Fixed wireless access (FWA) technology for broadband internet continues to attract new users.

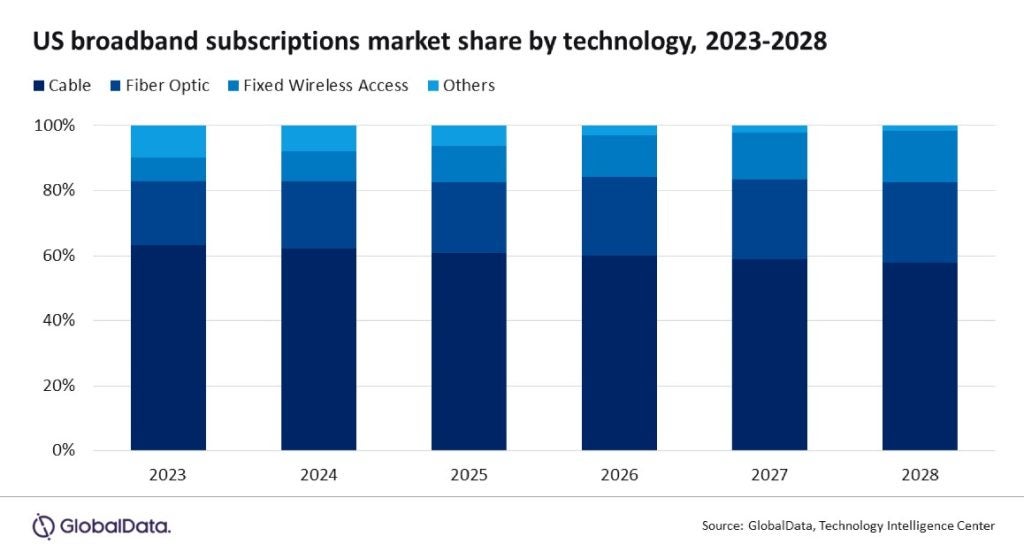

The tech is expected to more than double its subscription market share in the US, expanding from a 7.2% share in 2023 to 15.8% in 2028. However, GlobalData’s updated report, “United States Fixed Communications Forecast,” reveals that despite its rapid adoption, FWA will remain in third place behind cable and fibre subscriptions in the US market.

Popularity growth for FWA

FWA, which delivers broadband internet services over radio spectrum, is rapidly gaining adherents. Carriers such as T-Mobile US and Verizon are successfully providing FWA service over their 5G networks, with the two operators concluding Q2 2023 with 5.9 million FWA subscriptions between them. Additionally, AT&T this week announced it is expanding availability of its nascent 5G-based FWA service, called Internet Air, to more US cities.

Easy self-installation and affordability, combined with high reliability and performance, thanks to underlying 5G technology, are among FWA’s selling points, but so is the fact that FWA offers a new service choice versus solutions from cable and fiber service providers. Additionally, FWA is suitable for both primary and backup internet service and can be deployed in locations where internet service may only be needed temporarily.

Cable keeps hanging on

Cable technology will lose market share over the next five years but will retain its dominant grip on the US fixed communications market, representing 58% of total broadband access lines in 2028. However, cable faces rising competition from 5G FWA networks deployed by mobile network operators as well as rollouts of new fibre-optic networks.

Fibre presents a significant challenge to cable as it is highly reliable and can deliver the symmetrical multigigabit speeds that are increasingly demanded by consumers and businesses. Additionally, fibre deployment is gaining momentum as government subsidies lead to an unprecedented expansion of the nation’s fibre broadband infrastructure, leading this technology’s share of the market to grow from 19.5% in 2023 to 24.7% in 2028.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataCable operators are upgrading their hybrid fibre/coax (HFC) networks with new DOCSIS 4.0 technology that is expected to support 10 Gbps downstream and up to 6 Gbps upstream capacity. This will help cable technology retain a dominant market share. However, some cable operators are starting to roll out their own fibre networks, particularly in ‘edge out’ situations where they expand their service footprints into nearby neighbourhoods and communities, which will also help boost fibre technology’s market share. Total US broadband services revenue is expected to increase at a compound annual growth rate (CAGR) of 4.2%, from $102.9bn in 2023 to $126.3bn in 2028.

Related Company Profiles

T-Mobile US Inc