Intel has reached a definitive agreement with Apollo Global Management for the sale of a 49% equity interest in a joint venture (JV) entity associated with its Fab 34 facility in Ireland.

Apollo-managed funds will invest $11bn (€10.1bn) for acquiring the stake in Fab 34, which is Intel’s high-volume manufacturing (HVM) facility located in Leixlip, Ireland.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

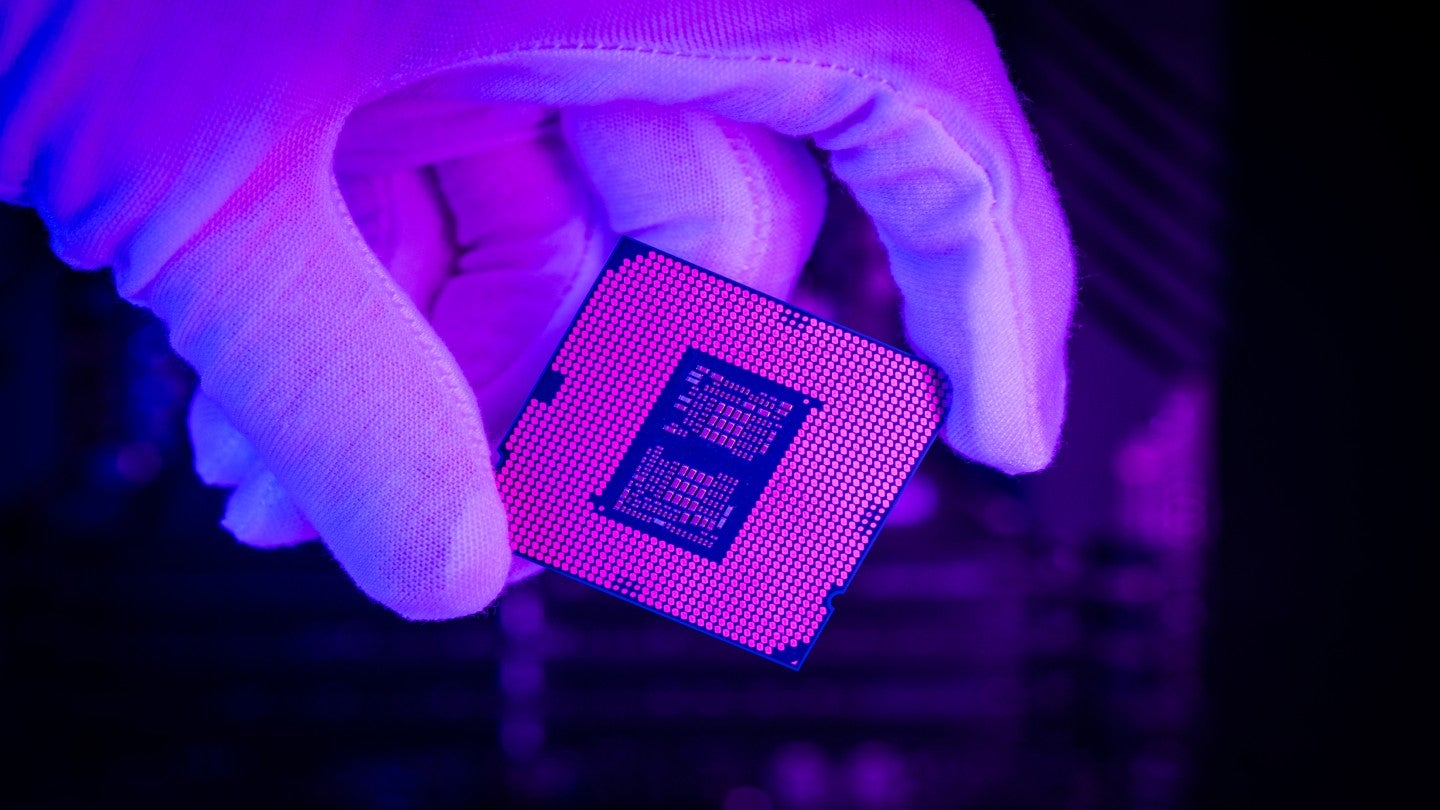

So far, Intel has invested $18.4bn in Fab 34, that has begun producing Intel Core Ultra processors using Intel 4 technology from October last year.

Construction of Fab 34 is largely complete, marking a significant milestone with the commencement of HVM and introduction of extreme ultraviolet lithography in Europe.

The transaction, which is expected to complete in the second quarter of 2024, is part of Intel’s second Semiconductor Co-Investment Program, which is integral to the company’s Smart Capital strategy.

This move is part of Intel’s broader strategy to create financial flexibility and to invest in manufacturing operations worldwide, without impacting the balance sheet.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThrough this agreement, Intel will be able to reallocate a portion of its investment in Fab 34 to other business areas while continuing the facility’s development.

Intel’s transformation strategy further includes billion dollar investments to regain process leadership and expand its wafer fabrication and advanced packaging capacities worldwide.

Under the latest transaction, the JV will have the rights to produce wafers at Fab 34, which will further allow Intel to meet the long-term demand for its products and deliver capacity to Intel Foundry customers.

With a 51% controlling interest, Intel will maintain full operational and ownership control over Fab 34 as well as its assets.

The transaction is structured to strengthen Intel’s balance sheet by providing capital at a cost lower than its cost of equity and is expected to be viewed as equity-like from a ratings perspective.

Intel CFO David Zinsner said: “Intel’s agreement with Apollo gives us additional flexibility to execute our strategy as we invest to create world’s most resilient and sustainable semiconductor supply chain.

“Our investments in leading-edge capacity in US and Europe will be critical to meet growing demand for silicon, with global semiconductor market poised to double over the next five years.”