News of Microsoft’s $3.3bn investment in a state-of-the-art AI data centre in the US state of Wisconsin demonstrates a marked trend in data centre investment by the companies driving energy hungry AI development.

A few days after Microsoft’s Wisconsin AI data centre announcement, the company announced (13 May) that it will invest $4.3bn in cloud and AI infrastructure in France, expanding its data centre footprint across existing sites in Paris and Marseille as well as a new data centre campus in the Grand Est Region, in Mulhouse Alsace Agglomération.

In March, The Information reported that Microsoft and OpenAI are planning a $100bn US data centre, including an AI supercomputer called Stargate, which is scheduled for completion by 2028. According to reports, the facility is said to be 100 times more costly than some of the world’s biggest existing data centres. Verdict reached out to Microsoft to confirm the report, but the company did not confirm or deny the report.

And in November 2023, Microsoft announced it would invest $2.5bn in its UK operations over the next three years to expand its AI data centre infrastructure across a number of sites. The investment is the largest Microsoft has made, to date, in the UK.

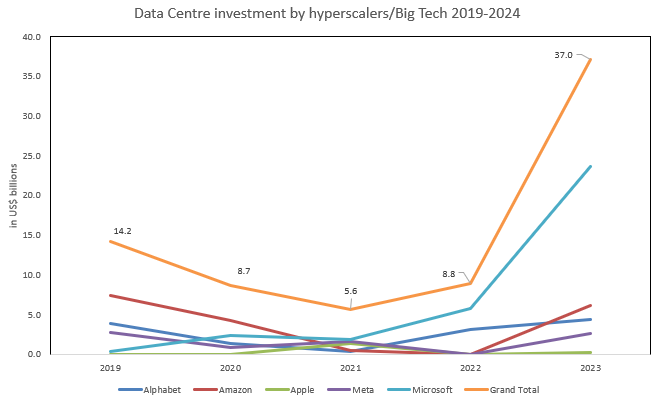

Vast amounts are being spent by Big Tech to ensure that cloud computing and AI infrastructure are in place to facilitate a lead on AI development. According to data from research and analysis company GlobaData, which tracked investment by the big five – Microsoft, Amazon, Meta, Alphabet, and Apple – in data centres from 2019 to date, investment has already soared in 2024 compared to previous years. Investment jumped from $8.8bn in 2023 to $37bn in announced investments in 2024.

Microsoft’s investment in data centres far outweighs its Big Tech rivals, according to GlobalData. Microsoft invested $5.8bn in data centre capacity in 2023 increasing its investment to $23.7 in 2024 so far. In comparison, Amazon has invested $6.1bn and Alphabet $4.4 in 2024, so far.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Altman focused on power hungry AI

Microsoft's $10bn investment in ChatGPT maker OpenAI created an alliance which sees OpenAI CEO Sam Altman the more nimble newcomer to the old line tech giant. Altman has been on an energy sourcing mission to drive AI development, a move which can only increase Microsoft's lead in the field.

In January, Altman addressed his energy concerns to an audience at Davos warning that an energy "breakthrough" would be critical for future AI development as the technology will require exponentially increasing amounts of compute power.

Altman's focus on energy dates back long before his warning to global leaders at Davos. In 2021, he publicly revealed his personal investment of $375m in nuclear fusion startup Helion, which is reportedly his largest investment to date. On 10 May, it was announced that Microsoft had signed a power purchase agreement with Helion to buy electricity from the startup by 2028 when it aims to start producing electricity. The agreement is the first of its kind between a nuclear fusion company and a potential customer.

In April, Altman's investment in solar power company Exowatt, a startup focused on producing energy to power data centres was made public. Exowatt co-founder Jack Abraham posted on LinkedIn that the company has, "invented a new solar technology that can power the future of AI and data centres with lower electricity costs than fossil fuels. We have significant deployments coming this year."

Data centres are adapting to energy hungry AI

Altman's quest for energy innovation may not come quick enough. Meanwhile, existing data centre technology is reforming to address AI's new energy requirements. Equinix is one of the world’s two biggest data centre co-location companies with 260 data centres across 33 countries and five continents. Equinix UK managing director Bruce Owen told Verdict that hosting high performance computing systems (like AI applications) leads to higher power density per rack or floor area in data centres.

“As businesses, organisations and individuals try to leverage AI for machine learning, natural language processing, robotics, and healthcare, for example, the demand for high performance computing and therefore power is growing,” said Owen.

The energy consumption of AI workloads has significant implications for data centre design and operations, according to Owen. “Power-hungry AI workloads pose challenges for our teams at Equinix in terms of power distribution, cooling, and overall operational efficiency,” he said.

The data centre industry is using methods including energy-efficient hardware, adopting renewable energy sources through power purchase agreements, and designing energy-efficient infrastructure to try and mitigate energy requirements.

Equinix is implementing infrastructure to support advanced cooling systems like direct to chip liquid cooling, enabling efficient, high-density deployments for compute-intensive workloads like AI. The company is also working with customers in trialing quantum and immersion cooling.

“We plan to support direct-to-chip liquid cooling in over 45 metros, this expansion allows customers to deploy advanced liquid cooling solutions tailored to their mission-critical needs,” said Owen.

Data centres have become geopolitical

But despite innovation in data centre energy efficiency, the net result of the AI revolution will be increased energy consumption, said GlobalData senior analyst Beatriz Valle.

Against the backdrop of the current competitive landscape in GenAI, Microsoft’s investment in a new data centre footprint is par for the course, according to Valle, who notes that the data centre industry has become geopolitically significant.

“A lack of global trade cooperation and much rivalry, as seen, for example, in the case of the US sanctions stopping NVIDIA, and other semiconductor vendors, from selling to Chinese companies, all this is translating into enhanced government investment, by the US and the EU, poured into new data centre construction to accelerate AI and to avoid relying on technology manufactured by countries that may not be strategically aligned,” said Valle.

Indeed, President Biden's presence and role in announcing Microsoft's Wisconsin data centre footprint expansion was conspicuous and served as a campaigning opportunity for his re-election in the upcoming US Presidential Election.

“Against the backdrop towards increased deglobalisation and trade barriers, investment in semiconductor technologies and data center facilities has become top of mind, and both the US and EU are pouring money into this.

Wisconsin is a good area to invest in, far from large urban centers and probably safer from a legal and environmental perspective than coastal cities (and cheaper),” added Valle.