As AI development gained pace over the last year, competition for specialist AI skills has intensified. The FT reported this week (30 March) that Apple has been involved in the hiring of at least 36 AI specialist Google employees since 2018, in addition to opening a low-key research laboratory in Zurich to consolidate its global AI expertise.

Apple has long been viewed as the least proactive among its Big Tech peers on AI development. This may be partly perception due to the massive public investments by competitors including Microsoft’s $10bn investment in OpenAI and Google’s $2bn and Amazon‘s $4bn investment in Anthropic AI. However, according to M&A trend data from GlobalData, Apple has largely kept pace with its competitors on AI deal count from 2019.

The reporting of Apple’s talent grab by the FT, alongside its considerable AI investments – albeit low-key – may signal the company’s long-awaited public commitment to AI, amid speculation around an on-device AI iPhone.

Although it could be argued that Apple is joining the AI battle a bit late, the company is no stranger to coming from behind, GlobalData thematic intelligence research director, Josep Bori, told Verdict. Apple’s iPod cornered the portable media player market in 2001, a decade after the creation of the MP3 player, and the iPhone’s launch in 2007 was preceded by Ericsson and Nokia’s market dominance of the early 2000s.

Apple’s AI talent acquisition spree

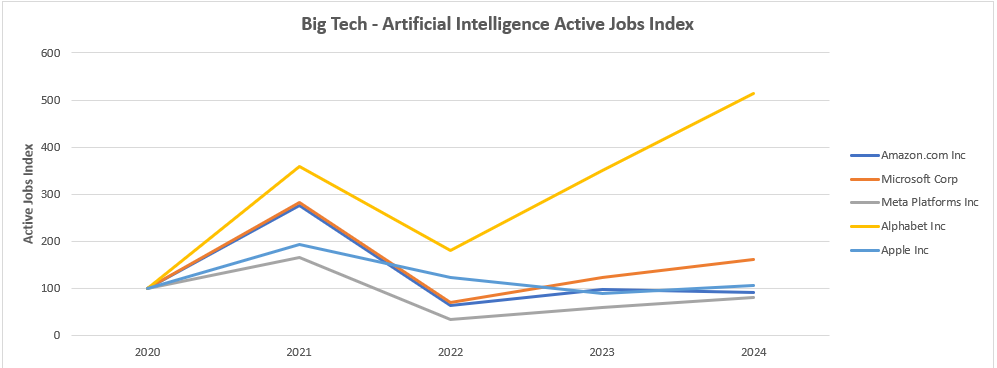

Apple poaching AI talent from its competitors is not particularly surprising, or inconsistent with current industry trends. The Big Tech arms race for AI talent has been a longstanding issue. Tales of PhDs sunning themselves on roof decks at Google’s Mountain View campus, seemingly ‘on the bench’, have persisted for years as the company pursued aggressive hiring tactics designed to bleed its competitors dry of available deep tech expertise. Indeed, GlobaData’s Active Job Index demonstrates that Google has a big lead on hiring among its Big Tech competitors.

But reports that Apple has been working behind the scenes to bolster its AI capabilities is notable, according to Bori. “It seems to be a signal that the company is now seriously trying to build a credible AI capability and finally get into the ring of the ongoing AI fight between the big tech firms, such as Microsoft, Alphabet, Meta and Tesla,” said Bori.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAccording to GlobalData, the AI market will grow from $103bn in 2023 to $1,037bn by 2030, with a 39% compound annual growth rate between 2023 and 2030. It is widely acknowledged that the company that eventually leads market share of the AI industry will be assured future success across a number of vertical industries. But much of this success will depend on the acquisition of specialist talent.

The Big Tech formula for specialist hires has typically been through small company buyouts – or acquihires as they are better known – which have seen these large companies monopolise global AI talent. Acquihires can sometimes provide insight on a company’s strategic priorities.

Apple acquired Canadian AI start-up DarwinAI in March 2024. Though the acquisition is ostensibly to improve manufacturing processes – DarwinAI uses AI to find manufacturing faults in printed circuit boards for better quality control – a more likely motivation would be to acquire the startup’s IP and talent. Indeed, DarwinAI chief scientist Alexander Wong, became a director in Apple’s AI group along with dozens of DarwinAI employees.

On-device AI: the future of the iPhone?

Furthermore, DarwinAI has expertise in making AI models smaller and more efficient which may confirm what many industry insiders believe will be Apple’s winning sprint in the race – running AI models on devices rather than sending data back and forth to the cloud.

This shift in the way AI models will be deployed – known as on-device AI – could be where Apple finally claims centre stage within the AI industry, with devices that are widely viewed as the gold standard.

The company is said to be developing natural language generation within its iPhone voice assistant, Siri, and is expected to release it at the company’s Worldwide Developer Conference in June 2024.

However, the idea of a widespread shift towards on-device AI is a “red herring”, according to Bori. The size of LLMs is growing faster than any company’s ability to miniaturise and pack more memory in small devices, explained Bori.

“Serious AI will have to remain in the cloud for quite some time, so improvements will need to come from communications (reducing latency to ensure the ‘answers from the cloud’ can be received quickly on the device) rather than pretending that we will stuff a full 1.76 trillion parameter GPT-4 model in a portable device,” he said.

While many straightforward AI-driven tasks like voice recognition, face recognition, basic user interfacing logic, etc., can be done on-device, reaching the sophistication level required for artificial general intelligence cannot. “This will certainly first happen on the cloud before we can somehow fit it inside a portable device,” said Bori.

Drawing conclusions about Apple’s intentions becomes problematic when considering a specialist skills lag phenomenon. “The current scarcity of computer science engineers with AI skills only exists because nobody could predict the demand acceleration of the last 2-3 years,” said Bori.

An area where Apple may find difficulties in attracting top AI talent, particularly with expertise in LLMs like ChatGPT or Gemini, is in its ability to build enough AI processing infrastructure, according to Bori. “Training these models require tens of thousands of very expensive and highly coveted GPUs, typically from NVIDIA, or even custom AI chips developed specifically for that purpose,” he said adding: “Top AI researchers will not easily give up their access to large labs and infrastructure at Google, Microsoft or Meta unless Apple can match it.”