An exchange-traded fund or ETF is a type of investment that tracks a particular index, sector, or commodity that can be traded on a stock exchange like a regular stock.

A bitcoin ETF would make it easier for both individuals and institutions to gain exposure to bitcoin, as well as signalling mainstream acceptance of the digital asset.

For the time being, investors buy their bitcoins from disreputable cryptocurrency exchanges and risk losing them if they leave their coins on the exchange, as was the case for customers of FTX, Mt. Gox, and many other failed cryptocurrency custodians.

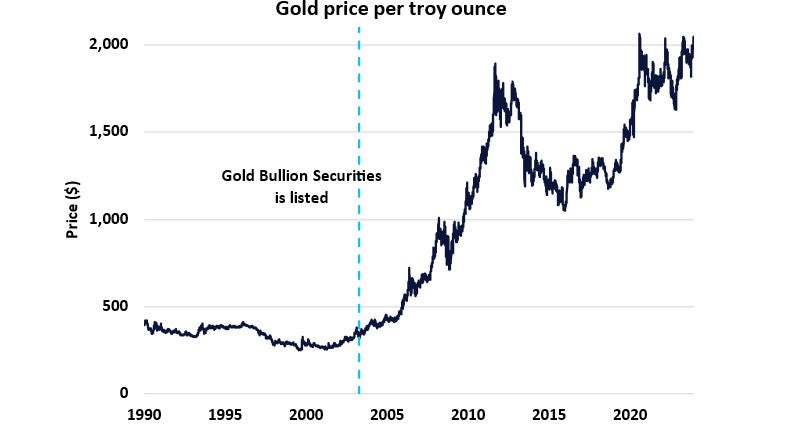

Image Source: GlobalData

The chart above shows the subsequent price rise of gold following the listing of the first gold ETF in March 2003. When gold ETFs were introduced, they provided an accessible and cost-effective way to invest in gold compared to buying physical gold.

ETF rejection

The first spot bitcoin ETF was submitted (and rejected) over a decade ago by Cameron and Tyler Winklevoss when bitcoin was trading at $90. Today, bitcoin trades above $40,000, and over a dozen asset managers await SEC approval for a spot bitcoin ETF, including the world’s largest asset manager Blackrock.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGlobalData predicts that in Q1 2024 a group of spot bitcoin ETFs will simultaneously gain SEC approval to prevent any single asset manager from gaining a competitive advantage.

Bitcoin becomes scarcer than gold

Every 10 minutes or so, a new block is mined, and Bitcoin miners are rewarded with 6.25 newly minted bitcoins–worth over a quarter of a million dollars at the time of writing. When Bitcoin’s 840,000th block is mined (expected on April 17, 2024) the block reward will be cut in half to exactly 3.125 bitcoins in a preordained event known as the halving.

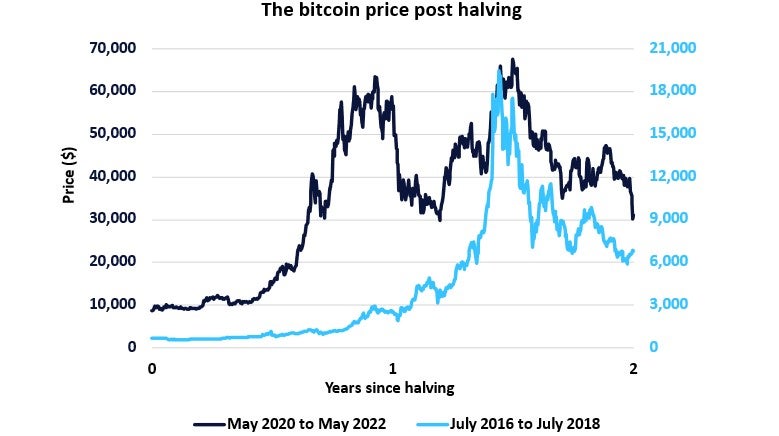

Image Source: GlobalData

Bitcoin halving occur every 210,000 blocks or roughly four years, and in the past, this supply shock has been followed by an impressive bull run.

Scarcity can be difficult to quantify, but one way of doing this is by using a stock-to-flow ratio. At block height 839,999 (just before the next halving) the stock of bitcoin will be 19,687,500–the total number of mined bitcoins.

Bitcoin’s flow is the number of bitcoins mined per year, after the halving this works out to 164,250 bitcoins per year, resulting in a stock-to-flow ratio just shy of 120 years. Meaning, at the post 2024 halving it would take 120 years to mine all the bitcoins in existence. Gold on the other hand is not so programmatic or auditable, but using data from the World Gold Council we can see that its stock-to-flow ratio can be estimated at 60 years.

Greater demand for risk assets

Central banks around the world have been raising interest rates and keeping them high since Q1 of 2022 to fight inflation. Generally, in high-interest environments, low-risk fixed-income investments, such as government bonds, are favored over risky investments like bitcoin. When interest rates are cut you can expect greater demand for risky assets, including bitcoin.

The house view at GlobalData’s TS Lombard is that the Federal Reserve will cut rates at the first sight of the economy wobbling. The broader view of the market can be gauged by looking at Fed Funds futures, these are tradeable contracts that enable investors to speculate or hedge against the target federal funds rate. FedWatch by CME Group is a handy tool that gives probabilities of rate cuts, as implied by the futures price data.

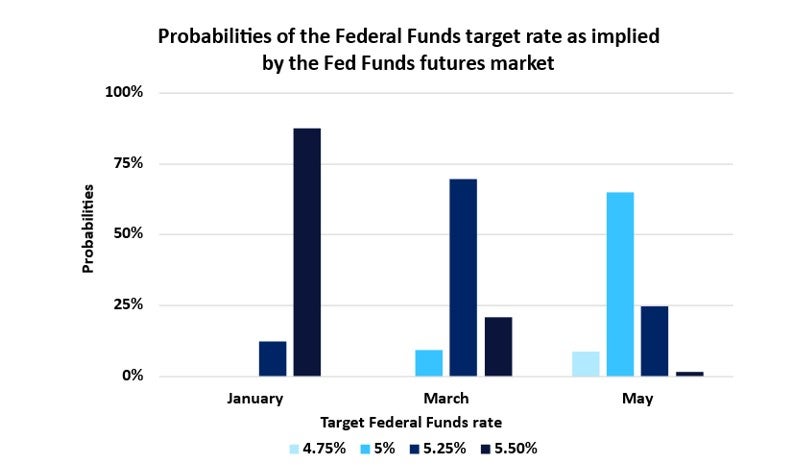

Image Source: GlobalData

The chart above shows these probabilities over the next three FOMC meetings. We find that investors are expecting the Fed to keep rates high but are expecting a rate cut as early as March 2024, giving a March rate cut a probability of almost 80%. Investors give a 1.6% probability that there will not be a rate cut by May 2024.

ETF: Final thoughts

With bitcoin up over 160% year to date, you could argue that a lot of what I’ve talked about is already priced in. The anticipated approval of a Bitcoin ETF, the impending halving event, and the possibility of rate cuts by central banks have likely contributed to the recent surge in Bitcoin’s price, but I believe there’s still a lot of upside left for bitcoin.