Russia has been holding on to its Cold War role as the world’s second biggest arms exporter, yet this position is under threat.

According to a new paper by Chatham House out today, growing international production, international relations changes and domestic concerns are causing issues for Russia’s export business.

Richard Connolly, associate fellow of the Russia and Eurasia programme at Chatham House and the paper’s co-author, said:

Despite its position as the second largest supplier of weapons globally, Russia still faces fundamental external and internal challenges. India and China, Russia’s two key buyers in its most important market, are both moving toward further self-sufficiency, or are seeking new suppliers. If successful, these efforts will inevitably challenge Russian dominance in key arms markets.”

Here is what you need to know.

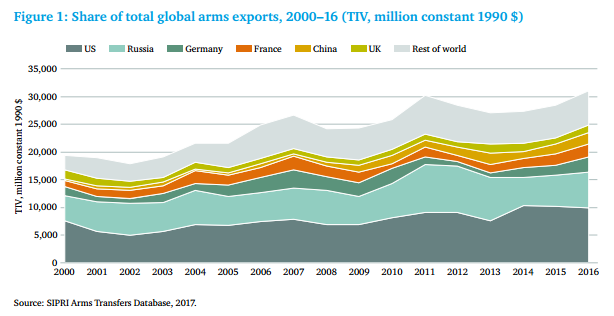

Russia is second to the US when it comes to arms exports

According to data by SIPRI, 21 percent of global arms sales in 2016 were Russian. As well, between 2000 and 2016, it was responsible for an annual average of 25 percent of global exports.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataClick to enlarge

India and China are its biggest markets, but this is starting to decrease

Two of Russia’s main buyers, India and China, are choosing to increase their own production of weapons and are sourcing new suppliers.

The loss of China would have a huge impact on Russia and this is already happening. In 2005, China accounted for 60 percent of total Russian arms exports, and this had slumped to around 10 percent by the early 2010s.

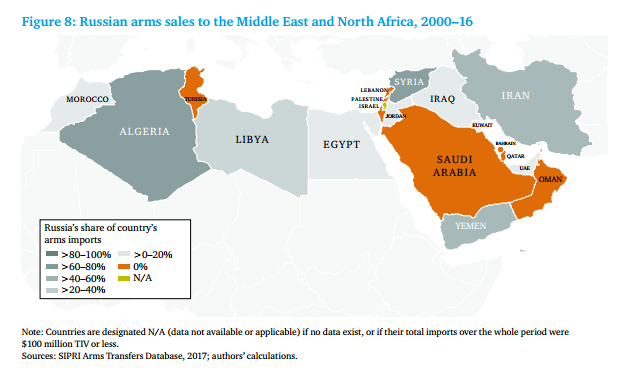

It has its eye on growing in the Middle East and North Africa

One of the ways Russia can offset the loss of the Chinese market is to grow elsewhere. The Middle East and North Africa (MENA) is the country’s second-most important region for arms exports.

Algeria is the most important country for Russia, as 9.1 percent of its export arms sales are to Algeria. Countries like Iraq, Syria and Egypt make up about 1.4 percent of sales, whereas Iran accounts more 2 percent.

Its dominance in the market is under threat domestically

A lack of investment in research and development and an ageing population in this industry is affecting the country domestically.

The report cited poor links between defence-industrial firms and higher education as a factor which will hurt its exporting capabilities in the future.

Russia needs arms exports for its economy

If it fails to keep up its position in the market, those that are employed in the development of arms domestically in Russia could suffer.

The defence industry is responsible for over three per cent of total employment and production occupies a dominant place in many cities and regions.

As well, it is a money-maker for the government. Arms exports were worth $14.6bn in 2015.

Click to enlarge

Changes in international relations can hurt the country’s exports

After the illegal annexation of Crimea in 2014, Russia had reduced access to components of weapons systems because of international sanctions. This could lead to shortages that will impede production and exports.

The report states that Russia’s large portfolio suggests it will still an important market position in the years to come and it can take advantage of being a source of weapons for countries that don’t particularly like the US.

Connolly said:

“To maintain its position of dominance, Russia needs to redevelop its long-term strategy in arms sales. This must include improving product innovation and addressing the issues of weak after sale-support and guidance by Russian firms. These changes could help Russia maintain a strong position in countries such as China despite their declining dependence on Russian equipment.”