Tech giants in the US are increasingly looking to neighbouring countries, such as Mexico, to diversify their production and reduce reliance on manufacturing facilities based in the Asian continent. The United States-Mexico-Canada Agreement (USMCA), which came into force on 1 July 2020, is viewed as mutually beneficial, and particularly advantageous for the US amid its efforts to distance itself from China. According to GlobalData’s Tech, Media, & Telecom Predictions 2024 report, the US will increase its supply chain reshoring amid ongoing geopolitical tensions, and a continuation of the technological race with China means the US will continue reshoring its semiconductor supply in China.

The US nearshoring to Mexico

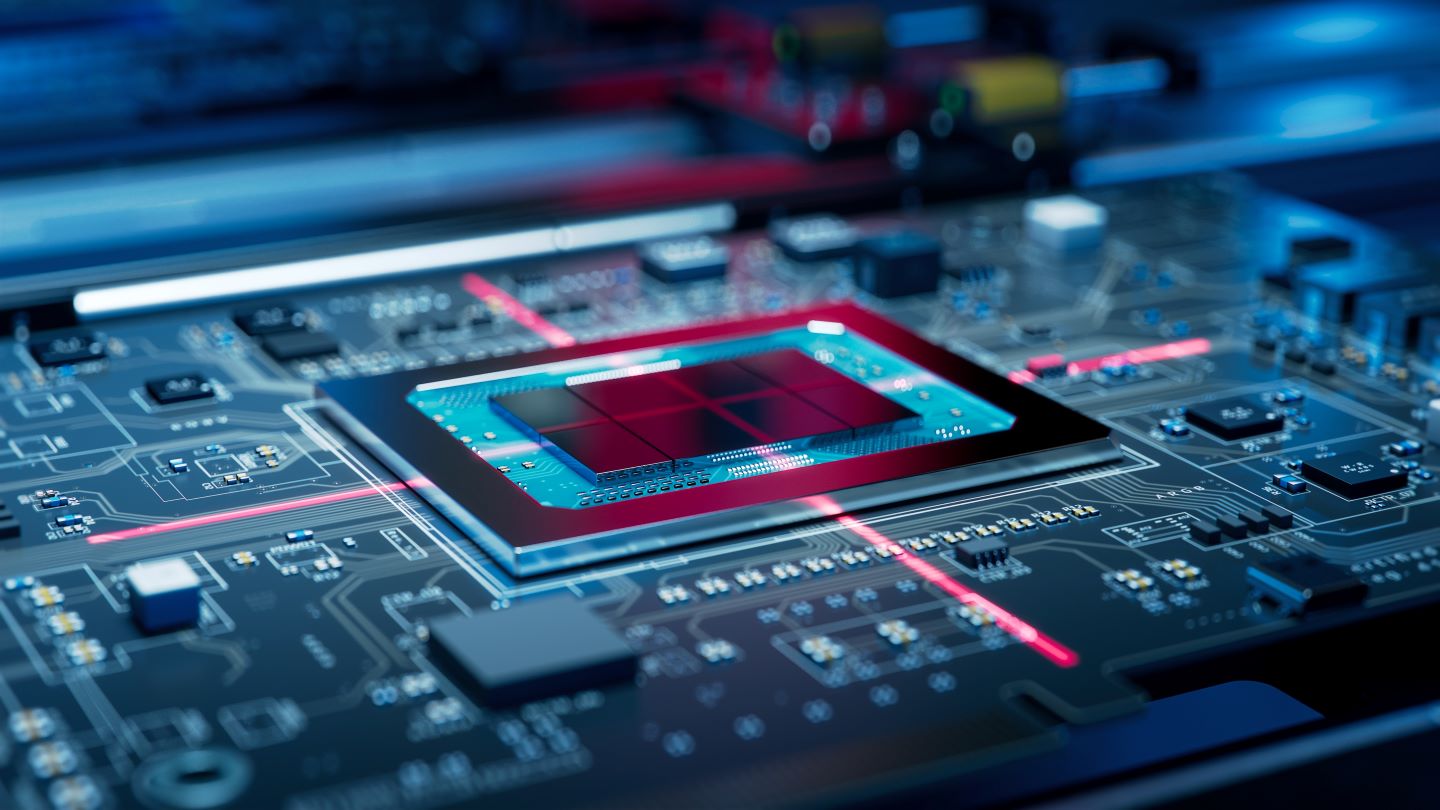

Mexico’s attractiveness as an investment destination has been on the rise, with imports from the country surpassing those from China for the first time in two decades. US tech giants and investors are drawn to Mexico’s potential for profitable returns, not only in AI hardware but also in automotive manufacturing. With the concept of nearshoring gaining traction, Mexico is seen as an ideal location to replace Asian production and establish closer supply chains. Taiwanese-owned Foxconn has already set up two factories in Mexico, while other companies that manufacture AI servers in Asia are considering similar moves. Nearshoring can help create a more resilient supply chain for the US semiconductor industry. By reducing dependence on overseas vendors, particularly in East Asia where most of the chip manufacturing is currently concentrated, the US can mitigate the risks associated with disruptions in global supply chains. This can help ensure a stable and reliable supply of semiconductors, even in times of geopolitical tensions or amid other disruptions.

Mexico is actively trying to create a favourable environment for semiconductor companies and is considering incentives to attract private investment. Additionally, Arizona State University is collaborating with higher education institutions in Mexico and microelectronics industry partners to boost semiconductor production in North America. Furthermore, Therm-X has opened a new facility in Nuevo Laredo, Mexico, to support the machining and manufacturing of semiconductor equipment for customers in North America. These developments all suggest that Mexico is positioning itself as a viable location for semiconductor companies.

The US governments push for trade relations

The Biden administration is actively working to strengthen trade relations with Mexico and attract investments to reduce reliance on China amid ongoing tensions. However, a Republican win in the upcoming election—especially given Trump’s history of contentious relations with Mexico raises concerns for tech giants—could potentially disrupt plans for nearshoring supply chains from Asia to Mexico.

Challenges of moving production to Mexico

Despite the opportunities, Mexico may face challenges in becoming the hub for semiconductor manufacturing, particularly due to its infrastructure and talent pool. Mexico must invest in infrastructure—including reliable power supply, transportation networks, and advanced manufacturing facilities—to support semiconductor production. Mexico would need to invest in education and training programs to cultivate the necessary talent pool for semiconductor manufacturing, as developing a skilled workforce with expertise in semiconductor fabrication and testing is crucial.

One issue that stands out is the presence of organized crime in Mexico, including the cartels, which could potentially pose security and stability concerns for chip manufacturing facilities. Security concerns could be one of the reasons that may deter investment from Mexico as cartels have historically disrupted operations. To alleviate this issue, the US Government may collaborate with Mexican authorities to address security concerns and ensure safety in the operating environment by implementing robust security measures, collaborating with the local authorities in the areas, and carefully evaluating the risks and benefits of operating in certain regions.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAs geopolitical tensions between the US and China increase, it appears clearer that the US will be more keen than ever to work with the Mexican government, to both help boost the Mexican economy and increase foreign investment in the country. This move may also encourage Big Tech companies in other countries to divert semiconductor manufacturing to Mexico.