The semiconductor industry has gained increasing relevance globally ever since the Covid-19 pandemic caused significant disruption to its supply chains, highlighting its importance to the global technology sector.

The shortages caused by the pandemic have impacted numerous sectors and dented the availability of products such as cars, mobile phones and computers.

Most importantly, the disruptions caused by the pandemic highlighted that the semiconductor industry is reliant on a limited number of suppliers of raw materials and a few large manufacturers.

The effects of that overreliance have become even more evident against the current geopolitical backdrop of Russia’s invasion of Ukraine, which is set to impact the bottom end of the supply chain.

So who owns the semiconductor industry? Which countries have a monopoly on the production of, for example, silicon, which is essential to produce microchips? Before trying to answer this question, it is worth setting the scene by looking at the bigger picture.

Impact of China-US trade war on semiconductors

Governments of advanced economies have become alarmed by semiconductor shortages and have rolled out plans to mitigate tight supply conditions by stimulating local production to achieve self-reliance in the mid-term.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe trade war between China and the US is a great example of how governments’ protectionist stances have affected the semiconductor industry’s supply chains.

In May 2020, the US administration extended its executive order barring US companies from buying equipment from foreign telecommunication companies that pose a national security risk. It also banned all companies from selling hardware and software products using US-based intellectual property or components for their production.

The order, which was first aimed at Chinese company Huawei, was further extended in September 2020 to include Shanghai-based Semiconductor Manufacturing International Corporation (SMIC), the world’s fifth-largest semiconductor foundry, in the blacklist of companies deemed as threats to US national security.

According to a recent GlobalData report, as part of the geopolitical pressure being applied by the US against China, Netherlands-based ASML, which is the sole supplier of the most technologically advanced ultraviolet lithography machines in the world, was successfully pressed to cut off Huawei’s semiconductor subsidiary – HiSilicon – as well as SMIC from its manufacturing tools and technologies.

“This has greatly impacted the semiconductor industry at whole, forcing the rearrangement of supply chain contracts during 2020,” the report says. “US buyers have been forced to find alternative suppliers to SMIC, the same as Huawei, which had to find non-US affiliated suppliers, eventually overcrowding the rest of existing suppliers.”

Asia-Pacific maintains semiconductor supremacy

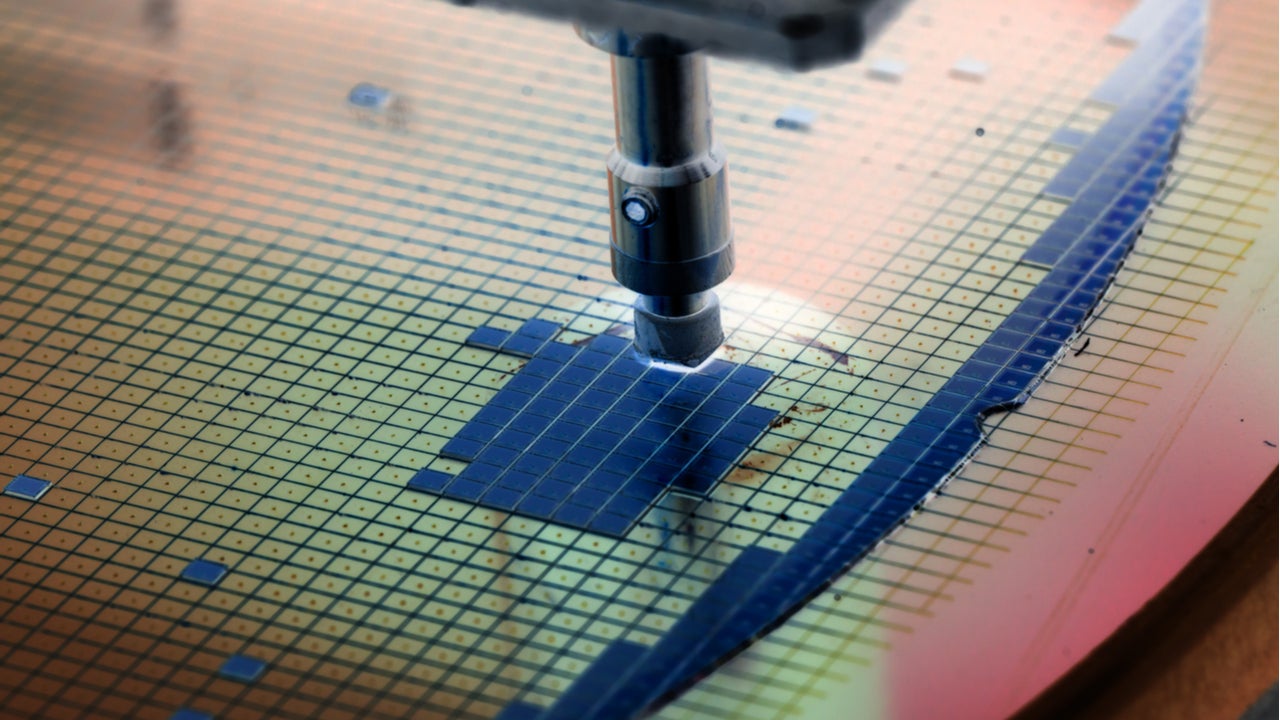

As previously reported, the most significant bottlenecks in the global semiconductor supply chain lie in advanced manufacturing capacity, for which Taiwan and South Korea have a combined 100% of the global manufacturing capacity in seven-nanometre (nm) and 5nm chips.

Boston Consulting Group estimates the split as South Korea (8%) and Taiwan (92%). This monopoly means disruption by natural disasters, infrastructure problems or geopolitical conflicts may result in repeated and severe global chip shortages.

Taiwan’s semiconductor company, TSMC, which has a global monopoly on supplying 5nm chips, is dealing with increasing difficulty in power and water supplies, according to GlobalData principal analyst Michael Orme. In fact, a number of widespread blackouts across the island were reported in March 2022 in addition to others over the past five years.

“There is also a shortage of engineers as the older generation retires and younger ones try to find ways to earn more money on the mainland [China], whose shortage of semiconductor engineers to work in its fabs is acute,” says Orme, who adds that this comes despite the Taiwanese government doing all it can to clamp down on migration to China.

The chips that are at the core of the semiconductor industry are made of silicon. According to GlobalData’s report, China is the world’s leading silicon producer by a considerable measure.

In 2021, China was responsible for the production of six million metric tonnes (t) of silicon. Russia, Brazil and Norway followed quite far behind with 580,000t, 390,000t and 350,000t, respectively.

Data collected on semiconductor orders by thousands of dollars in the period between 2000 and 2022 confirms that Asia-Pacific has been at the forefront of the industry even throughout the pandemic.

In 2021, Asia-Pacific accounted for $351.5bn, followed by the Americas at $129.5bn and Europe at $47.8bn.