For years, NVIDIA was a household name to PC gamers alone.

Founded in 1993 as a provider of graphics cards for computer games, it is now the world’s third most valuable company, after only Microsoft and Apple, and it dominates the market for data centre AI chip design.

Nvidia’s 2024 Q4 earnings release on Wednesday, February 21, showcased a record quarterly revenue of $22.1bn, up 265% from the year before, exceeding Wall Street expectations of $20.4bn. The company’s strong performance has reignited AI optimism, justifying investor enthusiasm and hype. But how long can Nvidia continue to smash records?

A recent history of Nvidia

Nvidia reported record data center revenue of $18.4bn, up 409% year on year. The company’s chief financial officer Colette Kress said this was primarily driven by demand for Nvidia’s Hopper GPU computing platform. She went on to add that about 40% of data center revenue was attributable to AI inference—applying AI models to solve problems.

Nvidia’s leading chips, such as the H100, a powerful and versatile processor designed to meet the requirements of AI workloads, are the industry standard for large language models (LLMs). Nvidia’s next-generation AI chip, the B100, will likely drive another wave of demand when it is released in the coming quarters. Supply, rather than demand, is the greatest limit to Nvidia’s growth.

In October 2023, the US introduced further export rules for the semiconductor industry, to prevent Beijing from benefitting from the most advanced US chips. This meant that Nvidia, alongside rivals AMD and Intel, had to limit the capabilities of its chips to continue to sell in regions such as China and Taiwan. This was particularly crippling for Nvidia as two of its AI chips, the A800 and H800, were modified specifically to comply with previous export regulations.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataNot only has Nvidia recently surpassed a $2trn valuation, but it has such a high weighting in the S&P 500 that it alone is responsible for more than a quarter of the S&P’s year-to-date growth. Any significant movement by Nvidia has the potential to swing the market. Following Nvidia’s earnings announcement, the Stoxx Europe 600, Japan’s Nikkei 225 and the FTSE All-World index all achieved record highs, and the tech-leaning Nasdaq Composite increased by nearly 3%.

Jensen Huang, the hip, leather-jacket-clad founder and CEO of NVIDIA explained during the 2024 Q4 earnings call: “Accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries, and nations.” This has led to investors and analysts marking the Q4 2024 earnings as a risk on par with the release of inflation data, with some even likening it to a market-wide risk comparable to March 2024’s Federal Reserve policy meeting.

The competition

Tech giants Meta, Microsoft, and Nvidia currently account for approximately half of all gains in the S&P 500, according to calculations by Deutsche Bank.

For many, the AI boom is reminiscent of the late 1990s, when the stock price of Cisco Systems, a networking equipment manufacturer, experienced a rapid and unsustainable increase. During this time, investors were overly optimistic about the potential of the internet and technology sector, which led to inflated stock prices for many companies, including Cisco.

The bubble eventually burst in 2000 and resulted in a significant crash in stock prices, and financial losses for many investors.

Nvidia must manage challenges

Chip companies are particularly vulnerable to cyclical swings in demand, as investment booms and busts. Nvidia’s prospects look bright, but it must manage challenges such as competition from other tech giants, supply-side constraints, and regulatory hurdles.

Growing discontent over Nvidia’s encroaching market dominance from hyperscalers such as Microsoft, Amazon, and Google has led to all three designing their own AI chips, to go from being Nvidia customers to competitors.

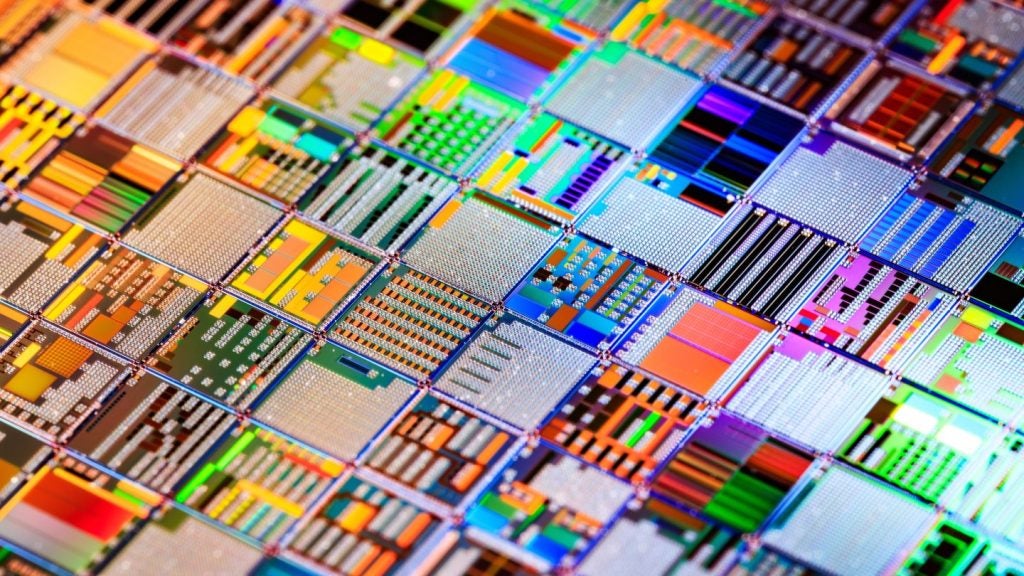

Indeed, AMD, one of Nvidia’s closest rivals, has already released a next-generation AI processor chip to outperform Nvidia’s. However, like Nvidia, it is also constrained by the number of high-end chips the advanced foundry TSMC can produce for it.

In the next decade, novel neuromorphic chips, which are modelled on the human brain, and photonic chips could blow Nvidia’s leading chips out of the water, provided they can be successfully scaled by Intel and other competitors like Cerebras.

Unlike Nvidia, Intel can fabricate its own chips, and photonic processors do not need an advanced foundry like TSMC to make them.

For now, no company comes close to the range of chips, systems, and software tools it has amassed. But we are at a crucial time when companies are beginning to test generative AI to determine what return on investment it can deliver. If competitors reduce their reliance on Nvidia’s chips by successfully producing their own, or the AI infrastructure boom collapses, the whole market could experience a humbling valuation reset.

Related Company Profiles

NVIDIA Corp

Microsoft Corp

Apple Inc

Intel Corp

Meta Platforms Inc