Artificial intelligence (AI) startup CoreWeave has sold a minority stake at $7bn valuation, reported Bloomberg.

Leading the transaction was Fidelity Management & Research Company, with participation from Daniel Gross, Goanna Capital, Investment Management Corporation of Ontario, Jane Street, JPMorgan Asset Management, Nat Friedman, and Zoom Ventures, .

In an emailed statement to the publication, CoreWeave co-founder and CEO Michael Intrator said: “Our explosive growth trajectory has been recognised by top-tier institutional investors, and this transaction highlights the differentiation our market-leading performance, significant technology advantage, and strong customer adoption is receiving in the market.”

Founded in 2017, CoreWeave provides clients with access to specialist cloud services to run AI models.

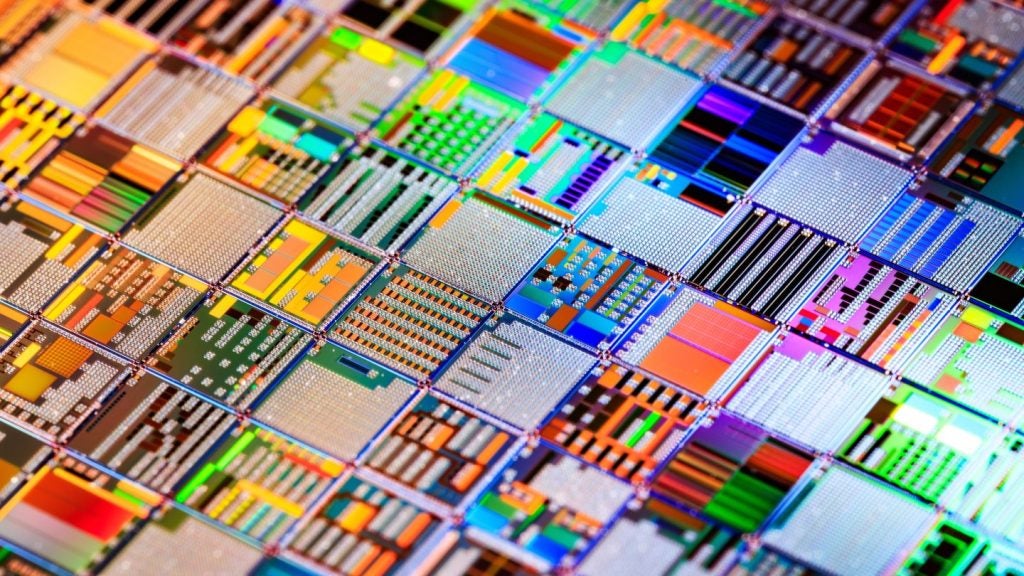

The US-based company uses NVIDIA’s GPUs to power its cloud infrastructure.

NVIDIA is also an investor in CoreWeave.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIntrator continued, stating that the AI sector is experiencing a moment of transition and CoreWeave is playing a key role by offering clients “the most differentiated” AI infrastructure.

This year, the AI infrastructure provider has raised billions in debt and equity funding.

Early in August 2023, CoreWeave announced a $2.3bn debt financing facility, which was led by Magnetar Capital and funds managed by Blackstone Tactical Opportunities.

Along with funds and accounts administered by BlackRock, PIMCO, and Carlyle, the asset management firms Coatue and DigitalBridge Credit also contributed to the debt funding.

At the time, CoreWeave said it will use the funding to expand its workforce, build new data centres, and enhance its computing capabilities.

Before the debt funding, CoreWeave raised $421m Series B funding round in two tranches, both led by Magnetar Capital.

In July 2023, the technology vendor opened a $1.6bn data centre facility in Plano, Texas.