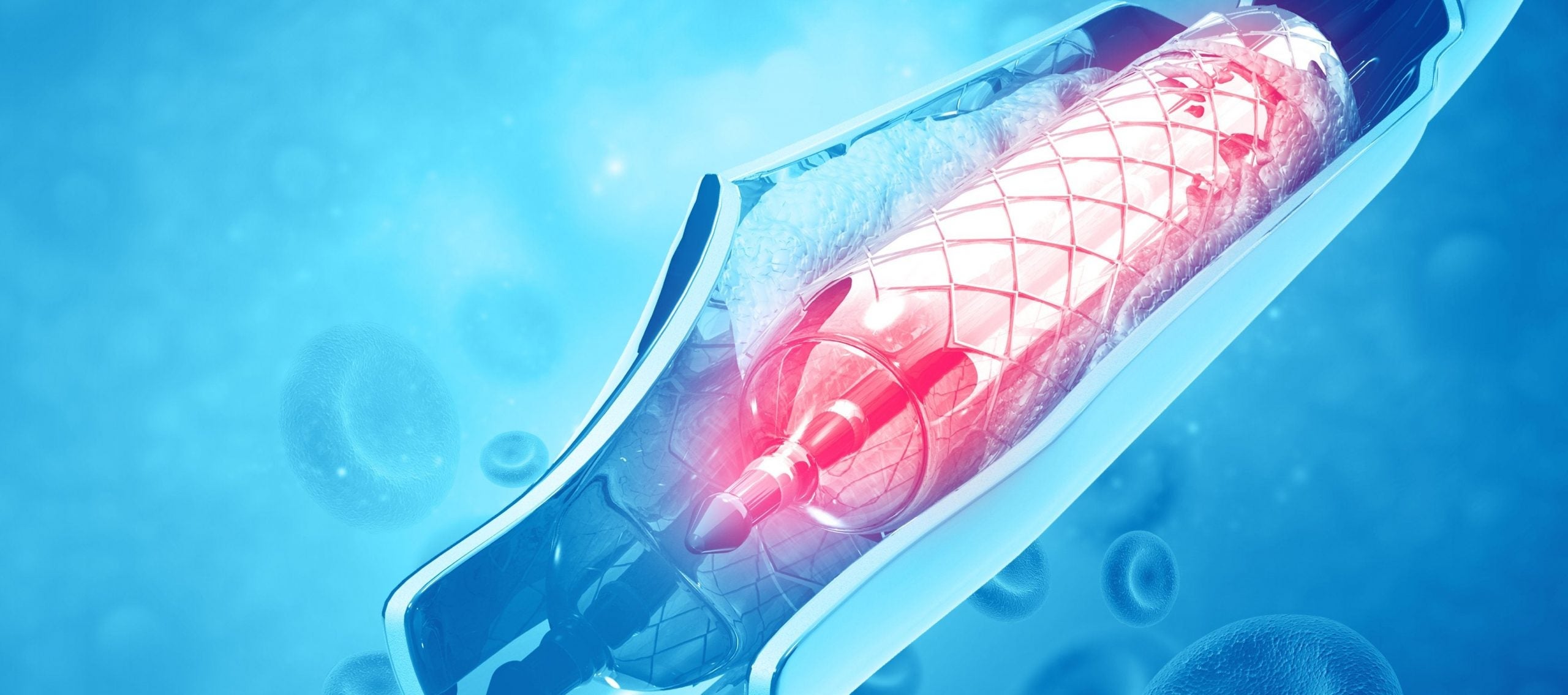

The news that UK start-up Cambridge Quantum Computing (CQC) and US multinational Honeywell have agreed a milestone merger may signal an era of much-needed consolidation in the quantum computing sector. The most significant merger in the sector to date combines the industrial conglomerate’s business unit, Honeywell Quantum Solutions (HQS), with CQC’s software business to create the largest stand-alone quantum computing platform in the world.

Only a handful of quantum computing mergers and acquisitions (M&A) have taken place. Investors, wary of the unproven technology, have typically focused on smaller investments in start-ups, while tech companies have established partnerships rather than embarking on full-scale M&A. According to CB insights, the number of venture capital deals rose 46% in 2020 compared with 2019, despite the total amount raised in the quantum computing sector falling by 12% to $365m, indicating a proliferation of smaller players prompted by advances in quantum computing technology.

With more quantum start-ups entering the field, GlobalData’s Quantum Computing thematic research highlights a 'much-needed consolidation' in the sector. These start-ups require vast sums of funding with little chance of immediate returns, making the need for funding a primary driver for consolidation within the sector.

This [merger] allows us to bring a fully integrated quantum company to market. Ilyas Khan, Cambridge Quantum Computing

Honeywell CEO Darius Adamczyk said in a press release announcing the Honeywell/CQC merger that investors have been eager to invest directly ever since the company announced its quantum business in 2018. He also added: “The new company [HQS merged with CQC] will provide the best avenue for us to onboard new, diverse sources of capital at scale that will help drive rapid growth.”

For CQC, the merger was a way to accelerate the development and scaling of its technology and software development platform as well as ensuring a quicker route to market, according to CEO Ilyas Khan. Combining CQC’s software development and HQS’s hardware expertise was key. “This allows us to bring a fully integrated quantum company to market,” says Khan.

Honeywell and CQC have had a partnership dating back to 2018, before announcing their merger in June 2021. Honeywell is part of a group of industrial conglomerates including GE, Schneider Electric and Siemens. GlobalData head of thematic research Cyrus Mewawalla says that these conglomerates “have, in many ways, missed the tech boom of the past 20 years. Management now recognises the opportunity to get in on the next tech boom and how quantum computing will transform the industrial internet". Mewawalla expects all of these big industrial players to invest in quantum start-ups going forward.

Quantum kings will change face of technology

Alhough investment in quantum computing appears high-risk at present, Mewawalla says the company that ultimately dominates the sector will change the face of technology. If quantum investing were an equation, investors should evaluate risk in relation to probability to assess the impact of their investment. Among all the predictions and claims, no one knows when the technology will reach maturity. This ‘winner takes all’ outcome may be enough to persuade risk-averse investors and prompt cash-rich companies to speculate. “Big Tech is always looking for the next big thing in ten years and quantum is definitely in the top three. If I were Google or Amazon, I would buy everything in the quantum space,” says Mewawalla.

If I were Google or Amazon, I would buy everything in the quantum space. Cyrus Mewawalla, GlobalData

However, Big Tech has yet to make its move. The average quantum computing deal size for 2020 was just under $10m, according to CB Insights data, demonstrating that there is no quantum bubble… yet. According to GlobalData, there is a Big Tech buying spree of quantum start-ups somewhere on the horizon. "Larger tech companies will be the most likely acquirers of quantum start-ups and may make purchases less for intellectual property and more for the workforce's talent," writes Giacomo Lee in GlobalData’s thematic research.

As start-ups begin to struggle for funding, a dearth of specialist quantum talent will drive Big Tech towards acquisitions, most likely taking the form of 'acquihires'. Indeed, the Big Tech companies are still the only entities with pockets deep enough to accelerate development of the technology. According to Khan, Big Tech is very aware of the power and potential of quantum. “These companies have long, medium and short-term goals for strategic M&A and it is impossible to know when they will make a move that the outside world deems as significant,” he says.

Big Tech's quantum research

For now, Big Tech has been using its own expertise and resources in the race for quantum supremacy. In 2019, Google announced its quantum project Sycamore had solved in just 200 seconds a computing task that would have taken classical computing 10,000 years. This was later disputed but highlighted nevertheless how Big Tech was making strides in the technology.

In 2019, Amazon Web Services launched Amazon Braket, a cloud-based product that allows corporations to simulate quantum computing problems to see how the technology could improve processes. The tech giant is using quantum technology from some of the leading private companies in the sector and is said to be ‘auditioning’ them for future partnerships or acquisition.

Microsoft’s Azure Quantum is closing the gap on Amazon’s leading position in quantum cloud services, while IBM is leading the field overall with a full complement of hardware and software in addition to the most assigned patents. Like Amazon, the company is running a cloud-based service offering companies simulation opportunities.

Following the fault lines of geopolitical competition, China’s Hefei University of Science and Technology announced in December 2020 that its own quantum computer, Jiuzhang, was up to ten billion times faster than Google’s Sycamore. China’s non-free market model for innovation has seen a concerted effort made by its ruling communist party for global tech supremacy codified in policy initiatives, including government investment of $10bn in the country’s National Laboratory for Quantum Information Sciences.

Alibaba leads other Chinese internet giants Tencent and Baidu in the quantum computing arena. Development of quantum processers at its $15bn DAMO science and technology research centre and its fast-growing quantum cloud service make the company important strategically to China’s drive to be a world leader in quantum technology.

Will quantum investor patience run short?

However, despite technology advances and Big Tech’s cloud simulation offerings, full commercialisation is still at least a decade away. Without the prospect of even medium-term revenues there is a danger that investors’ patience will be tested. In fact, in Gartner’s specialist model of the cycle a technology goes through from innovation trigger to mainstream adoption, quantum computing in 2020 ranked at a ‘peak of inflated expectations’. What typically follows is a trough of disillusionment before the technology reaches commercialisation in what Gartner predicts is going to be in more than ten years.

Nonetheless, significant capital raisings by private companies including Rigetti, Zapata Computing, D-Wave and PsiQuantum demonstrate that investor appetite remains strong. CQC was among this leading group of quantum start-ups, advancing quantum technology while bringing it to the mainstream attention of the business world. By striking a deal with Honeywell, CQC has raised an important question as to whether this group of leading private companies has now revealed a potential enticing enough for Big Tech to finally make its move.