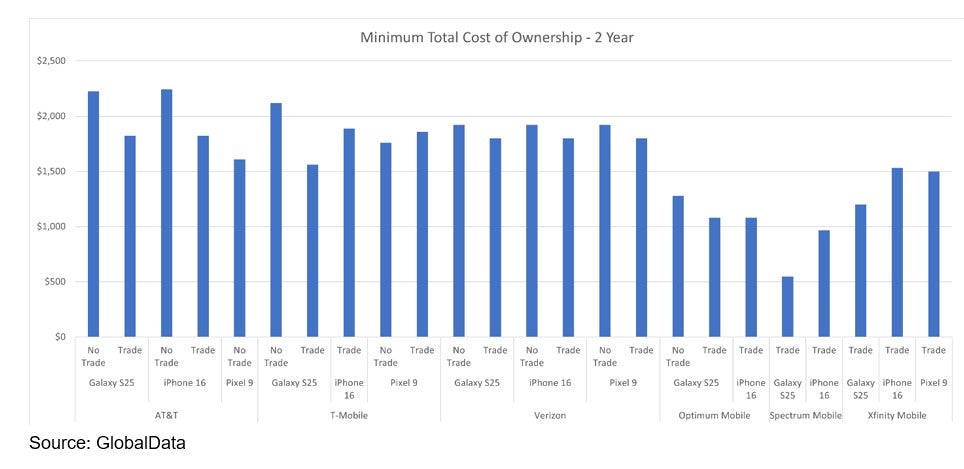

Cable companies’ mobile virtual network operators (MVNOs) dominated the US wireless services space in a comparison of minimum total cost of ownership (TCO) for the latest flagship phones.

Considering the promotional device cost and the cost to carry the required plan over term, GlobalData compared the minimum TCO of the latest flagship devices across multiple carriers, and cable MVNOs are the clear winners on plan cost alone.

Winning on service pricing

Cable MVNO entities such as Spectrum Mobile, Optimum Mobile, and Xfinity Mobile present the lowest minimum TCO across the industry.

Their device promotions are formidable, yet their principal advantage stems from competitively priced WiFi-enabled mobile services. By harnessing both WiFi and 5G technologies, the US multiple system operators (MSOs) can direct nearly 90% of data traffic through WiFi.

This strategy keeps MVNO expenses minimal and profit margins robust, enabling them to substantially undercut the pricing of postpaid mobile services.

Plan pricing stands out as the foremost determinant of TCO, even when combined with the most aggressive device promotions. AT&T, Verizon, and T-Mobile mandate that most device promotions, which are generally distributed over two to three years, be tied to premium postpaid plans priced at $75 or more.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataNotably, a mobile phone with one of the highest no-trade TCOs—specifically, T-Mobile’s Galaxy S25—is actually available at no cost. However, this offer necessitates subscribing to the operator’s most expensive plan, which exceeds $100 per month in service costs. MVNOs also attach plan requirements to device promos, but the costs of those plan range between $20 and $50 per month.

MVNOs poised to disrupt within their respective footprints

As cable MVNOs become increasingly assertive in their marketing strategies, offering complimentary mobile lines, the cost disparity will continue to widen, presenting a formidable challenge to justify. Major carriers, particularly T-Mobile and Verizon, which have yet to iron out consistent upgrade promotions, must enhance customer retention efforts with compelling upgrade offers that do not necessitate a change in plans.

This is crucial to deter customers from exploring alternative providers. Home internet companies have an optimal marketing platform to entice customers with low-cost, and occasionally free, mobile lines coupled with competitive device deals. These companies are just beginning to tap into their extensive reach. A recent promotion by Optimum Mobile exemplifies the effectiveness of all-inclusive pricing: two Samsung Galaxy S25 Ultra phones with two lines of service for a mere $45 per month, a deal that integrates an attractively low service cost.

Trades take the edge off

Typically, incorporating a trade-in requirement offsets the promotional expenses sufficiently, allowing these operators to reduce the mandatory plan expenditure. Like major postpaid operators, MNVOs are currently using this strategy to help offset costs.

While these trade-in offers provide compelling material for advertising, customers are increasingly retaining their phones for extended periods; Verizon, for instance, reports an average upgrade cycle of approximately 42 months.

Even when customers manage to maintain their devices in an undamaged state suitable for trade-in—a notable achievement in itself—it remains challenging to ensure that the devices retain sufficient value over such durations. Operators leaning on trade-in value to offset plan costs will need to expand to accept broken trades.