It has been clear for a long time that operators need to move beyond connectivity if they are to make any serious money from IoT.

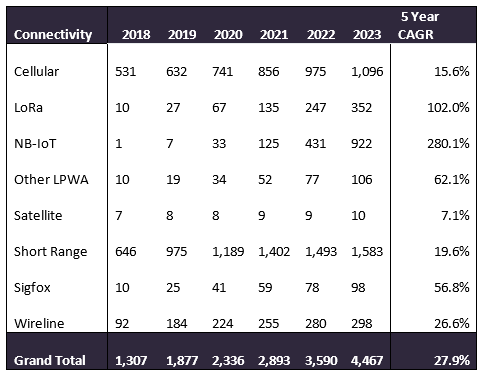

According to new forecasts from GlobalData, the global number of Internet of Things connections will reach 4.5 billion by 2023, dominated by short-range and cellular connections but with especially strong growth from low-power wide-area networks (LPWANs). At 28%, the 5-year compound annual growth rate (CAGR) for all IoT connectivity types is moderate.

IoT connectivity forecast

These numbers are only moderately good news for mobile operators which will see their cellular connections grow by only a CAGR of 16% over five years, while their licensed spectrum LPWANS (including NB-IoT and LTE-M, the latter of which is included in “other LPWANs”) will grow strongly by 280% and 62% respectively but which start from a much lower installed base.

By the end of the period, cellular and short-range access types (which include WiFi, Bluetooth, RFID, and Zigbee) will dominate the number of connections with 24% and 35% of the total respectively. The operators may source or help deploy short-range access, but this does not appreciably boost their revenues in IoT, which come from cellular and LPWAN connectivity.

What does this mean for mobile operators’ long-term strategies?

Operators have been trying to make money in beyond-connectivity services with mixed success. Most tier 1 service providers have added consulting and advisory services, proof of concept, deployment/pro services/integration, and ongoing managed services such as device lifecycle management and application enablement.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataWhile this makes sense when courting large corporate customers and MNCs, however, it may not make sense for SMBs or for the types of use cases that do best with LPWANs; these are optimised for low bandwidth, low-touch, long-term deployments with low or sporadic data transmission requirements. For that reason, LPWANS typically cost less for the customer than traditional cellular options, but their value rests largely on the expectation of “massive connectivity” rather than on providing the operators with more lucrative value-added services.

In addition, the operators are increasingly marginalised by other members of the IoT ecosystem that may be better situated to provide business consulting, private networks, security solutions, application development, and data analytics. Infrastructure vendors, WiFi vendors, IT service providers, systems integrators, IoT platform vendors, and even automotive OEMs are infringing on segments and services that the operators hoped to participate in.

While GlobalData forecasts predict a market of over $317 billion in IoT revenues by 2023, connectivity is only about 5-10% of the total, with most of the revenues going to services and solutions.

Where does 5G fit in?

The cellular connection numbers include 5G by the last several years of the forecast, but 5G may also provide new service opportunities for the operators as it is expected to add not only support for massive connectivity but new use cases that need ultra-low latency and can benefit from granular tiered service approaches derived from network slicing capabilities.

Operators expect that 5G will be a boon to their IoT revenue streams, through private network opportunities and support for real-time manufacturing environments, robotics, autonomous vehicles, and technologies such as AR/VR and advanced video capture and analysis.