Google Cloud has selected Advanced Micro Devices (AMD) semiconductors for use in its data centres as it continues to gain market share from rival Intel.

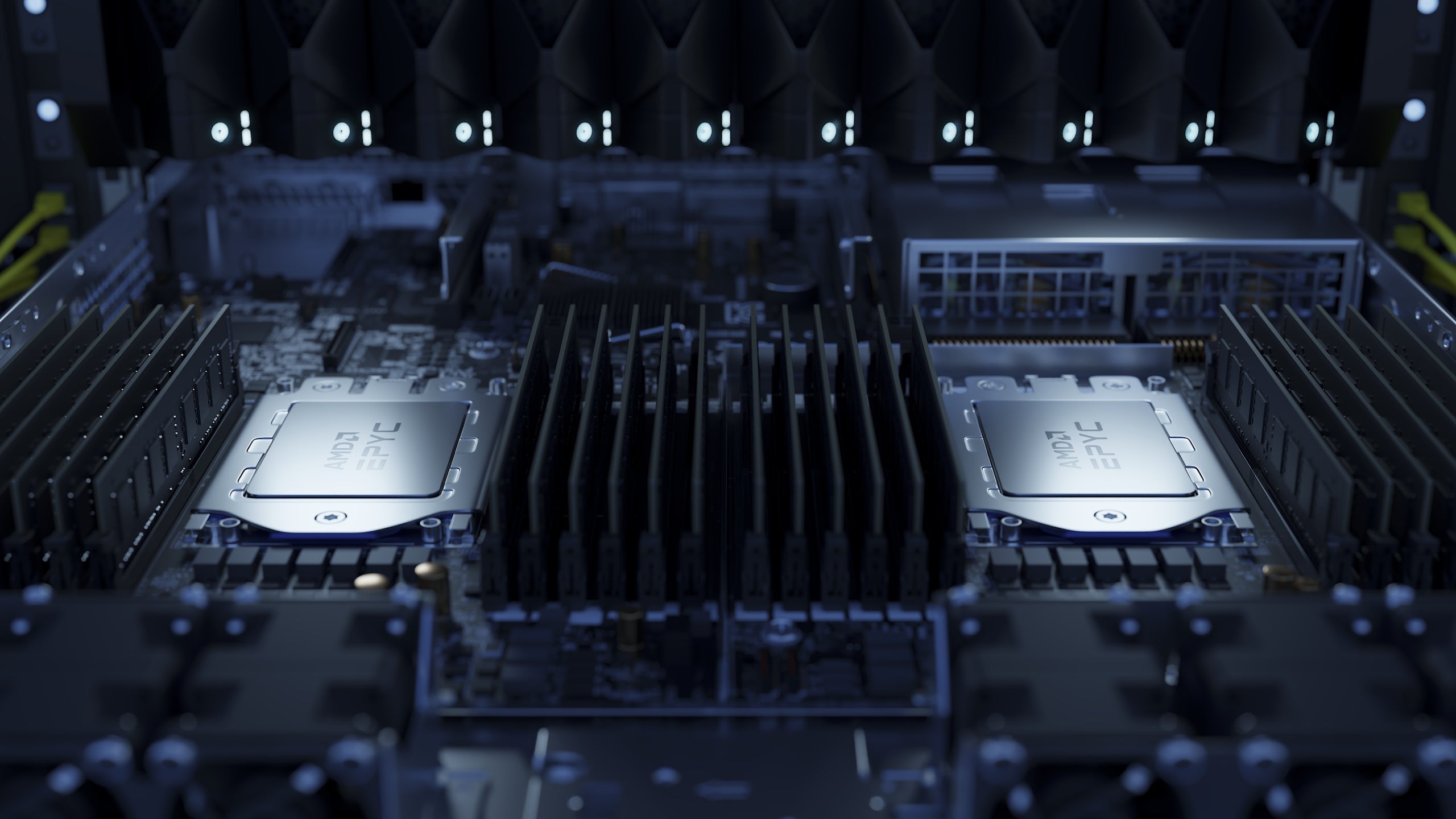

Google’s cloud computing arm will use AMD’s latest EPYC processors for a new range of virtual machines (VMs), collectively called Tau VMs.

Google claims the Tau VMs will offer 56% higher “absolute performance” compared to rival general-purpose VMs, including those made by Arm and Intel.

It will also be compatible with x86, a CPU instruction set widely used in servers, desktops and laptops. Tau VMs will also be compatible with Google Kubernetes Engine support from “day one”.

T2D VMs will become available to Google Cloud regions in the third quarter of this year. Google Cloud customers Snapchat and Twitter have already been testing the new AMD-based data centre chips.

“At Google Cloud, our customers’ compute needs are evolving,” said Thomas Kurian, CEO of Google Cloud. “By collaborating with AMD, Google Cloud customers can now leverage amazing performance for scale-out applications, with great price-performance, all without compromising x86 compatibility.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAMD President and CEO Lisa Su said: “We work closely with Google Cloud and are proud they selected AMD to exclusively power the new Tau VM T2D instance which provides customers with powerful new options to run their most demanding scale-out workloads.”

AMD’s selection by Google is another blow for Intel, which has long been the dominant player in the data centre chip market. Its 8086 processor line paved the way for x86 architecture, which for decades has shaped the instruction sets used by chips in PCs, games consoles and data centre servers.

But in recent years AMD, ARM and Nvidia have been eating into Intel’s data centre market share.

In its most recent quarterly results Intel reported a 20% drop in its data centre business. Executives blamed this on cloud “digestion” – a delay in customers buying more chips because they are still implementing previous orders. GlobalData’s thematic research also cautioned that it’s not just the growing competition Intel has to worry about, but also its overreliance on a limited number of customers for the majority of its revenue.

In 2020 AMD doubled its server processor sales and its overall data centre sales are now a “high-teens percentage” of the company’s total annual revenue, Su told analysts earlier this year.

Last week AMD announced its EPYC 7002 processors would power HPE’s enterprise storage products.

Meanwhile ARM, whose chip designs are ubiquitous in smartphones and tablets, have been growing in clout in the data centre. Last month Oracle unveiled server chips based on Arm designs in another blow to Intel.

The prize for the companies providing the bulk of the components to data centres is high; according to GlobalData forecasts the data centre market will be worth $948bn by 2030.