The autonomous vehicles (AV) industry will no longer have to worry about automotive-grade semiconductor shortages in 2024, analysts at GlobalData have predicted.

The Covid-19 pandemic caused a dramatic slowdown in the development of AV technology due to the lack of semiconductors.

At the beginning of the pandemic, when automotive production was forced to shut down, semiconductor suppliers prioritised the supply of consumer electronics where demand remained stable and high.

As manufacturing returned after the pandemic, the demand for automotive production rose quicker than expected for industry suppliers. This also coincided with a further boom in consumer electronic demand.

“The result has been a prolonged shortage of automotive-grade semiconductors, something that caused historic supply constraints on the industry,” according to research company GlobalData in its Thematic Research: Autonomous Vehicles (2023) report.

The report estimates that around 11 million production units were lost in 2021 largely as a result of semiconductor supply constraints.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“We estimate that, in 2023, that number will have fallen to between 3.5 and 4 million vehicles,” the report continues.

Alongside supply constraints, the AV industry has found it difficult to implement the technology in a tough regulatory environment.

Before the pandemic, the industry’s timeline for plans such as robotaxis was in the near future, but setbacks have meant the plans have been pushed back.

However, the report claims the situation has been improving slowly.

“By 2024, the significant shortages of semiconductors should be a thing of the past,” according to the report.

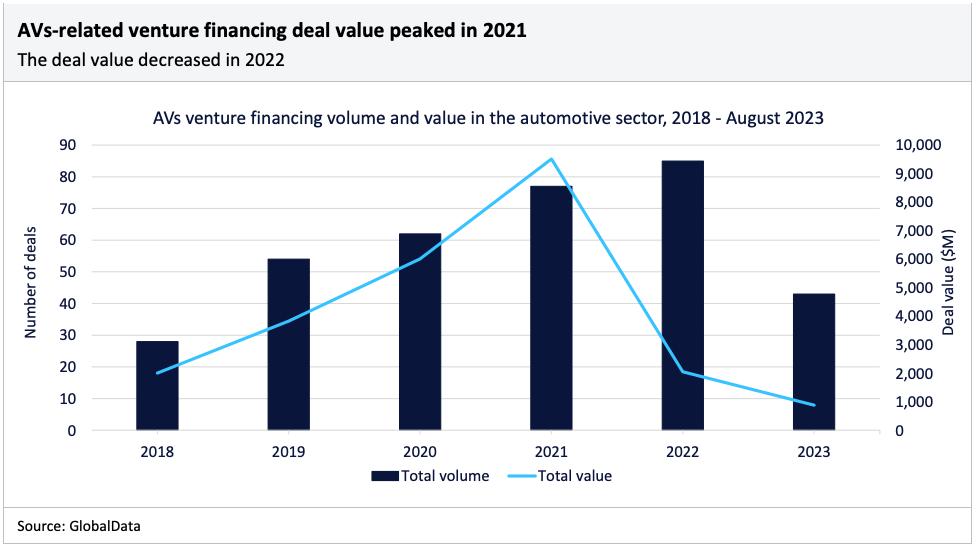

Meanwhile, venture financing deals in the AV industry peaked in 2021, according to GlobalData’s deal database.

Following the buzz around AVs in the 2020-2021 period, venture financing around the industry has slowed dramatically.

Although the volume of deals remains steady throughout the industry, it is clear that investors are less willing to take risks on the technology.

“The focus of investment has also narrowed as the number of remaining large players, especially in the robotaxi area, has reduced,” according to the GlobalData report.

The wide consensus within the AV industry is that a large portion of the advancements are being driven by the maturity in semiconductors and other related content.

All AV require hardware such as CPUs, GPUs, and MCUs, as well as a wide range of sensors and cameras.

According to the GlobalData report, the semiconductor content per vehicle will rise from around $700 currently to $1,000 or more by 2030, as in-car electronics expand.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.