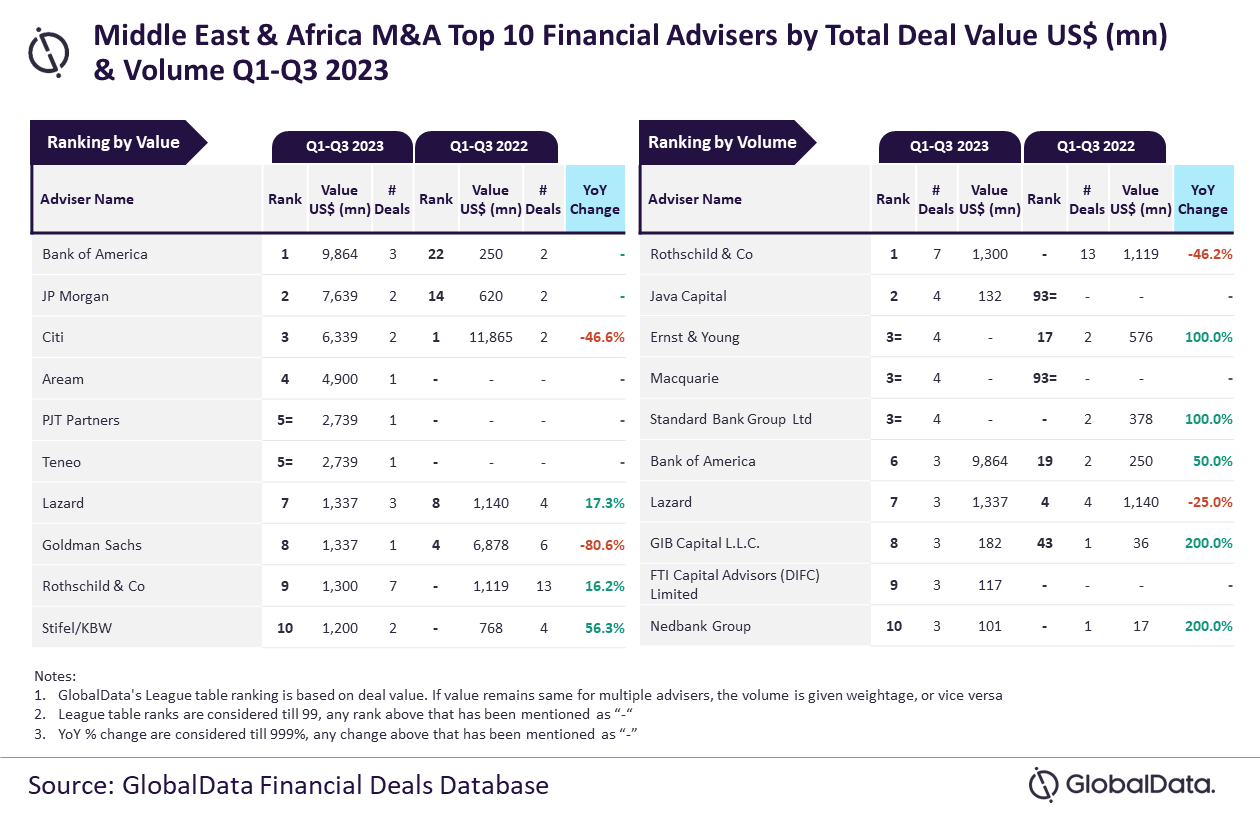

Bank of America and Rothschild & Co were the top M&A financial advisers in the Middle East & Africa region in Q1-Q3 2023, according to GlobalData’s ranking of leading M&A advisers.

Bank of America topped the charts when measuring the value of deals, advising on $9.9bn worth of deals during the period, while Rothschild & Co advised on the most transactions with a total of seven deals.

“Bank of America registered a massive jump in the total value of deals advised by it during Q1-Q3 2023 compared to the same period in the previous year,” said GlobalData lead analyst Aurojyoti Bose. “Moreover, it was just shy of touching the $10 billion mark in total deal value during Q1-Q3 2023. Apart from leading by value, Bank of America also occupied the sixth position by volume.

“Similarly, Rothschild & Co, apart from leading by volume, also occupied the ninth position by value during Q1-Q3 2023.”

An analysis of GlobalData’s Financial Deals Database reveals that JP Morgan came second in terms of value, by advising on $7.6bn worth of deals, followed by Citi with $6.3 billion and Aream with $4.9bn, while PJT Partners and Teneo jointly occupied the fifth position by this metric with a total deal value of $2.7bn each.

Measured by number of transactions, Java Capital occupied the second place with four deals, while Ernst & Young, Macquarie, and Standard Bank Group jointly occupied the third position by this metric by advising on four deals each.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.