Cigarette giant British American Tobacco (BAT) expects to double its ecigarettes sales in 2018 as it integrates rival Reynolds American.

Ecigarettes generated $551 million in revenue for BAT last year and it expects sales to hit $1.39 billion by the end of 2018 and exceed $7 billion in 2022.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

BAT bought Reynolds American for £41.8 billion in July last year, the largest acquisition the tobacco industry has ever seen.

BAT — which sells Dunhill and Lucky Strike branded cigarettes — has thrown itself fully into ecigarettes and devices that heat tobacco without burning it.

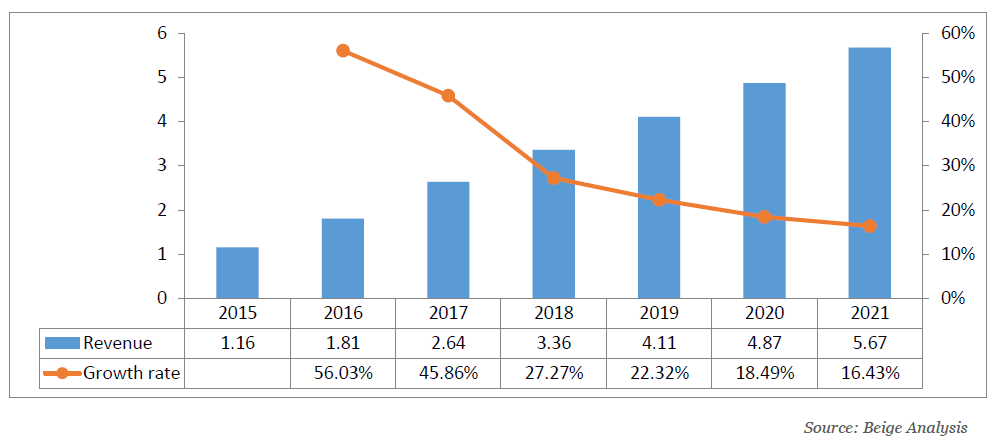

The global ecigarette market is expected to reach $27.6 billion by 2022.

Ecigarette growth took off in 2014 as new technology was developed, major acquisitions took place and government regulations were introduced.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataTobacco companies are now dedicating significant portions of their budgets to the research and development of ecigarettes.

BAT announced the expected sales growth alongside its full-year results for the 12 months to 31 December.

Overall sales climbed 38% from £14.7bn to £20.3bn, including Reynolds American, or 2.9% on an organic basis. Profts, stripping out Reynolds American, were up 3.7%.

Ecigarettes’ profits increased by 39%.

What was said:

Chief executive of BAT, Nicandro Durante said:

“Our investments are now coming to fruition and, recognising that not all consumers are the same, we now have an unrivalled range of exciting and innovative products across the potentially reduced-risk categories — including vapour, tobacco heating products, oral tobacco, tobacco-free nicotine pouches and moist snuff.”

Richard Burrows, BAT chairman, said:

“The transformational deal to acquire Roynolads marked a record year in 2017. The group continued to deliver on its commitment to high single figure constant currency earnings growth, substantially reinforced the long-term sustainability of that growth with the largest acquisition of a tobacco company ever completed and achieved significant success in its next generation products business.”

What this means:

The battle between BAT and rival tobacco company Philip Morris is heating up.

Philip Morris is regarded as having a lead in the tobacco-heating device market — which heat tobacco without burning it and removing some health risk associated with traditional smoking.

BAT has plans to submit a marketing application to the US Food and Drug Administration for its Glo tobacco-heating product this month, according to Reuters.

It expects to hear back on its application for a different device, with a carbon tip, by mid-year. While it has made progress away from traditional tobacco products in recent years BAT is lagging behind Philip Morris.

Charlie Huggins, manager of the Hargreaves Lansdown Select UK funds, which own BAT shares, said:

BAT ought to be better placed than most to benefit from these shifting sands. However, the industry is clearly changing at an unprecedented rate and it is very difficult at this stage to say how this all plays out in the long term.

BAT’s missed analyst expectations, sending shares lower.

Background:

BAT acquired the remaining 57.8% stake in Reynolds American that it did not already own in July 2017 for $58bn, the biggest by a UK multinational company in two decades, and giving it access to the US market.