“Who wants to carry bunches of bananas rather than go to work in a microprocessor factory producing the world’s most in-demand technology?” That was Costa Rican President Rodrigo Chaves’ question to young Ticos. He was visiting a region of the country that has a large banana production industry with US Secretary of Commerce Gina Raimondo.

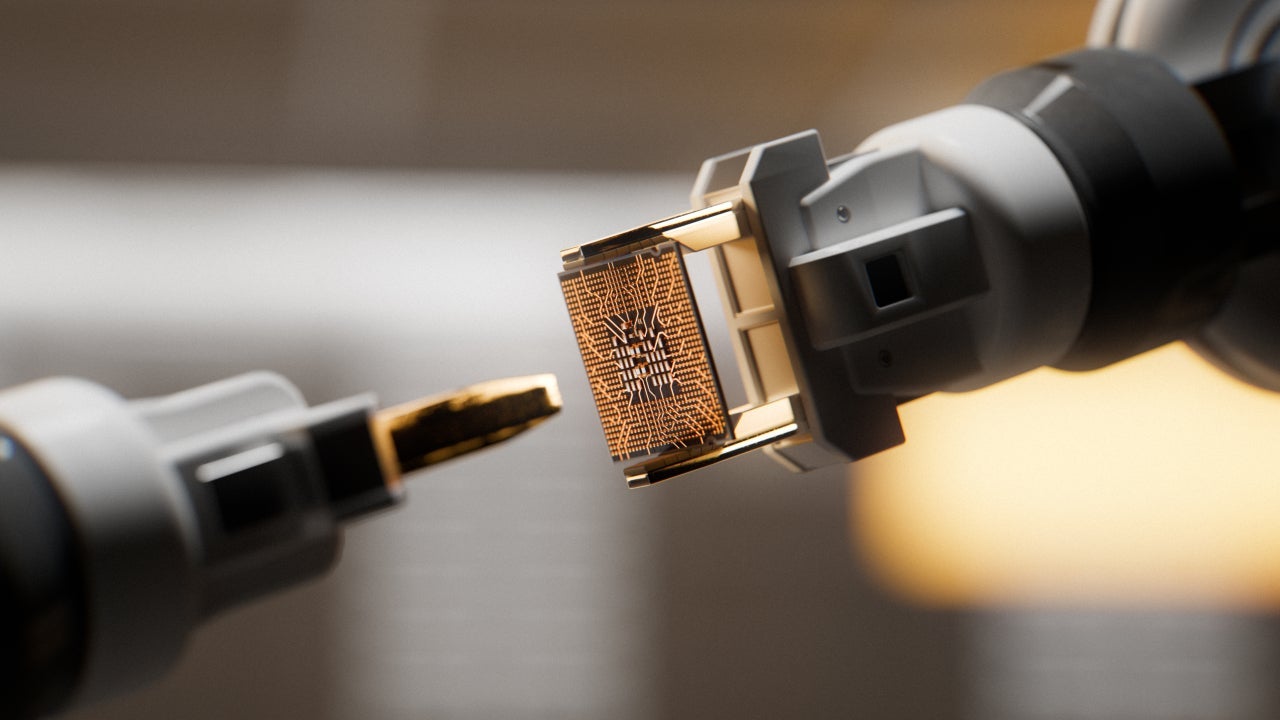

The US and Costa Rica have a similar goal, albeit for different reasons. They both want to grow the microchip manufacturing industry in the Central American country. For Costa Rica, greater FDI means a more skilled workforce, greater capital inflows, and fits into the country’s long term economic plans. On the other hand, the US is desperate to reduce their overwhelming dependency on the South Asian market for microchips.

Investing in Costa Rica

In 2014, Intel announced that after a nearly two-decade presence in Costa Rica, it was moving its production facilities to sites in China, Malaysia and Vietnam.

This seemed like a setback for one of Central America’s most stable democracies. But ten years, a pandemic, and a few trade wars later, it is regaining the confidence of the tech sector.

In August 2022, Intel inaugurated its only semiconductor chip assembly and test operations facility in the Western world in Costa Rica. Since, the company has said it plans to invest $1.2bln in the country over two years.

In 2022, Costa Rica ranked first in Investment Monitor’s Inward FDI Performance Index, which measure’s a country’s inward investment levels against its gross domestic product. The country has also had huge success in creating a medical device manufacturing sector. This has been one of the country’s top export for years.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe government has also made more efforts to attract FDI. President Chaves recently highlighted more tax incentives, regulatory reforms and a 99% renewable energy grid as part of the country’s appeal to foreign investors.

They launched a “roadmap for strengthening the semiconductor ecosystem in Costa Rica” which includes: talent development, modernizing incentives, attracting investment and improving their regulatory framework.

The CHIPS Act and the ITSI Fund

Costa Rica became the first of six partner countries granted a special fund from the American CHIPS and Science Act in 2022.

The international technology security and innovation fund (ITSI) is a $500m fund, distributed as $100m annual instalments over five years beginning in 2023. The fund aims to improve capacity in the semiconductor assembly, testing and packaging (ATP) sector in allied countries.

A rise in geopolitical tensions and protective policies have been huge factors in determining FDI flows for the last two decades.

The US’s focus on strengthening supply chains with stable allies and bringing production closer to home will likely continue to benefit Costa Rica’s plans of becoming Latin America’s Silicon Valley.