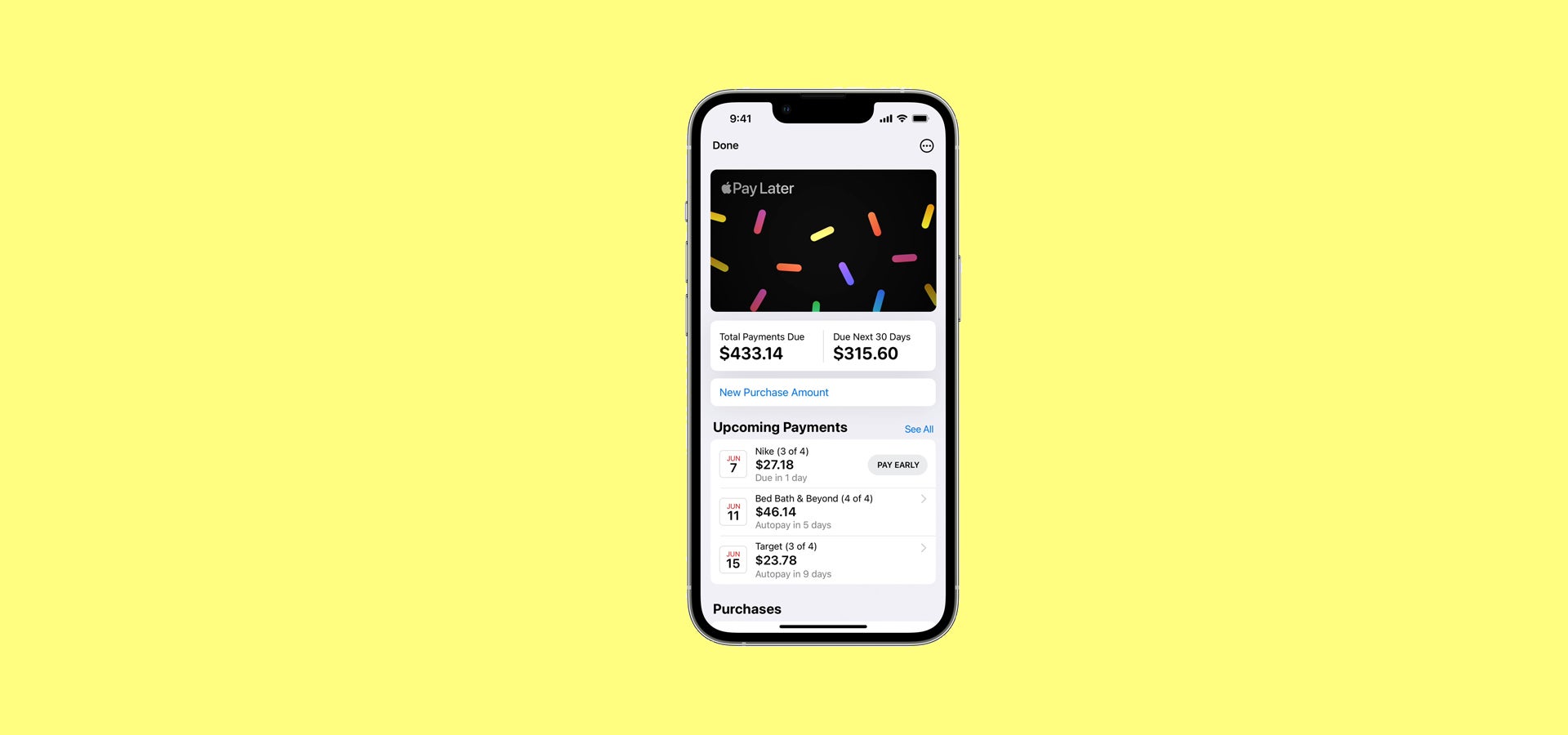

Apple Pay Later should worry the already beleaguered buy-now-pay-later (BNPL) industry. The iPhone maker announced this week that it is on the cusp of releasing an option for customers to split payments into four interest-free instalments paid over six weeks. This is no small threat to the likes of Klarna and Affirm for obvious reasons.

The Cupertino-headquartered tech titan has an humongous market grasp. The firm claims that its Apple Pay product is accepted at 85% of US retailers and any in-store locations that accept contactless payments. It shouldn’t take a massive leap of imagination to assume that the millions of users that already use Apple Wallet won’t be hard-pushed to adopt the new service when it goes online with the arrival of iOS 16 this autumn.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

After all, the last time Apple announced a significant update to its operative system, it ended up cutting off Facebook from great swaths of its revenue. The iOS 14.5 update empowered iPhone owners to stop Mark Zuckerberg’s minions from tracking their journeys over the web. This meant that Meta, as the company has rebranded itself, wouldn’t be able to offer targeted ads to its customers.

Despite fighting tooth and nail to keep the change from happening, the social media giant eventually relented last year. It’s one of the main reasons why the Zuck has been hard at work peddling his vision of the metaverse – he needs to make up for the losses in revenue.

While Apple Pay Later won’t cut off the BNPL industry to the same extent, it is still arguably a threat to their bottomline. This is even more the case when you consider the size of Apple’s war chest. Money is hardly an issue for Apple. The $2.3tn company has $28bn on its balance sheet. That means Cupertino is well-insulated from potential losses incurred from customers defaulting on loans.

The iPhone maker will finance the Apple Pay Later loans itself via its new subsidiary Apple Financing LLC. This means Cupertino will take on the role that banking partners like Goldman Sachs play in its other lending services. Goldman is, however, facilitating the move by providing Apple with access to its Mastercard network as the iMac maker lacks a licence to issue payment credentials directly. Apple will handle the underwriting and lending, according to the Financial Times. Apple will make money from the interchange fees of the transactions.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBad news has pummeled the BNPL industry lately. Publicly traded firms like Affirm have seen their stocks fall dramatically since the start of the year. Klarna recently joined the smattering of tech companies announcing mass-layoffs due to market volatility. The crisis has also forced investors to tighten their belts, signalling that raising money will be significantly trickier in the next few months.

Moreover, the industry is also affected by big players muscling in on the industry. Fintech firms like PayPal, Monzo and Mastercard have unveiled their own BNPL services over the past few years. Several traditional lenders have followed suit after seeing how popular these services became during the pandemic.

Clearly, the BNPL industry has reason to view Apple’s latest foray into financial services with some trepidation. But are they?

How worried should other BNPL players be about Apple Pay Later?

“They should be worried,” Max Levchin, CEO and founder of BNPL giant Affirm, told Bloomberg in response to the Apple Pay Later announcement. “I think this spells a certain level of concern for folks that are really specialised in this really short-term product.”

While he argued that Cupertino’s entry into this space would hit firms only offering instalments products like the one provided by Apple Pay Later, he didn’t worry about Affirm’s bottomline.

“Even as more players join the movement we started, the prize remains massive, and Affirm is well-positioned to win,” an Affirm spokesperson told Verdict. “We simply don’t think anyone can do what our team and our technology can do.”

Levchin has a point. For starters, the venture counts major airlines, Walmart, Amazon and even Apple among its customers. Affirm has a wealth of offers apart from its BNPL business. The $6.6bn fintech firm also provides 0% annual percentage rate loans and savings accounts. In other words, Affirm is on the path to becoming more like a banking provider than simply just a BNPL business. Contrary to Klarna, Affirm is also hiring.

Swedish quadradecacorn Klarna is on a similar path. As Verdict has reported in the past, the fintech is on track to becoming more of a one-stop shopping platform where customers can find and pay for stuff. It is also planning on expanding its banking services from Germany and Sweden to all the markets it is present in. Klarna declined to comment on this story.

Block, née Square, is similarly somersaulting towards becoming a one-stop financial services shop. It already provides point-of-sale contactless payment solutions and an app for transactions. Its $29bn acquisition of Afterpay has provided it with a BNPL service as well.

Should smaller firms be worried?

Apple Pay Later could arguably present a bigger risk to smaller pure BNPL services. However, far from everyone agrees that Cupertino’s latest fintech foray has set smaller startups on the path of moribund peregrinations

“[I] just don’t see Apple Pay Later taking large market share from the BNPL space,” Scott Harkey, executive vice-president of financial services and payments at software firm Endava, told Verdict. “The product is only available on Apple Pay transactions in the US and Apple Pay transactions don’t make up enough of the total ecommerce volume to pull meaningful market share from other BNPL providers. If it does impact smaller BNPL providers, it will be in that it forces them to have a very clear business model and value proposition in order to gain customers and scale.”

Philip Belamant, CEO and founder of $2bn BNPL provider Zilch, is similarly bullish about smaller startups’ chances. UK-based Zilch recently announced plans to expand into the States.

He welcomes Apple’s entry into the BNPL space, arguing that it validates the market. The entrepreneur is especially excited about how it could potentially challenge incumbent credit card companies’ fees. Both he and other BNPL players Verdict has spoken with have claimed that credit card companies give customers an unnecessarily raw deal and that the market segment is ripe for disruption.

“[Apple CEO] Tim Cook’s well-researched decision to enter this large consumer finance market to help offer people 0% short-term credit is welcomed and we remain very confident in our ability as a brand to continue scaling fast,” Belamant told Verdict.

Apple Pay users also differ from the demographics targeted by other BNPL providers. In short: they earn more and are better banked, meaning they have access to more credit alternatives. This adds to the argument that there won’t be an immediate big clash between Cupertino and smaller fintech firms.

How about customers?

The fact that Apple Pay users tend to earn more money also insulates the company against the common criticism that BNPL services put people’s financial health at risk. Market watchdogs have repeatedly sounded the alarm that these services may result in people living beyond their means. For instance, the US Consumer Financial Protection Bureau (CFPB) opened an inquiry into the sector in December 2021.

“Buy-now,-pay-later is the new version of the old layaway plan, but with modern, faster twists where the consumer gets the product immediately but gets the debt immediately too,” CFPB director Rohit Chopra said at the time.

Similar probes have launched in the UK and in other countries. These calls have grown in tandem with the growth of the BNPL industry. The sector is expected to keep growing to be worth $166bn by 2023, according to GlobalData’s thematic research.

BNPL companies have almost fallen over each other in their efforts to be seen to welcome inquiries into this space. They often say it will give the sector more credibility. This hasn’t prevented some market stakeholders from suggesting that Apple Pay Later could end up hurting customers.

“[This] kind of BNPL, which forces people to pay four times over six weeks, is predominantly used by those that live paycheque to paycheque and have to do this to make ends meet,” Christer Holloman, founder and former CEO of BNPL startup Divido, said in a LinkedIn post. “Is Apple really that desperate that they want to be affiliated with this type of predatory lending? Is it worth the negative PR which will come further down the line?”

Harkey adds: “I think it is a fair critique and I do think that regulators will come into the BNPL space to ensure that the product being offered meet all consumer protection regulations.”

Apple will likely do a soft credit check, but the details about this is scant in its press release. Apple didn’t return Verdict’s requests for clarification.

Apple Pay Later is another Big Tech move

Apple Pay Later is Cupertino’s latest foray into the fintech sector. It has previously launched a credit card and payment services. The announcement itself didn’t surprise anyone. In fact, Verdict first reported on speculations about the product back back in July 2021.

“It has been rumoured for a few months that Apple may launch a BNPL product and it makes sense based on their continued push into financial services,” Harkey says.

It also ties into a wider trend of Big Tech firms offering fintech services. Amazon, Meta, Google and Uber are just some of the companies that have added fintech services to their offerings over the years.

Regulators are increasingly waking up to this reality. Moreover, they are getting worried. The Bank for International Settlements, an umbrella group for the world’s central banks, warned central banks and financial regulators in August 2021 to be more alert to how massive tech companies can shape financial services.

Apple and its Silicon Valley peers already face intense scrutiny on both sides of the Atlantic. Market regulators have launched probes against Big Tech firms, accusing them of choking competition.

It remains to be seen if the iPhone maker’s latest announcement will motivate similar investigations.

GlobalData is the parent company of Verdict and its sister publications.