Nordic cloud-based challenger bank Lunar has raked in EUR40m ($47.2m) in Series C funding round to bolster its business banking and consumer credit offerings.

The latest round sourced fresh capital from existing investors Chr. Augustinus Fabrikker, who extended its existing equity in the fintech firm. Private investors Alan Howard and Klaus Ostergaard, from Brevan Howard Asset Management, also participated in the funding round.

The latest round of funding comes just months after Lunar raised an additional EUR20m ($23.6m) through its extended Series B. The latest funding round brings the total amount raised by the company to date to EUR104m ($122.9m).

Fresh capital will allow Lunar to expand

The fresh capital raised by Lunar will primarily be spent on rolling out new services, something which has been a priority for the company historically. Following its Series B funding round which closed in April 2020, Lunar has launched paid-for subscriptions, personal consumer loans and business banks accounts.

In June 2020, Lunar launched a digital bank account with a Visa card offering for non-citizens, ex-pats or international students living and working in Denmark. The bank account is meant for teenagers between 15 and 17 years of age and help them manage their allowances, salary and money on their account.

The following month, Lunar launched its Pro subscription offering, which costs DKK119 ($18.90) per month. This subscription provides customers with access to personal consumer loans and business bank accounts.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataLunar founder and CEO Ken Klausen stated: “Our focus is to roll out full personal and business banking operations in all Nordic countries and strive towards profitability in one of the world’s most profitable banking markets.”

The company appears to have set its sights on the booming “buy now, pay later” market, with plans to launch a product that will offer users the ability to split payments into monthly instalments. Lunar’s entry would theoretically encroach on current market pleaders Klarna and Affirm, which have most recently been valued at $11bn and $3bn, respectively.

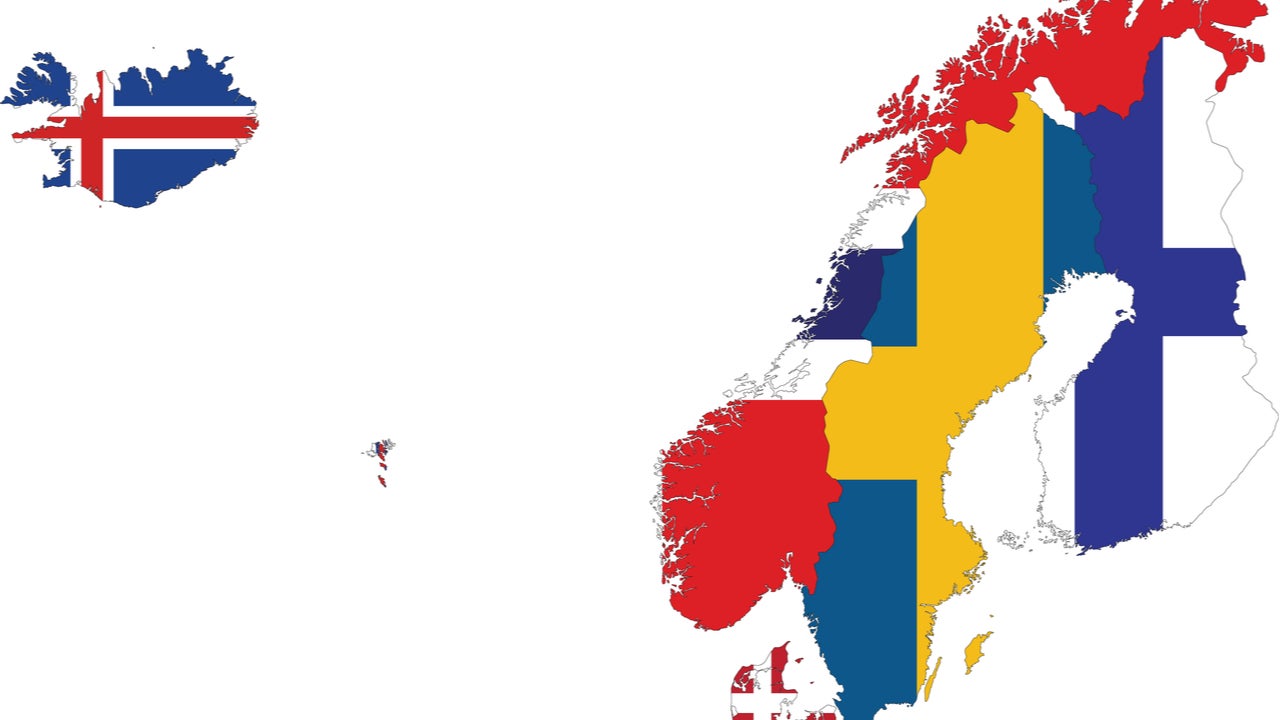

Expansion across the Nordic region

Launched in 2015, Lunar is the only digital bank that has won a banking license in the Nordics. In 2018 and 2019 Lunar expanded its offices to Stockholm and Oslo, making it possible for Swedes and Norwegians to manage their finances.

In 2019 the company obtained a European banking license from the Danish FSA, which enabled it to build a new bank from scratch with the products its users desired.

It now has over 200,000 personal customers and 5,000 business users across Denmark, Sweden and Norway. It has offices in Aarhus, Copenhagen, Stockholm and Oslo, with a headcount of more than 180 employees and plans to launch its banking app in Finland in the first half of 2021.

Lunar’s expansion into Finland will further enhance its position in the Nordic region and allow it to continue growing its customer base, in line with its plans.

Related Company Profiles

Visa Inc

Klarna Bank AB

Affirm Inc