Nintendo has announced it will be raising its operating profit forecast, despite falling short of analyst predictions, as the company continues to create popular games for its six-year-old Switch console.

The gaming giant announced on Tuesday (7 October) that it would be raising its operating profit forecast by 11% from $2.9bn to $3.32bn for the financial year ending March 2024. The forecast fell short of analyst predictions which sat at $3.5bn.

The rise in Nintendo’s profit forecast comes alongside the rise of its game sale forecast, which increased by 3% to 185 million, based on the company expecting to sell 5 million more units.

Nintendo had a number of popular releases this year, as the industry enjoys a plethora of heavy hitting games following the easing of pandemic disruption.

The long-awaited “Tears of the Kingdom” game on Switch sold 19.5 million copies as of the end of September, according to Nintendo. In just three days the game sold a whopping 10 million copies.

Speaking on a conference call after the earnings release, Nintendo president Shuntaro Furukawa claimed the Switch console is “different from past hardware”.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“It has the ability to give rise to different kinds of new demand,” he said.

The company kept its outlook for the six-year-old Switch hardware at 15 million units, despite Furukawa claiming it would be hard to accomplish.

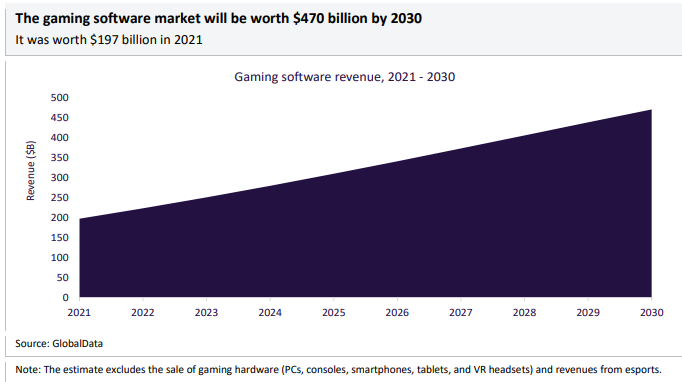

The gaming software market was worth $197bn in 2021 and will become

a $470bn industry by 2030, according to GlobalData estimates.

This estimates an increase at a compound annual growth rate of 10% over the period, the research company forecasted.

Cloud gaming will be the fastest growing segment in the industry, expanding

from approximately $2bn in 2021 to more than $30bn by 2030 at a CAGR of 39%, according to GlobalData.