Major economic powers including the US, China and members of the EU are investing heavily in nanotechnology as they seek to gain a strategic advantage from the technology, a new report outlines.

GlobalData’s Nanotechnology report states that, while many economies have been investing in the technology for decades, the significant investments that continue to be made today are aimed at securing a competitive edge in the global market, driving economic growth and addressing critical societal challenges.

The US established its National Nanotechnology Initiative in 2000 and has since established $43bn in it, with $2.2bn proposed for 2024. China has also been investing in research for over two decades and made nanotechnology a major area of its 13th Five-Year Plan (2016-20). The report adds that the EU “is supporting its nanotechnology industry through a combination of funding, regulation and collaborative initiatives.”

In defining the technology, the report explains: “Nanotechnology (nanotech) is defined as the design, production and application of materials, devices and systems where shape and size are limited to the nanoscale. It involves manipulating matter on an atomic or molecular scale, typically within the range of 1-100nm. These innovative materials and systems, crafted at the nanoscale, often demonstrate unique characteristics that do not exist when produced at a macro scale.”

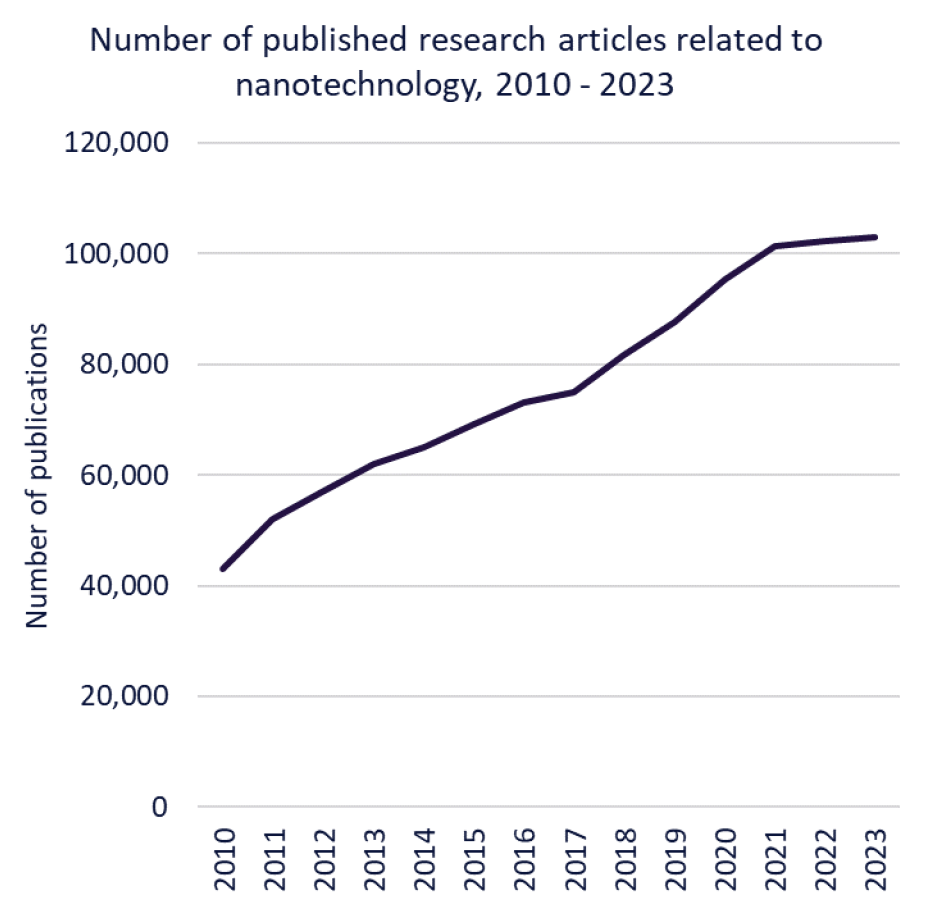

Analytics cited in the report reflect the continued year-on-year growth in interest in nanotechnology, with well over 100,000 research articles related to it published in 2023, up from a little over 40,000 in 2010.

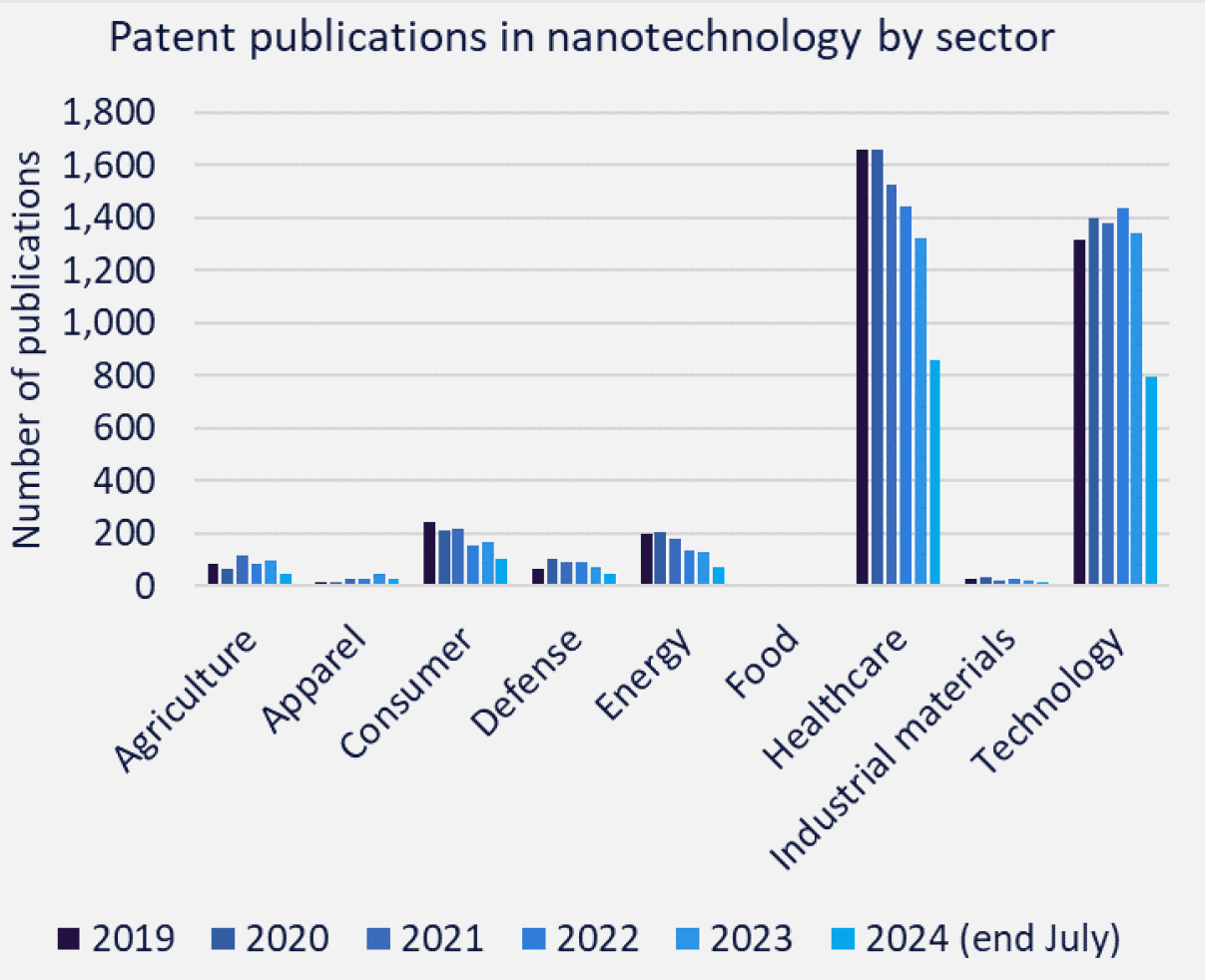

Despite the growth in interest and investment, commercialisation of the technology varies significantly by sector. Patent publications are particularly high in the technology and healthcare sectors, with falling numbers in the latter suggesting potential maturation. Among the other sectors in which there are nanotechnology applications are agriculture, apparel, consumer, defence, energy and food – however, patent activity across these is much lower.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataA variety of reasons are given for the varying levels of commercialisation, including the different stages of adoption of sectors, the complexity and regulatory hurdles faced in bringing nanotechnology products to market and mixed consumer perceptions of the technology.

The report also notes that the regulatory landscape has become unclear as the technology outpaces frameworks that have already been put in place, which it says has left gaps in oversight and enforcement.

It adds: “Furthermore, the potential risks and benefits of nanotechnology are still being studied, making it challenging for regulators to establish appropriate guidelines without sufficient scientific evidence. Overall, the lack of clarity and consistency has created a complex and uncertain landscape for both industry stakeholders and policymakers.”