Qualcomm‘s proposed acquisition of Israeli firm Autotalks has been terminated on anti-competitive grounds in the market for vehicle-to-everything (V2X) chipsets and related products used in automotive safety systems.

Concerns about the deal harming competition in V2X chipsets and related product markets led to regulatory scrutiny from multiple international regulators.

The deal failed following ongoing regulatory inspections, including investigations by the European Commission, UK, and Israeli antitrust regulators.

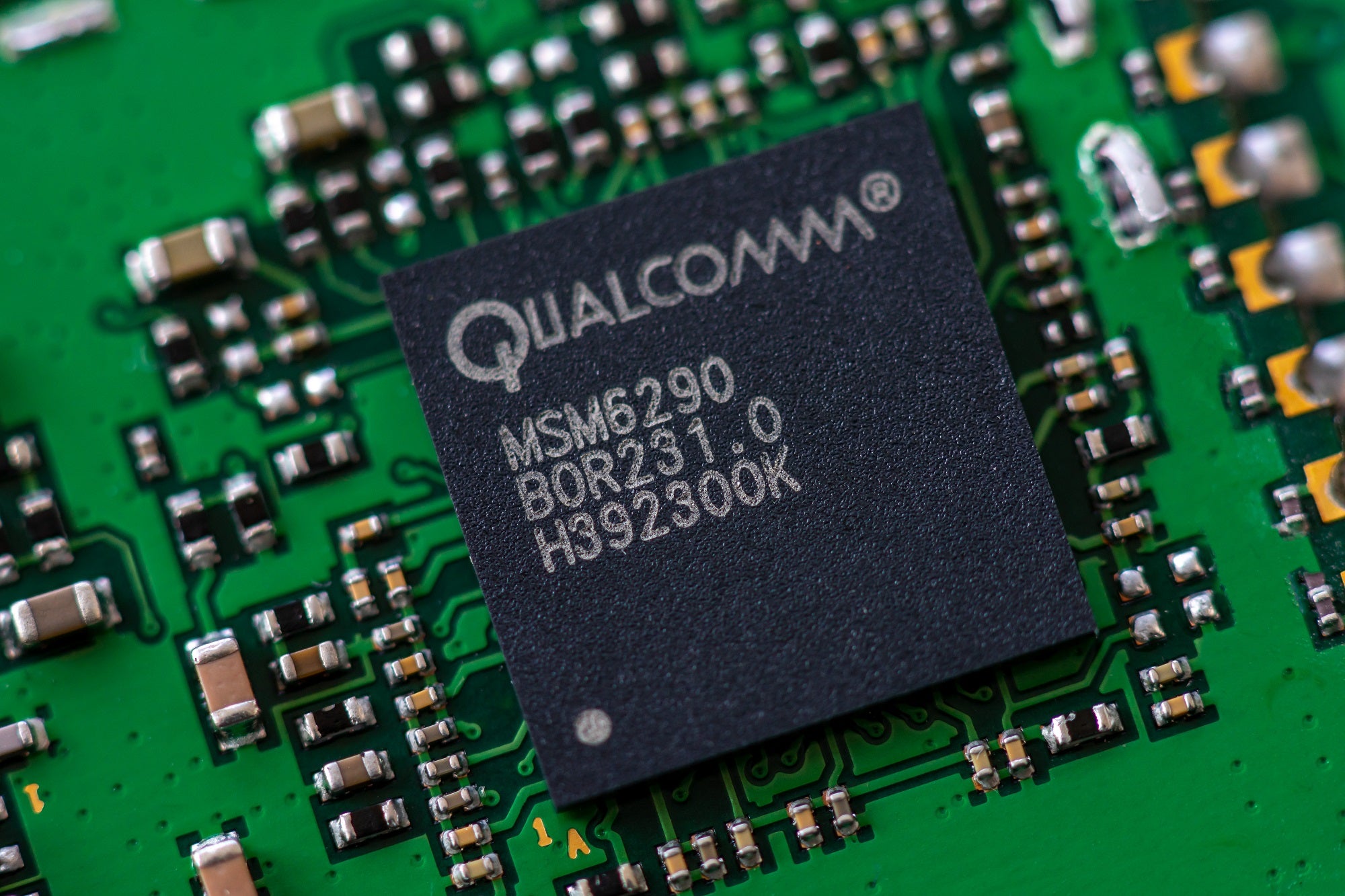

Qualcomm announced the acquisition in May, 2023. Media reports estimated the deal to be valued between $350m and $400m.

In March this year, Qualcomm criticised European Union antitrust regulators during a court hearing to overturn a proposed €242m fine.

The European Commission fined Qualcomm €997m in 2019 but the fine was overturned in 2022. The Commission alleged that Qualcomm had sold chipsets below cost between 2009 and 2011 to counter British software manufacturer Icera.

The acquisition aimed to combine two major players in V2X semiconductors, crucial for reducing collisions and improving mobility in automobiles.

Autotalks specializes in V2X communications and provides solutions aimed at enhancing road safety and mobility.

The acquisition would have integrated Autotalks’ solutions into Qualcomm’s Snapdragon Digital Chassis product portfolio, with the goal of accelerating the development and adoption of V2X solutions.

Companies including Volkswagen Group, Continental Automotive, General Motors, HARMAN, Quectel, Renault Group, Rolling Wireless, and Wistron NeWeb Corporation expressed support for the acquisition.