Higher prices and more retailers getting involved will drive Black Friday spend this year with sales set to rise 3.8 percent on last year.

Spend over the Black Friday period — between 20 November and 27 November — is set to hit £10.1bn ($13.2bn), accounting for 10.4 percent of spending in the fourth quarter.

While this growth is down year on year more retailers are expected to take part to try to stimulate a drop in demand over September and October.

What are going to be the big Black Friday spend winners?

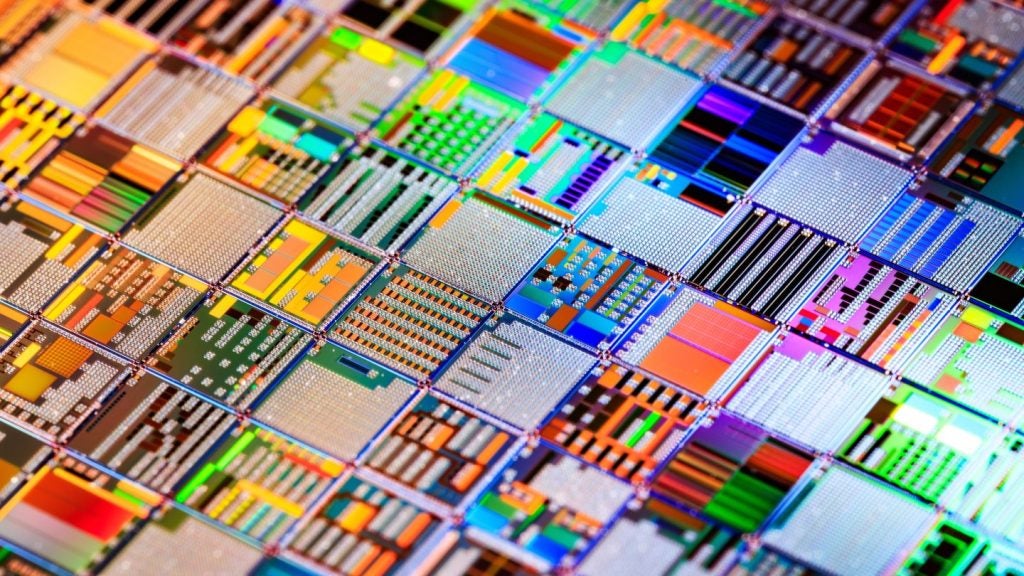

Electrical sales are expected to continue to dominate Black Friday promotions, although year-on-year growth is forecast to slow to three percent due to inflation putting people off.

While electronics have traditionally been the main focus of the event, over the past two years fashion retailers — led by the likes of ASOS and Topshop — have improved their Black Friday offers.

Health and beauty products are expected to record strong Black Friday spend growth after a good Black Friday last year. Department stores House of Fraser, Selfridges and John Lewis are offering strong discounts to get people through the doors.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataMeanwhile, home ware is forecast to have the strongest year-on-year growth, with a rise of 5.9 percent. This will be driven by poor home ware sales so far this year with retailers looking to clear out left over stock with heavy discounting.

Inflation issues

A rise in inflation on last year means retailers will struggle to offer the low prices seen in 2016.

This year retailers’ margins have been hit as suppliers have been forced to raise prices due to increased production costs following the devaluation of the pound.

As a result, retailers have been forced to increase prices in an attempt to mitigate margin loss.

As a result demand may waver, with people feeling less inclined to make bargain purchases on impulse.

Retailers will need to be creative with how they advertise Black Friday promotions this year, for example promoting multi-buy offers or free gifts with purchases if they cannot afford to offer large discounts.

Lower for longer

Interestingly, this year a lower proportion of Black Friday spend will fall on the Friday.

When Black Friday was first exported from the US to the UK the event promised impressive discounts for one day only. However, over time retailers have taken the opportunity to extend the event. This is both to get more people involved and take the pressure off straining websites and busy stores.

In 2016, most retailers advertised their Black Friday deals as starting on the Friday and finishing the following Monday.

US online retail giant Amazon took this further advertising a Black Friday sale running for 12 days between 14 November and 25 November and has already said its sale will run for at least 10 days this year.

In 2017 more retailers will extend their promotional calendars to include the whole week before Black Friday in an attempt to stimulate demand as they struggle this quarter.

As more shops advertise Black Friday deals early this will pull others into the spiral who will be forced to do the same to remain competitive.

This is particularly tricky for retailers that price match, such as John Lewis, which will have no choice but to bring down prices early.

Related Company Profiles

ASOS Plc

Amazon.com Inc