, which are tax-reducing movements, so really nothing to do with the competitiveness of your industrial base. So, policymakers make these big speeches based on FDI having gone up and down – but these numbers don’t really tell you anything.”

While the tension between harmonisation and validity persists, Linsi urges people making use of FDI data to be mindful of its shortcomings.

“[The IMF] has clearly moved towards harmonisation,” he says. “There are political imperatives to do so because policymakers want to have comparable data, right? And I think that’s fair enough. What I think is more the problem is the dark side of that is little acknowledged – that it comes at a cost, and the cost is that the data is maybe not so meaningful for many countries who are still forced to produce them. Statisticians acknowledge that if you talk to them privately. They also have footnotes and appendices and so on, but it’s not communicated very clearly that this is what’s happening.”

One alternative to data on stocks and flows is emerging not from international organisations, but from the private sector. The internet, the spread of information transparency laws, and advances in automated content analysis have opened up the possibility of gathering data on FDI at the level of individual investments.

Glenn Barklie, chief economist at the New Statesman Media Group, believes that this sort of data is particularly valuable for the possibilities it opens up for more fine-grained analysis. “For example,” he says, “when we look at greenfield projects and M&A deals, both are included in overall FDI flows and stocks. However, the trends in each can vary. Similarly, this data makes it possible to spot any outliers at the project level – one mega-acquisition could actually heavily skew a trend for stocks and flows.”

Another key advantage of this data is its ability to report the number of jobs created by each investment project, insofar as this information is publicly available. Many investment promotion agencies use this data to measure up to their own job creation targets. For instance, some agencies use project-level data to assess not only the number of jobs created by FDI, but also their quality – for instance, noting the proportion of these jobs that pay above the private sector median wage. As time goes by, project-level data may become a valuable tool for policymakers looking to discern between helpful and unhelpful capital inflows.

“One of the key benefits of FDI is job creation – even more so than the amount of capital invested,” Barklie says. “Although it is safe to broadly assume that a higher capital investment will be correlated to a higher number of jobs created, that’s not always the case. Job creation is a key priority for governments and FDI is an extremely important avenue for this. Project-level data gives insight into this, whereas stocks and flows data do not.”

While coverage is rapidly improving, the fact that the collectors of project-level data lack the institutional firepower of government statistical agencies makes it difficult to capture all projects. Investments by small or secretive companies are unlikely to result in press releases that can be scraped by an algorithm, while language barriers and data privacy laws may add further woes.

Ultimately, no data set is perfect. This is especially true for those that attempt to capture large, diverse and abstract phenomena such as capital flows. Nonetheless, decisions will continue to be made and narratives will continue to be built on whatever data is available.

It’s therefore not an option to just abandon flawed data sets altogether. “It’s important to acknowledge the uncertainty that is hiding in the numbers,” Linsi says. “We can and we should use numbers, but we should take them with a grain of salt more than we do now.”