Chinese startup Zhipu announced today (20 October) that it has secured over $341bn in funding this year. Its investors include Alibaba, Tencent and Xiaomi.

Zhipu developed ChatGLM, an open-source rival to ChatGPT which can generate responses in both Chinese and English. The company also has its own text-to-image generative AI tool named CogView.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

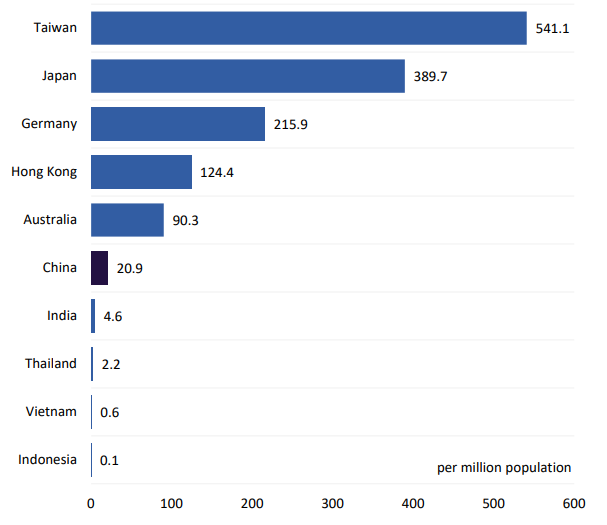

Despite the tremendous backing that Zhipu has received, GlobalData analytics state that China only had 20.9 patents per million population in 2021. This is significantly lower than peer countries such as Taiwan or Japan.

Number of patents granted per million population (2021).

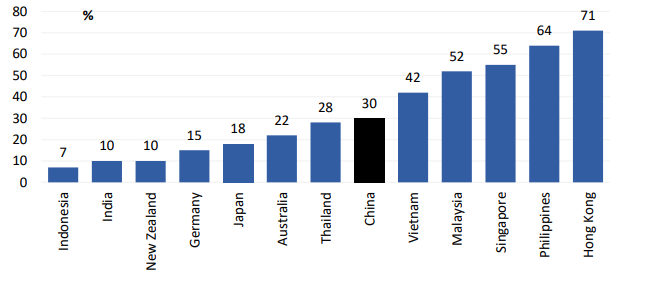

China’s share of high-technology exports has also dwindled compared to peers.

China’s total manufacturing exports decreased from 31% in 2020 to 30% in 2021. Whilst above the percentage of manufacturing exports by Japan or Taiwan, it remains below Singapore or Hong Kong.

Percentage of high-technology exports (2021).

The US’ later regulatory actions against China, alongside a dwindling of tech exports, may have ignited action within China to reorganise its supply chain to survive. Writing in an industry update this March, TS Lombard analyst Rory Green stated that China has been seeking to “de-Americanise” its supply chain rather than de-globalise.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCompanies in Guangdong or Zhejiang, Green writes, continue to produce high-tech items but the final assembly now often takes place in geographically close, low-cost countries such as Vietnam.

Despite these concerns and a slight drop off in exports, Green states that China remains a competitive and attractive market for investment thanks to its large middle-class market that continues to make investment in China a core strategy for companies wanting to tap into that market.

Additionally, Green credits China’s highly trained flexible workforce and superior infrastructure as further reasons why China will remain attractive to investors despite US sanctions.

“It is significant,” he writes, “that major political pressure and huge global upheaval were needed to dent China’s appeal” referencing the Russia-Ukraine conflict and the COVID-19 pandemic.

Zhipu will likely continue to receive significant funding to develop its AI, however specialising in generative AI tools may hinder its progress due to strict Chinese regulation over the content generated by such tools.

Just this month (16 October), China’s Cyberspace Administration announced further potential guardrails against the training data that can be used to create generative AI tools.

These regulations would bar any data that is determined violent or a threat to national unity from being used in the training of chatbots or other generative AI.

Laura Petrone, principal analyst at GlobalData, described the rules as the “most stringent and detailed” globally. However, she stated that China would remain a key player in global AI regulation and believed that China’s regulatory stance on AI would have an impact on other countries watching.