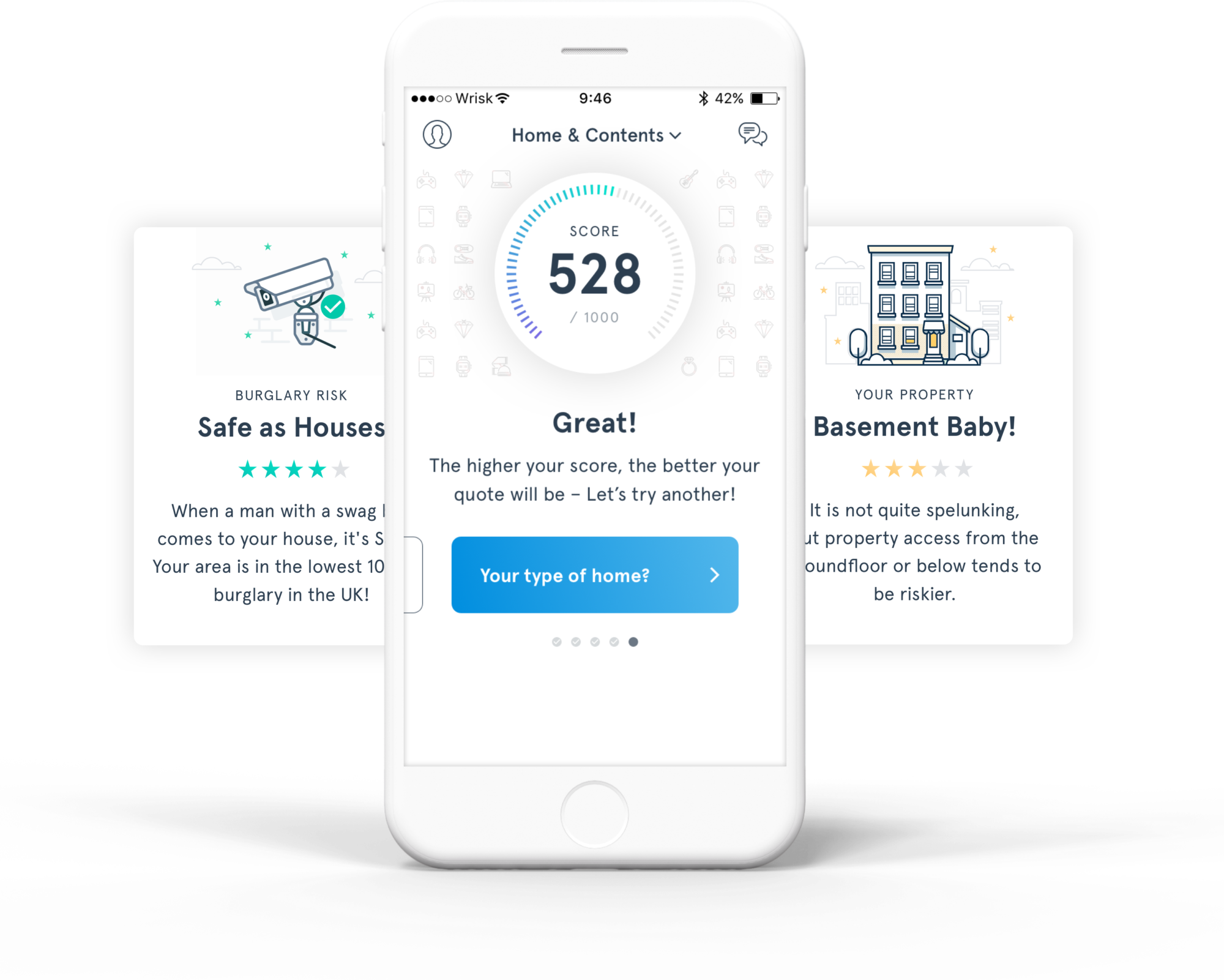

Alex Harin is the chief technology officer at Wrisk, a mobile-first insurance company that has created a white-label platform used by firms in sectors ranging from automotive to retail. Founded in 2016, Wrisk’s aim is to bring insurance up to date in the digital era in which consumers have come to expect personalisation and simplicity. It counts among its customers BMW, Allianz and Hiscox.

In this Q&A, the fourth in our weekly CTO Talk series, Harin explains what the traditional insurance industry has got wrong, how startups like Wrisk can benefit from Big Data and how Linux helped shape his interest in tech.

Rob Scammell: Tell us a bit about yourself – how did you end up in your current role?

Alex Harin: I’m the CTO of Wrisk, and I have been involved in the company since its early beginnings.

I’d been a software and IT consultant for tech and insurance consultancies for most of my career and was technical lead and principal consultant for ThoughtWorks where I met Wrisk’s co-founder Darius Kumana. When he first talked to me about the project for Wrisk, I thought it sounded fascinating, and a completely novel idea. I soon started working part-time for Wrisk, moving on to a full-time role in July 2016.

From day one, I’ve used my software architect background to develop Wrisk’s platform, and to build it with flexibility at its core to allow us to develop different types of products. I’m now responsible for the day-to-day engineering of it and for making sure we keep evolving it to fit with our customers’ needs.

What’s the most important thing happening in your field at the moment?

Insurance is a fairly old-fashioned industry where a lot is commoditised, where everything is centred around the insurer rather than the insured – and where the end customers don’t understand or care much about the product they get. In other industries, however, consumers are already used to being put first and new technologies are transforming their experience from driving, to eating, to managing personal finances by empowering them with new data and personalised services.

An important change happening at the moment is the fact that insurance is now following suit and getting fit for the digital age. This means building a relationship with customers through digital channels, making their lives easier through shorter policy cycles and subscription-based insurance, and being more transparent about how their lifestyle affects their policy pricing.

In the future, with the proliferation of all kinds of sensors in consumers’ day-to-day lives, insurers will use the increasing data available to offer truly customisable and flexible insurance products, based on people’s individual lifestyles.

This is important for us because startups like Wrisk are much freer and more flexible to innovate in this space than more established companies, as they aren’t constrained by any legacy systems. I think we’ll see increasing demand from traditional insurers for insurtech partners that can help them to bring a digital-first experience to customers, without having to overhaul their whole business model.

Which emerging technology do you think holds the most promise once it matures?

It’s been said that there has been a lot of hype around Big Data – and there has indeed been a lot of hype around Big Data. But I do think this is still one of the most powerful concepts allowing us to make technology progress today – and part of that is because it’s become a much more accessible resource in recent years.

In the world of insurance, the idea of personalising quotes and policies to fit with how customers live their life is a huge shift and would not be possible without access to data. Importantly, while traditional insurers now feel the need to leverage Big Data to understand customer demand better, the costs of using this data and implementing the tech around it to respond to these demands have gone down dramatically, meaning smaller players can make the most of it too.

How do you separate hype from disruptor?

To me it’s not about the proof or promise of one specific technology, it’s about making the disruption happen through general adoption.

No technology can solve every problem we have. Where disruptive technology has a real impact is when it’s democratised, allowing big and small entities to implement it at scale.

What’s the best bit of advice you’ve been given?

My dad was working in academia and his bit of advice was to pursue a career where you can satisfy your intellectual curiosity. I think I have been following that advice so far.

Where did your interest in tech come from?

I first witnessed the rise of computers in the late 80s. For my generation, having a computer was a novelty, so I was already intrigued by the promises it held. But my background is in math and physics – I’ve got a Ph.D in Applied Mathematics, not IT – so I wasn’t naturally destined to work in the tech industry.

What made me move to the tech side was the introduction of Linux, and the fact that for the first time, computing technologies and source codes were available to everyone, for free. We started using Linux at my university and I was just completely blown away by the fact that computers had suddenly become a free, collaborative medium – and by the potential of that new reality.

In fact, my first job out of university was an administrator on Linux.

What does a typical day look like for you?

My day usually starts with a team meeting where everyone checks in on their task of the week. I also catch up with the product team separately to understand where Wrisk is moving in terms of product and am involved in customer support systems. I’ll leave the team to solve any expected challenges that arise but get more involved when something new comes up that we haven’t seen before.

Generally, my day is focused on designing the Wrisk platform, and defining the direction for our technology.

What do you do to relax?

I love cycling – which is the way I get to work – spending time with my family, and everything else that helps people resting from the day-to-day – from reading to listening to classical music!

Who is your tech hero?

Linus Torvalds, the inventor of Linux. He was a huge influence on me when I started my professional career. He was my first entry into the world of tech and his approach to making technology accessible to everyone, achieving something that many institutions could not, continues to inspire me to this day.

What’s the biggest technological challenge facing humanity?

Honestly, it’s probably that we are often too reliant on technology. Tech is transforming our societies, and a lot of that is incredible progress, but we tend to forget the things that make us human, and I think it’s important to acknowledge that this side matters as much, if not more.

Read more: CTO Talk: Q&A with Asset Control’s Mark Hermeling